We delve into the differences between US and UK institutional portfolios and what allocations they use to build the best portfolio mix. Throughout your investing journey, one of the most important considerations is where you invest your money. There’s no quick answer; different geographies of the world offer different advantages and risks for investors. This article focuses on the perfect portfolio that institutional funds in the UK and the US adopt. In particular, the differing allocations for a portfolio depend on the geographical area you’re in.

As expected, each endowment fund takes an individual approach to diversifying their fund allocation. Although when combining the portfolios, it shows a significant trend whether you invest in the US or UK. We studied the allocations of 46 institutions and how they allocate their investment portfolios. It was apparent that these allocations were very different depending on which side of the pond you were on.

KEY FINDINGS

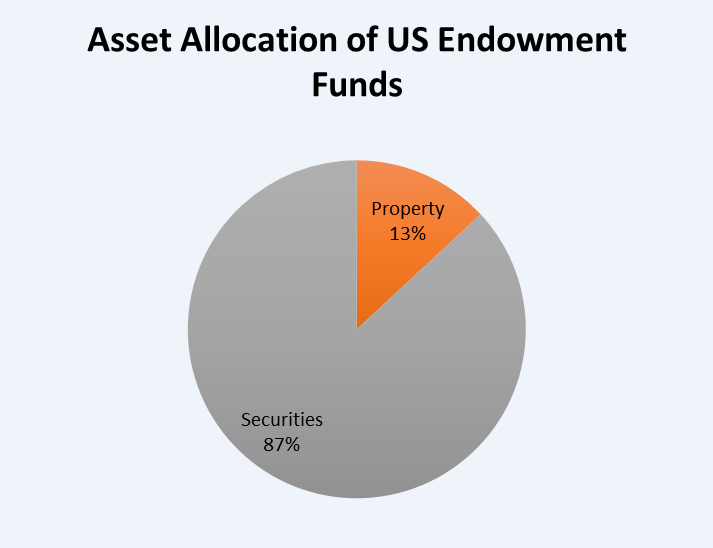

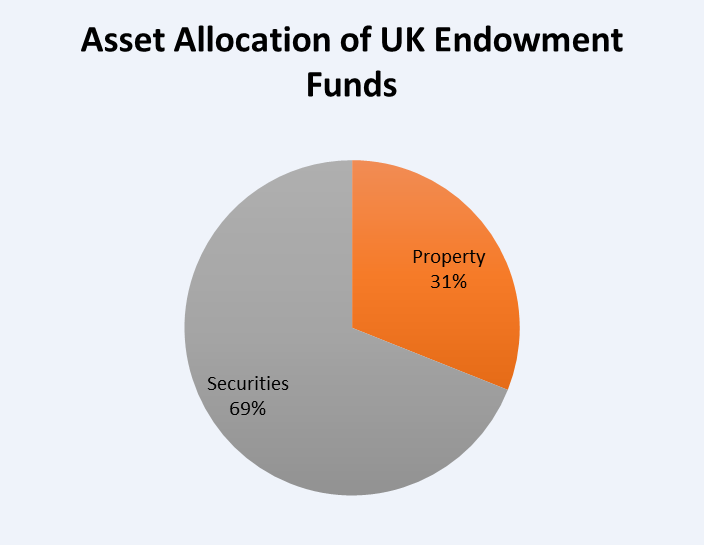

- UK endowment funds have a higher average allocation to property investments at 39%.

- US endowment funds have a lower average allocation of 13% to property-related investments.

- UK property capital appreciation is significantly higher than the US over a 40-year period.

- Supply and demand are the main drivers of growth over the long term.

