Real estate investing is extremely favorable in many ways. Obviously, real estate investments provide challenges as well which is why it’s sometimes overlooked by investors.

We consider the limitations of real estate, allowing you to make the most informed decision before allocating capital to property investment. The following will provide you a comprehensive understanding of the cons apparent in real estate investing.

THE CONS OF REAL ESTATE INVESTING

1. Property requires a time commitment.

The time element covers 3 categories:

A) Property is an illiquid asset.

Due to the nature of illiquid assets, they commonly take time to purchase and dispose of. In comparison to stocks that are liquid assets, the purchase and disposal is normally at the click of a button. Property transactions commonly take on average 2–3 months to complete once terms are agreed. Although, this varies depending on the deal, and I have had properties take over 12 months to complete.

With this in mind, an immediate need for a significant amount of cash can be hard to meet. In these situations, you are at the mercy of opportunistic cash investors that can perform a quick transaction. In return, a steep discount to the market price of the property in common, ultimately resulting in a significant loss.

Maintaining a healthy cash reserve helps mitigated this situation somewhat. During negative cash flow situations, the reverse provides breathing space, keeps liquidity and releases the requirement to sell.

B) Research of real estate investing opportunities.

Purchasing an investment property requires a long process of due diligence. Learning about the neighbourhoods to invest in, organising and carrying out viewings. Furthermore, analysing numbers, identifying issues, offering opportunities, and arranging finance. The time commitment at this stage is essential to ensure your due diligence is correct. The research ensures you are investing in the right property to align with your long-term goals.

C) Ownership of property.

Once purchasing a property investment, actively managing your rental properties can be very time-consuming. Most investors tend to hire property managers to do the day-to-day running of the property operations and save time. Dealing with property managers still requires a certain amount of time when certain issues occur. Although, in general, it requires significantly less time and stress and enables you to leverage your time for other activities.

2. Real estate investing requires capital to start.

To start buying property, you’ll need a deposit payment plus any planned repairs and purchase fees, such as legals and stamp duty land tax contributions. The rent received by a tenant covers the properties operating expenses such as insurance, mortgage payments, and property maintenance. Although, it’s likely there will be cashflow issues in the first couple of months that requires supplementing until the rent catches up.

3. Property prices fluctuate.

With every investment, it’s inevitable that there will be price fluctuations at some point. Property is no different, there will be fluctuations in capital values and rental values depending on market cycles.

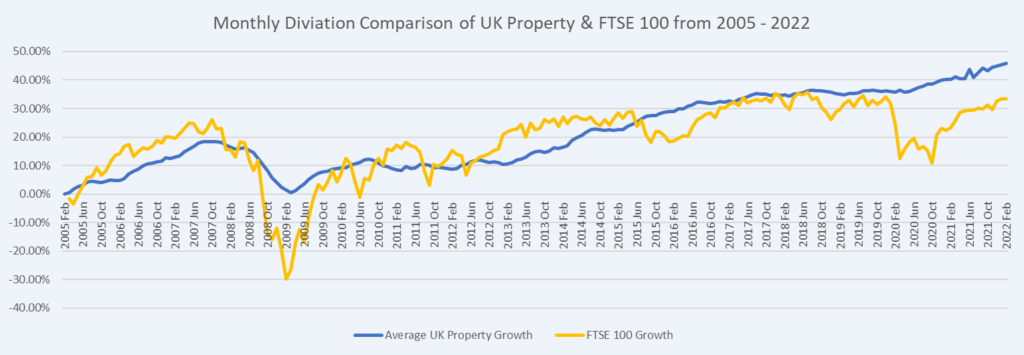

The fluctuations in real estate prices are significantly less volatile than investing in the stock market. The following graph shows the changes in average UK residential property values vs. the FTSE 100. The FTSE 100 suffers from more pronounced and sudden fluctuations in value than property, although you can see that property did suffer a significant decline between November 2007 and March 2009. You will have made a loss if you bought at the top in 2007 and selling soon after 2009. Although, by prioritising long term ownership, short term fluctuations in price have less of an effect on your decision making.

4. Property requires regular management.

Management of properties comes in different forms depending on the property type and lease structure the tenant is under. Although, property always requires an element of management. One example of management is repairs, which are inevitable and tend to come at the most awkward moment in my experience. Maintaining adequate cash reserves to counter such occasions is highly recommended. The other main type of management that can be a drain on your time is the necessity to keep detailed accounts for tax purposes, which need to be submitted yearly.

Summary

Owning real estate as an investment isn’t for everyone, as there are unique hurdles to get over, although it has historically been a very strong performing investment option. There is an element of extra time and management that is a given with property investment, so as long as you are willing to sign up for the grind and willing to hold the investment for extended periods of time, the majority of the limitations to property will be nullified and fruitful returns will be achieved.

Hopefully, this guide on the cons of real estate investing doesn’t scare you too much and helps you make an informed decision about whether to start your property career.