The following article will help you start constructing a simple investment portfolio. The three recommended investment portfolios come from experts such as Ray Dalio, Warren Buffett, and David Swenson. We show their ethos’ and how they allocate assets in order for their families to benefit in the future without lifting a hand.

The three financial experts have very different approaches to structuring a simple investment portfolio. We share the different investment strategies and principles that will prepare you for all economic seasons. Moreover, it enables you to understand the risk vs. return of each portfolio to decide which one best suits you.

EXAMPLES OF A SIMPLE INVESTMENT PORTFOLIO

There are many ways to win when creating and maintaining financial wealth, which doesn’t need to be complicated. The three strategies promoted create very simple and effective results. Largely through eliminating the human tendency to tinker with things, this is achieved by:

- No stock picking, since you’re broadly invested across pre-set funds.

- There is lower volatility due to the diversification of index funds.

- There is no impulse since you’re setting, automating, and forgetting about your portfolio.

- There are no low management fees or anything else to drag down returns.

The following article will show you the exact make-up of simple investment portfolios, the historic returns, and the volatility experienced. The three robust portfolio options provided by Ray Dalio, Warren Buffett, and David Swenson are as follows:

- Portfolio 1: Ray Dalio’s All-Weather Portfolio

- Portfolio 2: Warren Buffett’s Two-Fund Policy

- Portfolio 3: David Swenson’s 50/30/20 Portfolio

Ray Dalio’s All-Weather Portfolio

Ray Dalio is a hedge fund manager who founded and ran Bridgewater Associates in 1975 in New York. Bridgewater Associates has been the world’s largest hedge fund since 1985. The All-Weather Portfolio was created by Ray Dalio and explained in detail in Tony Robbin’s book, Money Master the Game: 7 Simple Steps to Financial Freedom. The portfolio is designed to be able to “weather” all economic environments. It uses asset class diversification to hold positions that will perform in all market conditions and limit volatility. Dalio explains that there are 4 seasons that affect your portfolio in very different ways. The 4 seasons are inflation, deflation. rising economic growth and declining economic growth.

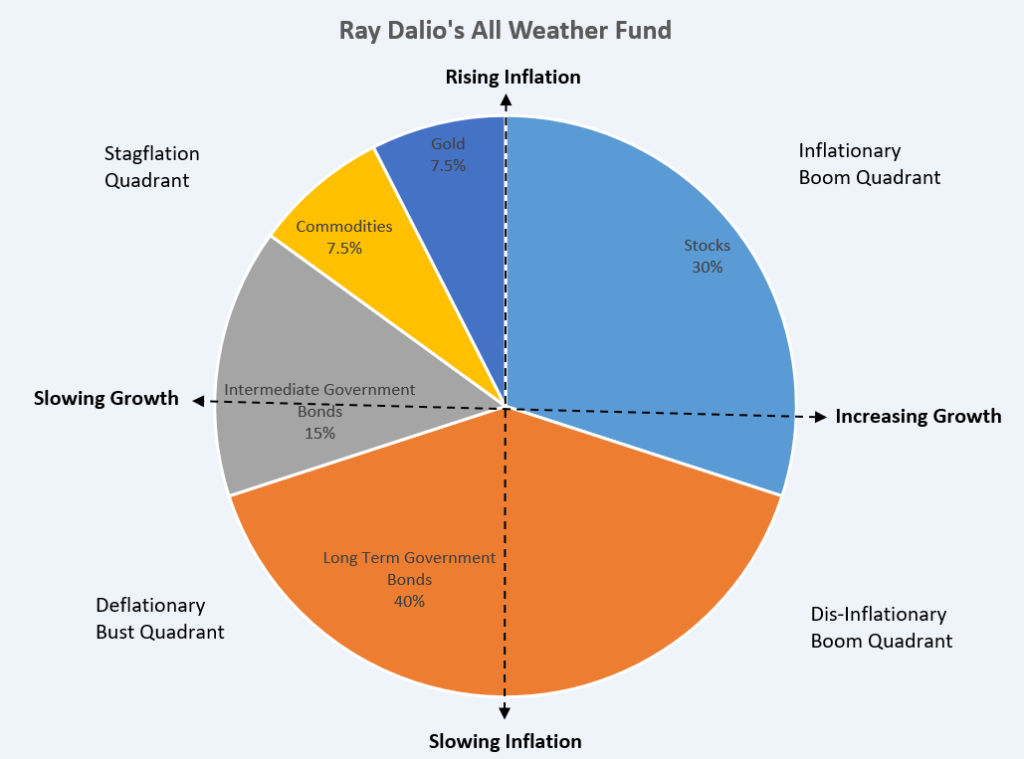

The All-Weather Portfolio asset allocation looks like this:

30% U.S. Stocks

40% Long-Term Treasury Bonds

15% Intermediate-Term Treasury Bonds

7.5% Commodities

7.5% Gold

Dalio articulates that, on paper, this goes against all investment allocation theory. Conventional 50/50 or 60/40 balanced portfolios are just where you put your money in assets. Although it’s not balanced in terms of risk as equities are three times more volatile than bonds. This results in your portfolio risk being significantly out of balance. The ethos around the all-weather portfolio is to have five assets, of which at least one will produce attractive returns in each season or quarter the economy finds itself in. This maintains a constant risk-adjusted return for the portfolio as a whole. The following chart below shows the asset allocation for each season of the market.