ENDOWMENT FUND TRENDS

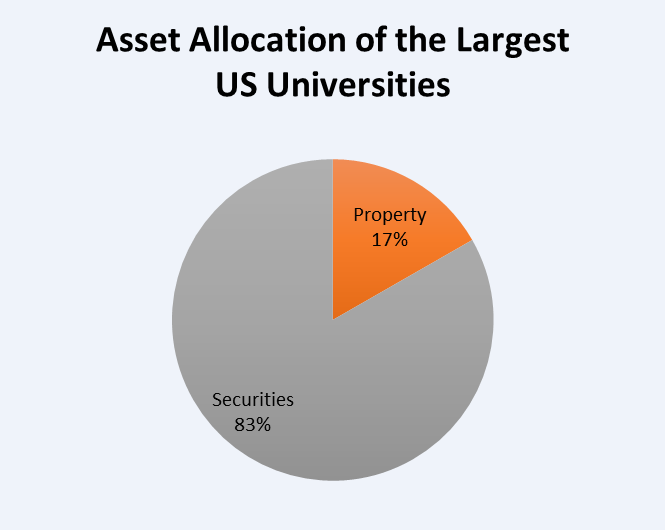

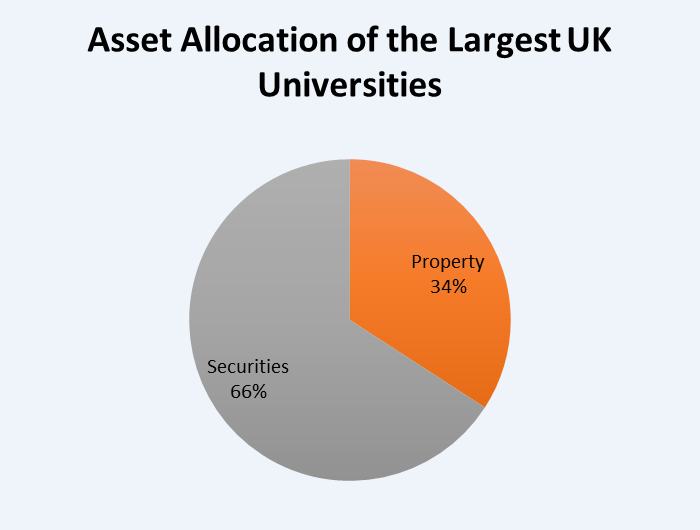

We collected the financial statements of endowment funds through publicly available sources to aid this analysis. The data highlighted that US funds have a higher concentration of security investments than property. The UK-based funds still have securities with the single largest allocation. Although they place a much greater emphasis on property within the portfolio, we split the analysis into two sections:

- Comparisons of the average UK-based university endowment allocations, such as Oxford and Cambridge Colleges, and the average US-based university endowment allocations, for instance, Harvard and Yale,

- The total of all institutions surveyed was split into US- and UK-based entities.

Average university endowment asset allocation in the US vs. the UK

Average institutional endowment allocation in the UK VS. the US.

We surveyed 26 entities from the UK and 18 from the US. There is a distinct difference between the UK and America, specifically when considering the allocation of property. The university comparison shows the UK to be twice as allocated as the US. Whereas the average for all institutions surveyed is well over double for real estate allocation in the UK.

It clearly shows whether you’re a university or another type of institution. If you’re based in the UK, there is a distinct likelihood of allocating more capital to property in your portfolio. In comparison, being in the US, you would likely place a greater emphasis on company ownership.

The best portfolio mix depending on location

This got my cogs working to try and understand why there was such an obvious difference in ethos depending on which side of the Atlantic you’re on. Understanding the historic returns achieved helps provide some understanding. The table below compares the average house price index growth achieved for all residential property types in the US and UK over the last 40 years.

UK vs. US property market 40-year performance comparison

| Country | 1980 index value | 2020 index value | 40-year total gain | Annualised return |

|---|---|---|---|---|

| US | 100 | 456 | 356% | 3.87% |

| UK | 10 | 124 | 1140% | 6.3% |

This paints a pronounced picture. Over the last 40 years, residential property asset appreciation in the UK has significantly outperformed that in the US. This could be why property investment in the US is less attractive to institutional investors than in the UK.

The best portfolio mix for real estate

UK property performance explained.

After understanding this, the first question was: Why are the returns so different between the UK and the US?

Over short periods of time, property prices are driven by a multitude of factors. Things like interest rates, affordability, economic climate, consumer confidence, unemployment rate, and so on. Over the long term, which is a key consideration for endowment funds, the main causes of property growth are supply and demand factors.

When looking at the US and UK property supply. The main macro-observation is that the US is a less populated country compared to its land mass, which creates natural supply and demand drivers compared to the UK. The US has 2% of its land that is urbanised compared to the UK, which has 8.7%. I’m unsure of the ethos of the American land conservation system, but we can drill deeper into the UK’s system.

UK land conservation & planning restrictions

The land conservation in the UK for greenbelt land covers 12.6% of the total UK land mass, which is located around towns and cities to restrict development. When adding the greenbelt to other land conservation areas such as national parks, areas of outstanding natural beauty (ANOB), sites of specific scientific interest (SSSIs), and land with significant flood risks, it totals 47.8% of the UK’s land protected from development. With 56.5% of the land mass in the UK either already developed or protected, it causes supply issues for new stock and puts upward pressure on development land and current property prices.

UK vs. US endowment fund overview

There are distinct differences in investment approaches when it comes to real estate allocations in endowment portfolios, depending on the location of the entity. Through further detail, it becomes clear that the reasons are likely to have to do with the historic investment returns of the UK and US property markets, with the UK almost doubling the capital growth of the US over a 40-year period. With this in mind, as an investor looking at their portfolio mix, the geography you intend the portfolio to be based in is a key consideration when deciding the allocation of real estate within your portfolio.

The best portfolio mix UK VS. US Overview

There are distinct differences in investment approaches when it comes to real estate allocations in endowment portfolios depending on location of the entity. Through further detail it becomes clear that the reasons are likely to do with historic investment returns of the UK and US property markets with the UK almost doubling the capital growth of the US over a 40-year period. With this in mind, as an investor looking at their portfolio mix, the geography you intend the portfolio to be based in is a key consideration when deciding the allocation of real estate within your portfolio.