When you’re looking to acquire an investment property, there is some background research that’s advisable. Below, we walk through the key aspects to consider when researching the ideal property investment for your specific goals.

ESTABLISHING THE FINANCIALS FOR YOUR INVESTMENT PROPERTY

First of all, establishing how much money you have available to put towards a deposit is a key driver for your search.

By using the deposit value, the following calculation will work out the maximum price you could pay for a property. The calculation is:

(Deposit x 4 (assuming you are putting down a 25% deposit) = Maximum Purchase Price)

You also need to consider closing costs such as legal fees and taxes. These will be completely dependent on the type of property you purchase, and there will be additional money on top of the deposit.

USING MORTGAGES FOR PROPERTY INVESTMENT

The amount you need to borrow to purchase the property is as follows:

(Purchase Price – Deposit = Your Mortgage Amount)

When dealing with mortgages and leverage within investments, there is more risk, although with that comes more reward. There are two types of mortgages you can take out: interest-only and capital-repayment.

Interest-only Mortgages

Interest-only mortgages do exactly what they say on the tin; you only pay the bank the interest for the loan. You don’t reduce the loan value or pay off the property over time; the loan amount is repaid either in a lump sum at a specified date or in subsequent payments. Interest-only mortgages provide lower monthly payments, which suit investors who want to generate meaningful cash flow each month. How to calculate monthly interest-only repayments

(Loan Amount * Interest Rate (say, 4.5%) / 12 = Your Monthly Payments)

Capital and Interest Mortgages

Capital and interest mortgages are normally for people buying their own home and sometimes investors. The borrower agrees to pay the bank over time through regular payments that cover both the principal and interest. Calculating monthly capital and interest repayments is a slightly trickier calculation. This is because you pay more interest and less capital at the start of the loan. Whereas you pay more capital off at the end of the loan and less interest. It’s easier to use a pre-populated service from Natwest to establish what your monthly loan payments would be.

For both mortgage types, the property then serves as collateral to secure the loan.

Stress Testing for Buy-to-Let Mortgages

Stress tests provide the rental level required to service a certain loan size. This is the rent you need to achieve from the subject property to ensure you fall in line with standard lending rules. 145% of monthly rent is a standard rule of thumb for most lenders, although some do provide products with lower entry levels, such as 125%. The calculation is as follows:

(Mortgage Interest Monthly Payments x 145% = Minimum Rental Requirement)

WHAT IS YOUR Ideal PROPERTY Investment GOING TO LOOK LIKE?

Is it a flat or a house? There is no right or wrong answer to this question, as it all depends on your objectives. Then you can select the property type that will produce the best returns and tenant profile in the location you’re targeting.

For instance, if you’re looking for a city centre location with professional tenants, then 1 to 2 bed flats or house shares such as HMO’s would be the best investment for you. Alternatively, for long-term tenants such as families, the suburban 2 to 3-bed houses would be more suitable.

WHAT IS THE LOCATION OF YOUR IDEAL REAL ESTATE INVESTMENT?

You need to decide the areas you want to buy. If you have a good budget, then you will have a lot of potential locations. The goal is to make sure that you have selected your location by the end of this section. Firstly, let’s establish your ideal investment property numbers, which will be the basis for your search.

Purchase Price………………………

Desired Yield…………………………

Desired rent………………………….

The area you are willing to invest in (such as North, South, East, or West)

Yield Research

After setting your parameters, you can research areas of the country you are comfortable investing in. You are researching the locations that have average yields that are at or above your ideal yield range. Write down everyone who satisfies your desired yield. If you have over 20 locations highlighted or under 3 locations, you will need to adjust your yield expectations or adjust your geographical search if you’re set on a certain yield. As a point to note, yields in the northern cities of the UK tend to be higher than those in the southern cities.

Locations 1: …………………………….

Location 2: ……………………………..

Location 3: ……………………………..

Locations 4: …………………………….

Location 5: ……………………………..

Location 6: ……………………………..

Locations 7: …………………………….

Location 8: ……………………………..

Location 9: ……………………………..

Sales Price Research

Once you have established a list of locations, you next need to search for the average house price for the size and type of property you are targeting. If the value falls within 10% of your maximum budget, then keep the town or city on the list; if not, delete it. Rightmove and Mouseprice are the best websites to help you in this search.

