This article provides detail to answer whether to rent or buy a home is the best investment in a specific situation. There are a lot of pressures from society to own your own home and that renting is purely throwing money away. Although there is an argument that homeowners also throw money away, it’s just not as obvious.

The common notion is that if the mortgage costs are cheaper than the rent means buying is a better decision. This is simply not true as you’re not comparing apples with apples. Property ownership demands other costs that need considering when comparing against renting a property. These costs are unrecoverable costs and need including in the evaluation to create a fair comparison of the 2 options. There is a helpful buy vs rent spreadsheet that evaluates an individual comparison scenario.

What are unrecoverable costs when you buy a home

A definition of an unrecoverable cost is a cost that you incur which won’t gain any residual value to the property. In home ownership this comes in the form of loan payments, maintenance and various taxes.

The True Cost of Ownership

The true cost of ownership includes the money spent within the year to keep a roof over your heads. Although, this expenditure doesn’t contribute to the value of the property increasing as a result.

Home Maintenance

The structure of a property depreciates over time. I would split home maintenance into 2 sections:

1) Routine maintenance: To preserve the quality and integrity of the property. These include roof repairs, external timber painting and pointing.

2) Emergency repairs: These are normally one of those things and tend to be urgent when they occur. These include but not limited to boiler breakages or water leaks.

For home maintenance, you would budget between 1%/2% of the property’s value. This is dependent on the age and type of property.

Value of Debt

This is in the form of the mortgage interest you pay as it’s something you don’t get it back. The capital payments are recoverable and excluded from the calculations. For example, you realise the value of the capital payments when you sell, refinance or the property is debt free.

Mortgage rates have taken a steep rise recently compared to the rates that have been achievable in the last 10 years. The interest rate in the buy vs rent spreadsheet that accompanies this blog is changeable to evaluate individual scenarios. This should reflect the current interest rate achievable at time of comparison.

Property Taxes

To establish the type of taxes you need to pay depends on the country you live in. For instance, if you live in Hong Kong or America the property owner pays property tax whether you live in the property yourself or rent in out. Conversely, in the UK, the party occupying the property would pay the property tax such as council tax. The calculator example reflects the UK tax process and so buy vs rent calculation ends up being equal. Although, this is adaptable for other market practices.

The Opportunity Cost

The opportunity costs are the returns you are missing out on by choosing to buy a home and not investing in other assets. Assets such as, owning rental property or investing in the stock market. The costs included in the opportunity cost anaylsis include deposits, stamp duty and the legals to purchasing the property.

Rental property: from 2005 – 2021, average UK property values grew by 3.25% per annum according to nationwide property index. When combining capital appreciation and a net rental yield of 4%. The total return of rental property owned in cash is 7.25%.

Mortgaged property: owning a rental property with a 75% mortgage elevates these returns. Capital appreciation is established from the full property value and the net yield is inflated due to the reduced deposit. Using leverage creates risk although is a common method gain elevated total returns in the region of 17%-22%.

Stock market: from the inception of the S&P 500 in 1957 to 2021, the benchmark’s average annual return was 11.88%. Coupling this with the average dividend yield achieved from the index of 1.99%, this gives a total return of 13.87%.

The opportunity cost method provides a reasoned approach to understanding spending decisions and the implications a certain decision has.

Rent vs Buy a home Example

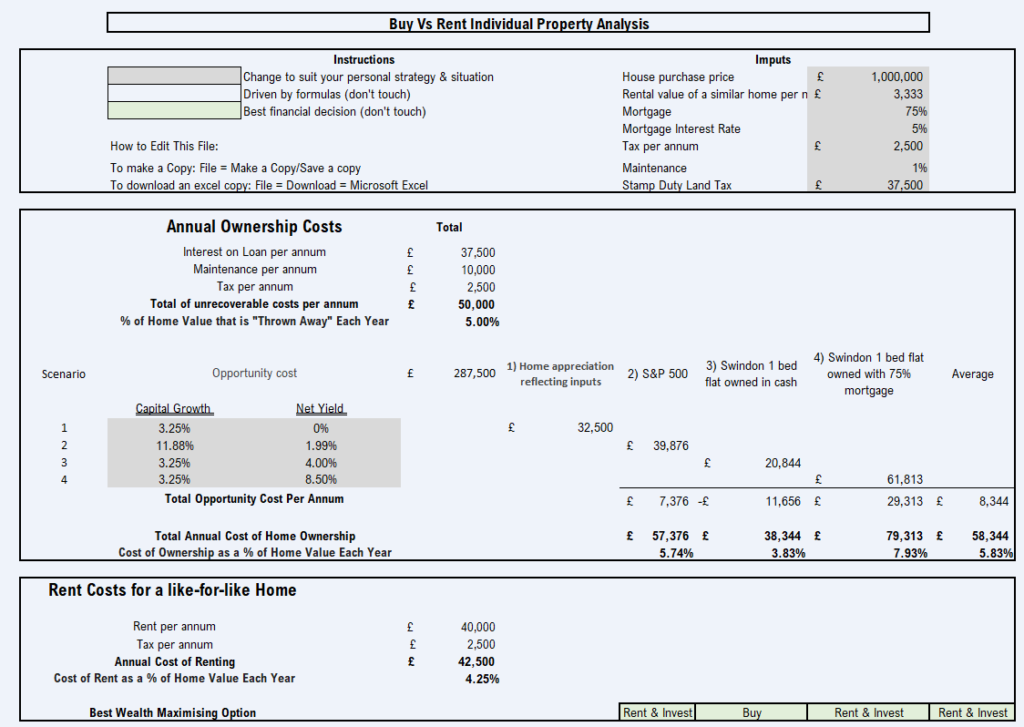

The first example gives a taste of a generic comparison between renting and buying a home. The results are generated by the inputs prescribed below in grey. Furthermore, comparison with the UK average property data and the S&P 500 index.

