Universities have a similar goal and mindset as most individual investors when they invest in the stock market. They strive for a long-term return on their money while maintaining relative stability by controlling volatility exposures. Whether you are saving for a house in 3-5 years’ time or building for retirement in 10–20 years. Endowment funds in the UK and US provide a fountain of knowledge to learn from in the way they invest and build their portfolios.

You can see below how the top academic Institutions allocate their assets to invest in the stock market. Furthermore, how Stanford and Yale Universities developed their portfolios over 20 or 30 years to create the portfolios they have today.

HOW INSTITUTIONS INVEST IN THE STOCK MARKET?

We have separated the real estate investments to fully understand how US and UK institutions approach stock market investing. Furthermore, their view on the best security portfolio allocation for 2023 to maintain wealth in the current economic environment.

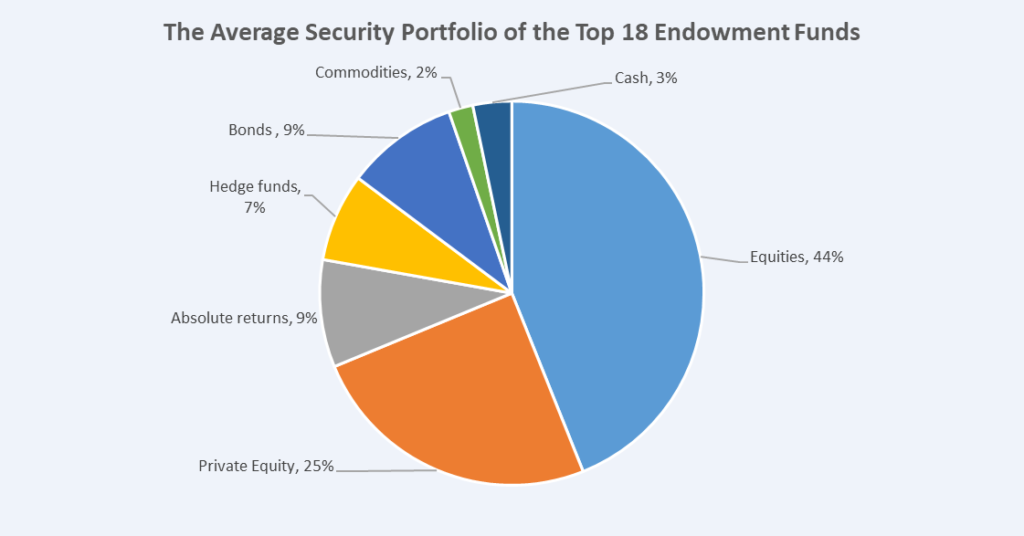

The following shows the average institutional portfolio taken from the 18 largest endowment funds in the UK and the US. The particular asset class allocations provide a template for individual investors looking to mimic entities with proven track records.

GLOBAL EXPOSURE TO PUBLIC EQUITIES

The first point to make is that it’s clear that institutions invest globally. The top 18 have exposure internationally to public stocks. This is achieved through a combination of emerging market and developed market investments across the world. The global exposure amounts to 34% of the 44% allocated to public equities in the portfolio. This is contrary to a significant number of individual investors who have a “home bias” and so invest largely or wholly in companies from their own country.

The table below shows the balance that institutions take when investing in domestic and international public equity investments in their portfolios.

| Public Equities | Developed Domestic | Developed Global | Emerging Markets |

| % Spread | 10% | 28% | 5% |

The exposure to different countries provides unrestricted access to cherry pick from the best companies in the world. The global reach provides access to better value and growth opportunities, instead of ring fencing yourself to one country. This approach can be replicated very quickly in your portfolio through global emerging markets and globally developed index funds. These offer a broad range of international stock exposure for a very low fee per year.

HOW has INSTITUTIONAL PORTFOLIO MANAGEMENT CHANGED OVER TIME?

