The advantages of property investment can be extremely rewarding. Although it requires a long-term view as you reap the rewards of capital appreciation over long periods of time.

There are a variety of different methods when it comes to real estate investing. For example, active options such as development to passive options such as owning shares in Real Estate Investment Trusts (REITs). The following provides in depth understanding of active and passive property investment styles.

Personally, I’ve found that owning actual property investments far outweighs the ownership of REITs, considering returns, control and personal satisfaction.

Below are the six main advantages of property investment and the benefits it provides your investment portfolio. It provides a comprehensive understanding of what the benefits are. Furthermore, why they should be considered when deciding whether property investment is right for you.

The advantages of property investment

1) Property Investment is a store of value.

Property is a hard asset which remains in high demand providing a good condition is maintained and location remains favourable. Specifically for residential property as traditionally, the deviations in price are less pronounced than in the stock market. Property is a tangible asset and will always have an intrinsic value to it. Value can be from the raw land and the buildings, whether that’s a house, an office, or a campsite. Well selected property appreciates over time, generally at a rate that’s superior to inflation.

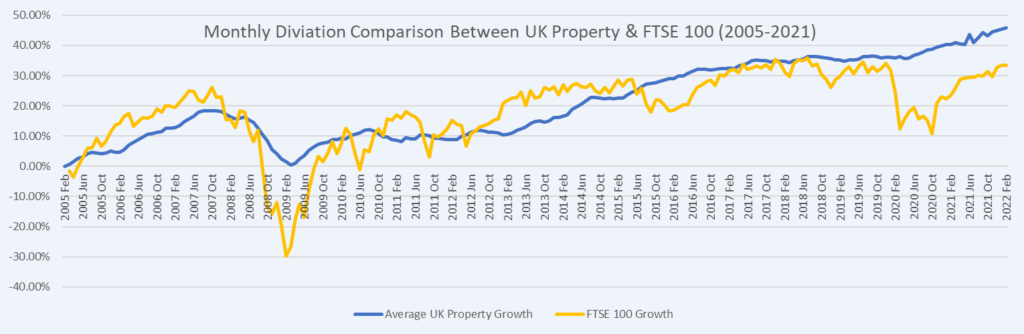

The graph below shows the reduced volatility and deviation of average UK property values compared with the FTSE 100. Property provides a constant source of value than stocks. This provides an investor a smoother ride on the journey (and a better return from 2005-2021).

2) Diversification of your investment portfolio

Diversification is one of the key advantages of property investment because of the uncorrelated returns it generates your wider portfolio. The general property market has a reduced correlation and provides strong independent returns compared to bonds and stocks.

Secondly, within property investment, you can also diversify through the variety of types of property investments you select. For example, through shares of REITs or providing capital as debt/equity for others to conduct real estate development projects. More conventionally, you can purchase ownership of your own physical properties with a variety of sectors to choose from.

Sectors include but are not limited to residential, commercial, rural land, and diversification projects. The following provides an in-depth guide to value of the various sectors involved in property investment.

3) Property investment is an inflation hedge

Historically, increases in inflation have negatively affected returns from the majority of investment vehicles. Property is the only exception of this, which has generally appreciated at a rate faster than inflation. As the price of milk and bread goes up, so do rents and property values. The one aspect of property investment that doesn’t increase is the monthly cost of your fixed-rate mortgage payment.

While inflation pushes the cost of living higher, your cash flow as a landlord increases as well. This is due to your annual rental income increasing, although your cost of ownership stays the same. Producing increased returns in line with inflation as well as the capital value that has historically followed suit.

A prime example of this is the following table. The table shows the performance of real estate and the FTSE 100 compared to the rate of inflation for 2022. It shows property values keeping pace with inflation, rents surpassing inflation. Furthermore, the largest companies in the UK falling way below inflation rates.

| Dec 2021–Dec 2022 | % change over the period |

|---|---|

| Inflation | 10.5% |

| Average UK Rent (final quarter) | 13% |

| Average house prices (England) | 10.3% |

| FTSE 100 (31 December–31 December) | 0.91% |

4) Using leverage with property investment

Leverage is using borrowed money, commonly from a bank, to purchase property, which normally increases the return on investment. For buy-to-let (BTL) mortgages, it often requires at least a deposit of 25% of the asset value. The power of leverage can serve as a mechanism to quickly grow your property portfolio. Moreover, the repayments of the leveraged debt on the property is paid for through the rent received by your tenants. The tenants essentially are financing the property for you. Using leverage increases your risk of downturns in the market and increases your exposure to interest rate changes.

Leverage is a powerful wealth creator because it allows you to use 100,000 to buy an asset worth 400,000. The benefits come from capital growth on 400,000 worth of property while only putting down 100,000 of your own money. This significantly increases your return on investment if owned in cash.

The table below shows that leverage at 75% over a 10-year period outperforms the cash investment by approximately 144k. This table has not considered the ability to remortgage due to the inflated capital values during the 10-year time period. Re-mortgaging builds your assets immeasurably and takes your wealth creation into overdrive.

| Years | Leverage at 75% | Growth | Cash | Growth | Assumed Capital Growth Rate |

|---|---|---|---|---|---|

| 0 | 400,000 | 100,000 | |||

| 1 | 416,000 | 16% | 104,000 | 4% | 4% |

| 5 | 486,661 | 87% | 121,665 | 22% | 4% |

| 10 | 592,098 | 192% | 148,024 | 48% | 4% |

| Total Equity Value | 292,098 | 148,024 |

5) Buy property below market value

A common saying in property is: ‘Money is made when you buy, not when you sell’. This shows that the price paid for a property is a key barometer of the future performance of the investment. Real estate doesn’t have a set price and so provides opportunities to negotiate on price to buy below market value. Whereas for stocks or bonds, the price is fixed and there is no room for negotiation. This opens huge opportunities to generate discounted prices when building your portfolio. Although taking advantage of these anomalies requires a deep knowledge of local markets.

6) Property investment gives you control over your assets

With property investment, you have complete control over your decision making and overall investment success. Compared to investing in securities, it’s unlikely you can sit in the boardroom of Apple or Amazon and make decisions. Even more unlikely you can persuade management to implement strategies that increase the value of the stock which you own.

An active property investor can select deals that suit them, control costs. Furthermore, they can judge which applicants will become their tenants, and decide when to sell. By participating in every aspect of the investment process, you are in control of your success. This might be daunting, although you can dictate how fast or slow you wish to go. You are effectively in control over how much you earn and your future wealth.

Summary

Purchasing real estate isn’t going to begin building wealth right away. Property can be incredibly powerful for wealth creation and rewarding through the control you have on your wealth creation. Learning and gaining experience will be the keys to understanding and securing good property deals. Moreover, having a strong, trustworthy team around you is just as important. These would include contractors, mortgage brokers, property managers, and legal teams to streamline the process.