Rental Prices Research

It’s now time to sense-check the list of locations you have with the rental income you want for your desired property type. You have already confirmed that the average yield for the area conforms with your goals. Although this stage ensures the specific type of property aligns with your rental and yield goals. Look at the average rental for the size you are looking for. If the average is within 10% or above your desired gross rental income, then keep, if not discard, the location. You will be left with locations that match your price point and rental income requirements for the chosen property type.

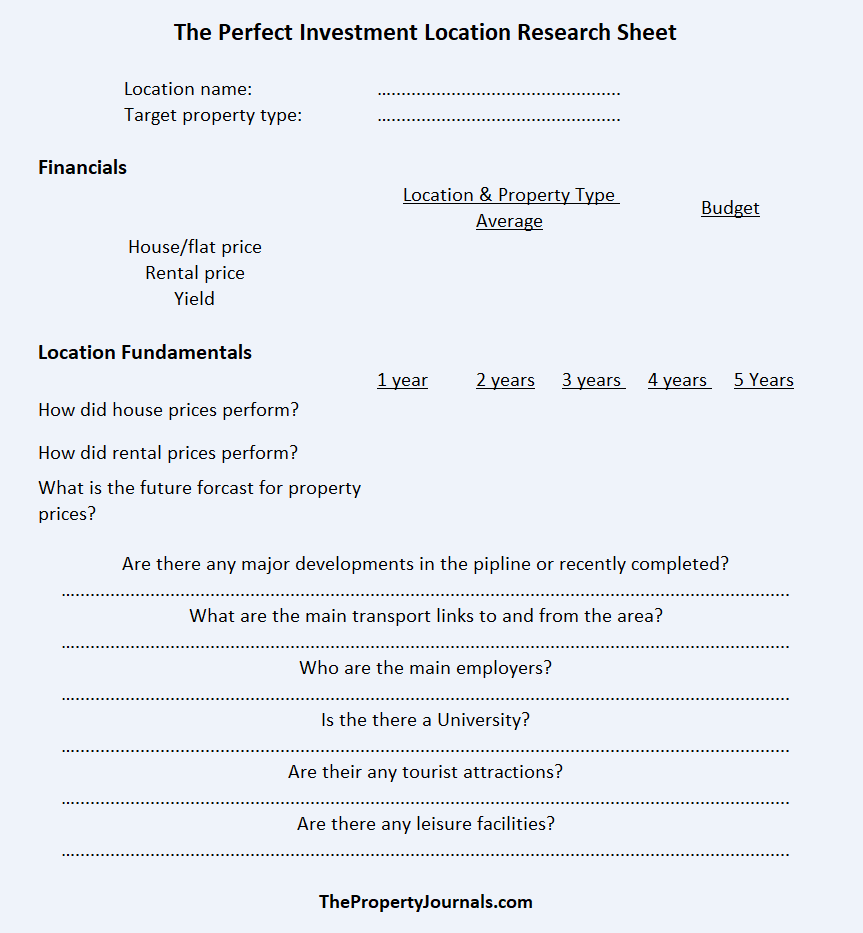

Location Fundamental Research

Your list is significantly refined now, and it’s time to analyse the remaining locations against each other. There are key aspects that are key drivers of property prices, which are listed below. The following printable sheet enables you to track each location’s financials and fundamentals on one sheet.

The sheet is to document and compare the locations you have left on your list. Moreover, by highlighting the key aspects, it should become obvious which is the ideal property investment location for you.

THE NEXT STEPS IN BUYING THE ideal PROPERTY INVESTMENT

By using this method, you may be left with a few very viable locations that, for different reasons, align with your goal. This is not the end of the world if you’re committed to building a portfolio. Having a few locations to invest in over time provides natural diversification within your future portfolio.

If you’re not familiar with the locations at the top of your list, it’s worth driving around the area to understand the neighborhoods. You can learn extra details for your location fundamentals research, such as traffic, town centre experience, and public transportation. Furthermore, which are the most appealing neighbourhoods, and are nearby properties well maintained? All of those are important factors that drive your potential rental demand, capital growth, and ultimate buyer in the end.

These ground checks can be done in conjunction with your first viewing day in the area. The aspects covered in this article will provide you with a well-rounded perspective and clarity on a location before you spend your hard-earned cash. If you have found your location, the next steps are to find a property that ticks your commercial goals and pull the trigger. Then rinse and repeat.