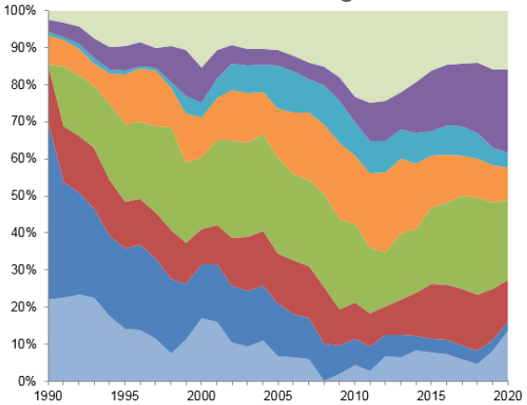

The development of institutional investing has changed significantly from the 1990s to 2021. It has been the growth of diversification through the development of non-traditional asset classes that has been the biggest mover. Over this period, private equity has driven the majority of changes in institutional portfolio allocation. In the 1990s, over three-quarters of institutional portfolios were invested in stocks, bonds, and cash. Whereas today, the same asset classes account for under a third of the average Ivy League endowment portfolio. This is shown in the following examples of Yale and Stanford’s endowment funds.

HOW DOES YALE ENDOWMENT’S INVEST IN THE STOCK MARKET?

Yale’s Investment policy has shifted over the years to strive for consistent, strong returns without volatility. The table below shows the asset allocation of Yale throughout the last 30 years and how diversification of assets has been at the forefront of the allocation transition over time.

Source: Yale Investments Office

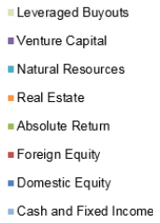

The transformation of Yale’s asset allocation has been so significant that the development of private equity, absolute return strategies, and real assets represent 77% of the endowment, and stocks, bonds, and cash represent 23%. The following chart shows the Yale Endowment portfolio as of 2021.

