When it comes to property investment, one of the fundamental decisions is weighing up flats vs houses. Each option has its pros and cons. The choice depends on various factors, such as budget, location, rental demand, and long-term goals.

In this blog post, we will explore the considerations involved in this decision-making process. Furthermore, weigh the advantages and disadvantages of purchasing flats vs houses as a property investment.

HISTORICAL PRICE GROWTH – FLATS VS HOUSES

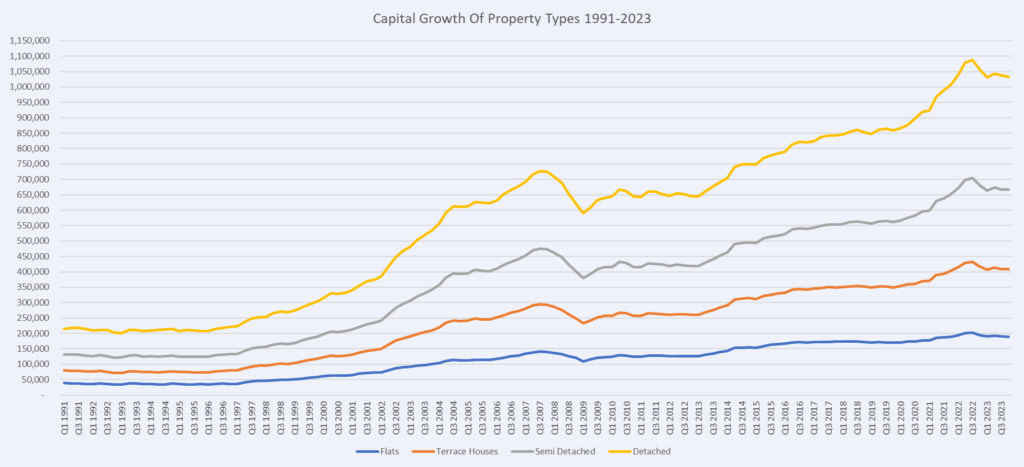

The historic capital appreciation performance of flats and houses has been influenced by various factors, including location, market conditions, and demand dynamics. The graph below shows the capital growth of the four property types over the last 33 years in the UK. This graph shows the average entry points for each property type throughout the market cycle.

Nationwide HPI News – Data & Resources (nationwidehousepriceindex.co.uk)

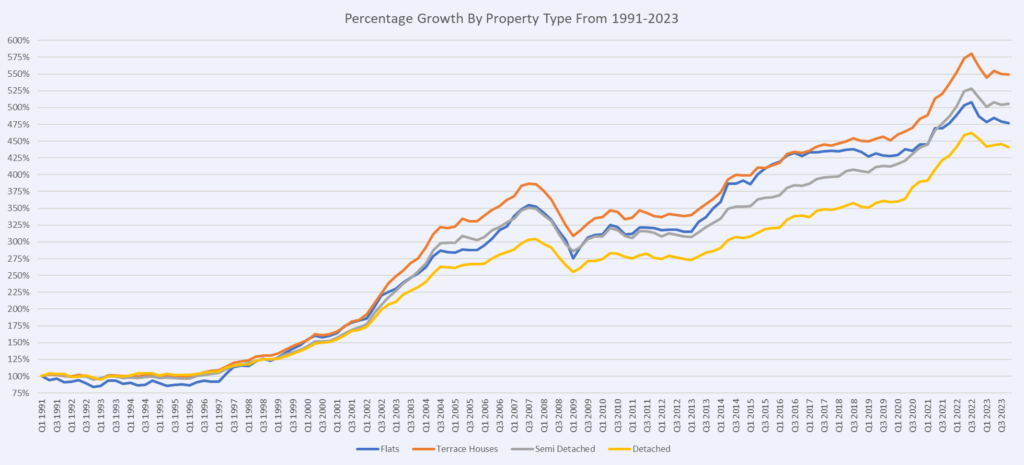

Although this graph can be quite misleading, you might think buying a detached home is the best for capital appreciation. The below graph compares the growth of different property investment types as a percentage, starting at 100% in Q1 1991.

Nationwide HPI News – Data & Resources (nationwidehousepriceindex.co.uk)

Flats vs houses: which is best?