This portfolio provides the lowest standard deviation but also the lowest average return. This is a lot safer and more consistent year-to-year, and it prioritises volatility management.

| Time Period | Annualised Returns | Standard Deviation | Sharpe Ratio |

|---|---|---|---|

| 10 years | 4.37 | 7.64 | 0.49 |

| 20 years | 6.56 | 7.60 | 0.71 |

| 30 years | 7.19 | 7.18 | 0.70 |

Ray Dalio All Weather Portfolio: ETF allocation and returns (lazyportfolioetf.com) 28th February 2023

Warren Buffett’s two-fund policy

Warren Buffett is an investor, businessman, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway; he took over that role in 1970 and transformed Berkshire Hathaway from an unknown textile mill to one of the largest conglomerates in the world and a Fortune 10 company. There have been many books written about Warren Buffett’s investment philosophy, which the link will show you. They detail his investment beliefs and how he became one of the most successful investors ever.

What is the 90/10 rule of investing? Warren Buffet wrote that his family’s inheritance is to put 90% of the money into stock-based index funds and 10% into short-term government bonds. Warren Buffett’s 90/10 strategy is the simplest investment portfolio to follow out of the three, which is why it is so effective as it eliminates the majority of factors that cause you to lose money. It is also the most aggressive, which results in the highest potential returns, although with that comes the highest standard deviation, which means you’re likely to experience significant drops in value in challenging economic periods.

| Time Period | Annualised Returns | Standard Deviation | Shape Ratio |

|---|---|---|---|

| 10 Years | 11.01 | 13.39 | 0.77 |

| 20 Years | 9.57 | 13.32 | 0.63 |

| 30 Years | 9.21 | 13.51 | 0.52 |

Warren Buffett Portfolio: ETF allocation and returns (lazyportfolioetf.com) 28th February 2023

David Swenson’s 50/30/20 portfolio

David Swenson was an endowment fund manager, investor, and philanthropist. Swenson was the chief investment officer at Yale University and managed the investments of Yale’s endowment assets from 1985 until his death in May 2021. Moreover, he invented the Yale model, which is commonly known as the “Endowment Model” in the investing world. He promotes broadly a 50/30/20 model, in which 50% of investment capital is allocated to stocks, 30% to fixed-income securities, primarily bonds, and 20% to real estate. Swenson explains in his book Unconventional Success: A Fundamental Approach to Personal Investment that these percentages should change depending on your risk tolerance, age, and financial goals. Any portfolio can be broken down into different percentages this way, such as 80/20 or 60/40.

US equity: 30%

Foreign-developed equity: 15%

Emerging market equity: 5%

REITS: 20%

Treasury bonds: 15%

TIPS: 15%

This portfolio allocation provides a middle ground between Buffett’s and Dalio’s approaches regarding standard deviation and returns. It provides the lowest average Sharpe ratio, which is the return vs. variability ratio. It’s the difference between the returns of the investment—the risk-free return, divided by the standard deviation of the investment returns—and is used as a comparison method for the risk vs. return of multiple assets.

| Time Period | Annualised Returns | Standard Deviation | Shape Ratio |

|---|---|---|---|

| 10 Years | 6.28 | 10.95 | 0.51 |

| 20 Years | 8.40 | 11.75 | 0.62 |

| 30 Years | 8.23 | 10.84 | 0.56 |

28th Feb 2023 David Swensen Yale Endowment Portfolio: ETF allocation and returns (lazyportfolioetf.com)

WHAT IS IN A SIMPLE INVESTMENT PORTFOLIO

Index funds

What’s clear is that all three experts are huge advocates for index funds and recommend them over mutual funds or individual stock picks for any investor who is not a professional. In the words of Warren Buffett,

“By periodically investing in index funds, know-nothing investors can actually outperform most investment professionals.”

Index funds are easy to manage, cheap, low-risk, and naturally provide diversification. Although index funds are more than just this, they’re a way to invest without bringing emotions into the fold, which is one of the main factors that affect investment.

Rebalancing regularly

Another key takeaway for whichever investment portfolio structure you pursue is to have a regular rebalancing schedule. This is to ensure that each facet of your portfolio is rebalanced to the planned allocation. This can be done every 6 months, and the beauty of it is that you naturally sell high in sectors that have exceeded your allocations and buy low in areas that have lagged behind. It’s a good routine to get into in order to maintain your optimal portfolio allocation.

Bond & stock exposure

All three are advocates for owning both stocks and bonds in a portfolio. The exposure to bonds varies, with Buffett being willing to go as low as 10% and Ray Dalio as high as 55%, although all recognise the value of having an element of bonds in a portfolio. In basic terms, a portfolio without bonds can get too hard to stomach for most people in the short term, although overexposure to bonds creates the opportunity cost of higher returns that are achieved through a higher stock allocation.

There are plenty of views on the allocation to implement, and most evolve around your age. Jack Bogle, the man who invented Vanguard, has the rule of thumb that you should have your percentage of bonds at the same level as your age. Other notions are to take your age away from 120, and that’s the percentage you should have allocated to stocks. These are all hypothetical, and essentially, your personal asset allocation needs to be in accordance with your risk tolerance and your financial objectives. This will be the main barometer in deciding which simple strategy and allocation to implement and commit to when creating and maintaining your wealth moving forward.

MY TAKEAWAYS FROM A SIMPLE INVESTMENT PORTFOLIO

- If you’re young and saving for retirement, look to Buffett for inspiration.

- If you’re saving for a specific event within 2–5 years or are planning to retire and live off the portfolio, look to Dalio for inspiration.

- If you’re new to investing and unsure of your risk tolerance, look towards Swenson or Dalio for inspiration and work from there.

Disclaimer: This post contains affiliate links. This means we may earn a commission if you choose to sign up or make a purchase of a product using the links. We independently evaluate all recommendations and love all the companies we promote to you.