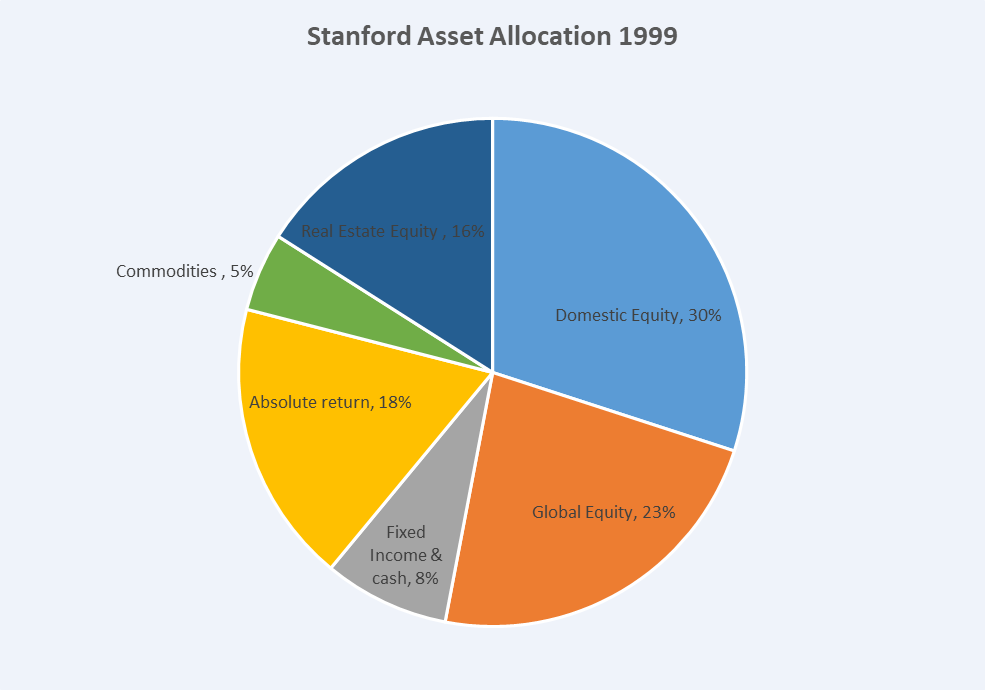

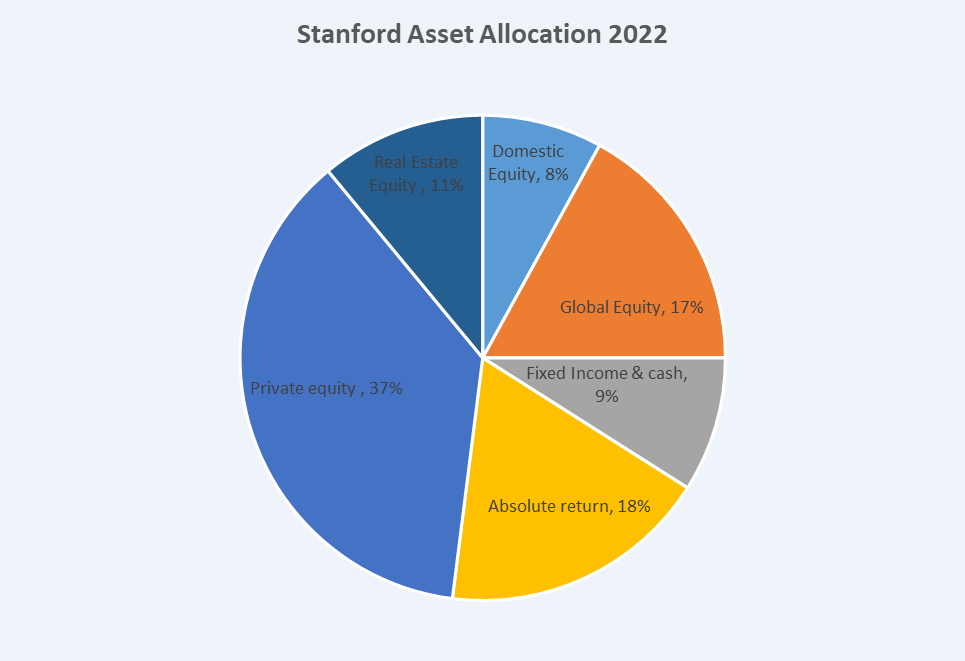

HOW DOES THE STANFORD ENDOWMENT INVEST IN THE STOCK MARKET?

The change in trend is just as obvious for Stanford University as it was for Yale. From 1999 to 2022, we reduced fixed income, stocks, and cash from 61% to 34% and diversified into private equity to the current level of 37%. Alternative investments stayed constant during the period, and these consisted of absolute return and leveraged buyouts.

WHAT IS PRIVATE EQUITY?

Private equity deploys capital to private companies that are not publicly traded on a stock exchange. It’s a transaction-oriented investment sector that uses leverage.

Pros of private equity

- Creates high, uncorrelated returns. In the case of absolute return strategies, you build a portfolio of events that don’t depend on the stock market growing.

- High portfolio diversification

Cons of private equity

- Carries liquidity risk as you are unable to sell these assets on demand like you can with publicly traded equity.

- It is hard to access quality funds that create the desired results.

- High fees due to the active management requirement for the asset class.

HOW THE UK & US INSTITUTIONS INVEST IN THE STOCK MARKET?

When accessing the merits of endowments, implement alternative assets such as private equity, venture capital, absolute returns, and leveraged buyouts in a portfolio. I don’t have a reason for this, although it’s quite a compelling stat that UK-based institutions put more emphasis on public equity investment than their US counterparts, which have more emphasis on private equity investment.

| Public Equities | Private Equity | |

| UK Endowments | 64% | 21% |

| US Endowments | 24% | 61% |

WHAT ARE BONDS?

A bond is a loan of your money for the right to receive a certain interest rate for a set number of years. It comes in the form of government bonds that produce low-risk and low-yield or corporate bonds that offer higher yields, although with higher risk levels. Institutions allocate relatively small amounts of their investments to bonds, which act as a stable reserve to draw from if needed for short-term spending requirements.

SUmmary

Endowment funds have huge influences on stock market investing. With their scale, they have access to the best active investment companies in the business to maximise returns and minimise risk. Their portfolios can be mimicked largely through index funds for the individual investor. Through understanding institutional asset allocations, I hope this will give you the confidence to start investing. There are no better entities to follow than endowment funds with a proven track record for generations.