Terrace houses have provided the strongest capital appreciation as a percentage over the time period. Throughout the period of just over 30 years, flats and semi-detached houses have jostled for second place. Therefore, depending on when you take the data reading, these two will interchange. As of Q4 2023, and off the back of the recent drive for more space due to COVID, semi-detached houses are second in growth. Detached houses have consistently been the lowest in regard to growth.

| Property Type | Percentage UK Growth 1991-2023 |

| Flats/Apartments | 376.6% |

| Terrace House | 448.9% |

| Semi-detached House | 405.5% |

| Detached House | 341.3% |

Over the years, urban regeneration projects and improvements in infrastructure have further contributed to the capital appreciation of urban areas. Additionally, real estate within cities benefits from land scarcity, especially in desirable locations. This can drive up prices and contribute to capital appreciation for flats, terraces, and semi-detached houses.

Detached houses are less obtainable for the majority of the population, as the average UK value is over 1 million. Ultimately, this creates less demand, generally in less urban locations such as the countryside.

It’s important to note that regional variations exist in the capital appreciation of both flats and houses. While some areas have grown significantly, others have seen more moderate or even negative growth. Do research on your target market for more specific historic results for your submarket.

AFFORDABILITY AND INITIAL INVESTMENT DIFFERENCES BETWEEN FLATS AND HOUSES

One of the primary factors to consider when choosing between a flat and a house is affordability and the initial investment required. The graph above shows the significant difference in entry points for each property type. This makes flats an attractive option for investors with limited budgets. Additionally, flats often have lower maintenance costs as communal repairs are split between owners. Furthermore, flats may offer shared amenities such as gyms or swimming pools, which can be appealing to tenants.

On the other hand, houses generally have higher purchase prices, and maintenance costs can be more significant. However, houses typically offer more space, both indoors and outdoors, which can be advantageous for families or those seeking more privacy. It is essential to assess your financial situation and determine the level of investment you are comfortable with before making a decision.

FLATS VS HOUSES: RENTAL DEMAND AND RETURNS

Rental demand and potential returns are critical factors for property investors. When it comes to flats, they are often in high demand in urban areas, particularly among young professionals and students. Flats can provide a higher rental yield due to their lower purchase price and the ability to rent out individual units in apartment buildings. Moreover, flats are typically easier to manage, and vacancies can be filled quickly.

Houses, on the other hand, may attract a different demographic, such as families or tenants seeking more space and a sense of community. While rental yields for houses may be lower compared to flats, houses often offer the advantage of long-term stability and the potential for capital appreciation over time. Families tend to stay in houses for longer periods, resulting in reduced tenant turnover and potentially fewer vacancies.

It is crucial to research the local rental market and assess the demand for flats or houses in your target area. Consider factors such as proximity to amenities, schools, transportation, and future development. Furthermore, the preferences of the target tenant demographic will help them make an informed decision about which property type is likely to provide better rental returns.

MAINTENANCE AND FLEXIBILITY

Maintenance and flexibility are significant considerations when choosing between a flat and a house as an investment property. Flats generally require less maintenance, as many aspects, such as building repairs and communal spaces, are often managed by the property management company or homeowners’ association. This can be advantageous for investors who prefer a more hands-off approach or have limited time to devote to property maintenance. Additionally, flats may offer greater flexibility in terms of exit strategies, as they can be easier to sell or convert into serviced apartments.

Houses, on the other hand, offer greater control and autonomy as property owners. Investors have more flexibility in terms of renovations, modifications, and the ability to expand the property. This can potentially increase the property’s value and appeal to a wider range of buyers or tenants in the future. However, it is important to note that houses require regular maintenance, including outdoor spaces, which can be time-consuming and costly.

SUMMARY

The decision of flats vs houses as a property investment depends on various factors, including affordability, location, rental demand, and personal preferences. Furthermore, if you have multiple property investments, having a blend of houses and flats is a good way to go. Having both gives you the combined benefits, which are as follows:

- Flats offer lower initial investment costs, higher rental yields, and lower maintenance requirements.

- Houses, on the other hand, provide more space, the potential for long-term stability of tenants, and greater flexibility for customisation.

Ultimately, investors should carefully evaluate their financial situation, research the local market, and consider their long-term goals to make an informed decision that aligns with their investment strategy and objectives.