The standard costs are relatively similar in this example, although the opportunity cost is what really swings the dial. With this template you can compare each type of opportunity cost and the recommended approach formulated in green below. The average reflects a blended portfolio of all the opportunity costs analysed for the capital involved in buying a home.

The opportunity cost has a big bearing on the outcomes of the comparison and depends on a couple of factors. Firstly, whether the home is purchased with a mortgage or without. Secondly, the type(s) of investments and the likely returns they would deliver. The comparisons will differ depending on the individual’s personal situation, investment preferences and location. This is why it’s a flexible model and can be modified to suit different circumstances.

Rent vs Buy a home – location Specific

The spreadsheet gives the ability to be granular and use specific examples to compare the relevant options. The property opportunity costs can be adapted to reflect the historic capital growth and yields of a specific town you are looking to compare. Moreover, you can input the historic returns of the specific investments you wish evaluate. This gives you the most relevant comparison in order to make a reasoned decision.

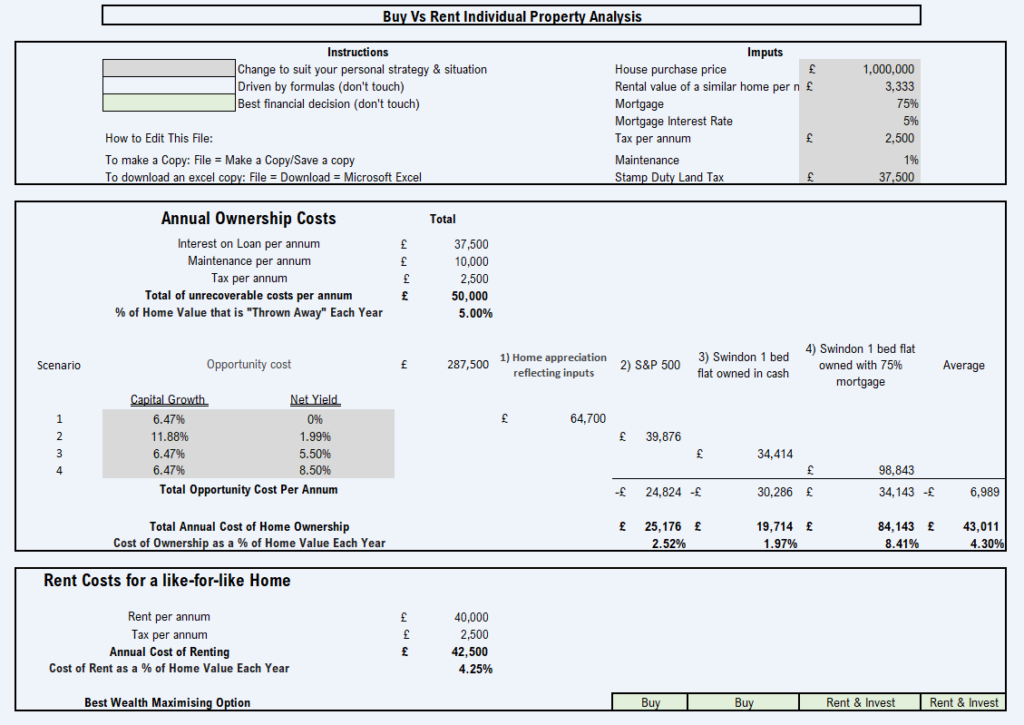

For example, a specific scenario below appraises whether to buy or rent a property in the Swindon area. With a pot of money totaling 280k.

- Buy a home with a 75% mortgage of the value of 1m in the surrounding areas of Swindon.

- Rent in the surrounding areas of Swindon and invest 280k in the S&P 500.

- Rent in the surrounding areas of Swindon. Then invest 280k in 1 bed flats in the centre of Swindon with no mortgages.

- Rent in the surrounding areas of Swindon. Then invest 280k in 1 bed flats in the centre of Swindon with 75% mortgages.

From 1997 –2020, according the office of national statistics, the average house price in Swindon went from 57,950 – 230,000. This equates to 6.47% growth annually. The yield you can achieve on investment 1 bed flats in Swindon is in the region of 6.5%, the net yield will be reduced to reflect maintenance and management. Larger rental houses in nearby villages to Swindon with a capital value of 1m are likely to achieve a yield of approximately 4%. Further assumptions are below along with the granular breakdown of whether financially it’s better to rent or buy.

The results of the specific Swindon example show that the most financially beneficial option is renting and buying investment properties with a 75% mortgage as home ownership would equate to 8.68% of the annual cost compared to 4.15% when renting and investing. In contrast owning your home with a 75% mortgage is better than renting and buying investment properties in cash or investing in the S&P 500.

Is it worth owning rental property over lived in property

In this specific example it shows the benefit of renting large value, lower yielding properties as your residence you call home and investing in lower value, high yielding properties to generate your investment returns that pay for your lifestyle. The income generated through the net rent received from the high yielding investment flats in option 4 would likely pay a good portion of the rent which sets you well on the way to financial freedom. Furthermore, the debt that you would be taking on would be paid for through a tenant instead of through you which enables you not to be a slave to a job in order to keep the dream house alive.

Summary

The supplementary spreadsheet will help you understanding the financially best option in relation to your own specific situations and will go a long way to solving the equation of whether it’s better to rent or buy. There are obviously non-financial aspects that need to be factored into the decision that are listed in the pros and cons list although there will be some factors that are specific to you. With such a range of factors that affect the decision, the weighted decision-making matrix article would be helpful for this situation to round up various elements involved and highlight the best path forward through weighting the various elements involved by importance to you.