The investment approach is the most common method for determining the value of income-generating real estate. This valuation approach focuses on the property’s current and future ability to generate income and calculates its value based on cash flows. There are two methods you can use for the investment approach.

- The capitalization approach.

- The term and reversion approach.

In this blog post, we will provide a step-by-step guide on how to value property using the two investment approaches. By understanding and applying these methods, investors can make informed decisions when assessing the value of properties that generate income.

When Would You Use The Investment Approach?

The investment method is for properties that produce rental income, such as commercial buildings or multi dwelling residential buildings. In order to value these types of properties, you are establishing the appeal to an investor instead of the owner occupier market.

There are two main drivers of value when you carry out a valuation of a commercial property.

Firstly, consider the risk the investment presents to the investor. This is the market yield you establish from comparable transactions. Moreover, the adjustments you make to reflect the lease terms, tenant covenant, etc to reflect the subject property.

Secondly, consider the income the property is generating and how that compares to the market rate at the time of valuation.

THE 5 STEPS TO CARRYING OUT THE INVESTMENT VALUATION APPROACH

1) Gather property information for the investment approach

Begin by gathering all relevant information about the property’s income streams. This includes rental income, lease agreements, occupancy rates, and any additional revenue sources. Obtain financial statements, rent rolls, and property management reports to gain a comprehensive understanding of the property’s income-generating potential.

2) Calculate the total income for the building

By using the rent roll and financial statements, you can establish the yearly cashflows for the property, which will be the basis of the valuation. By assessing the occupancy rates, you will establish if the property is fully let or part let. If the property is partially vacant, you will need to establish what the market rent is for that area that’s vacant. This can be done through the comparable method of other rental transactions in the building or in neighbouring buildings and adjusting to the subject property.

3) Determining the right yield & capitalization rate

While the investment approach primarily focuses on the property’s income-generating potential, yield selection is just as important. As mentioned previously, a yield is the barometer of risk for the investment. It represents the expected rate of return on a property, considering its income potential and the associated risk of receiving tenant cash flow.

You establish this through comparable evidence of other transactions, and you need to consider factors that may influence its value. Market conditions, location, tenant covenant, lease terms, property condition, and potential future developments in the area can impact the property’s value. Adjust the yield accordingly if these factors differ significantly from the market comparables.

By knowing the yield, you can determine the capitalization rate, also known as the cap rate. To establish the cap rate, you do the following calculation:

100 / Yield = Cap Rate

100 / 4.5 = 22.222

4) Understanding the nature of the tenancies in the building.

The nature of the tenancy has a big bearing on the yield. Previously, I mentioned the different adjustments that could be made to comparables to reflect the subject property. The following shows some example characteristics of a low and higher risk tenancy in an investor’s eyes.

Low risk (yield), aka a higher cap rate, would be for a tenancy with the following characteristics:

- A tenant with a good covenant

- Fully let with over 3+ years to run until the next lease expiry

- No significant planned maintenance is required on the property.

- No tenant break options

A higher risk (yield), aka a lower cap rate, would be for a tenancy with the following characteristics as an example:

- A start-up business as a tenant

- A pending renewal, a tenant break clause, or a building that has existing vacancies

- Large property management requirements, such as roof repairs

- Tenants that are paying above-market rent

5) How to calculate the property value.

This can be done through two investment valuation methods: the capitalization approach or the term and reversion approach. In order to do a thorough job, analysing both methods is the best way to make sure the value is reasonable.

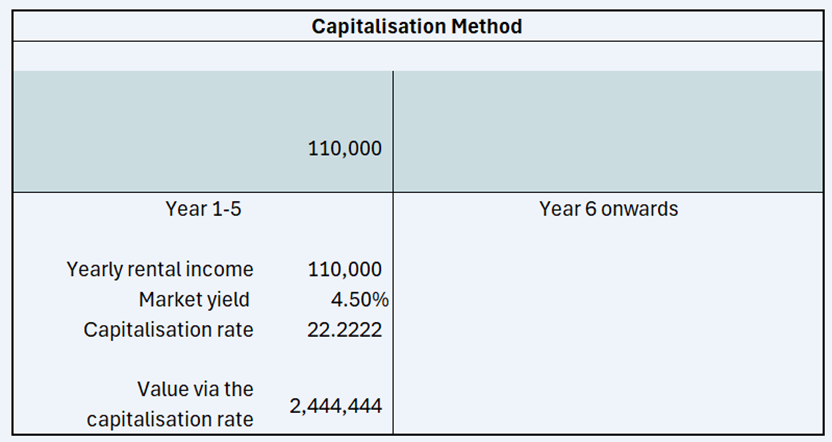

The capitalisation method

This is the simpler method and is used when the property is rack-rented. This means that the rent paid is the market value of the asset. This is commonly the case if a new lease or rent review has just happened. To determine the property’s value, you divide the subject property’s gross annual income by the market cap rate for that asset type. The formula is:

Property Value = Gross Rent / Cap Rate

For example, if the property has a gross rent of £110,000 per annum and the market cap rate is 4.5%, the property value would be:

This calculation provides an estimate of the property’s value based on the current income of the property and the expected rate of return.

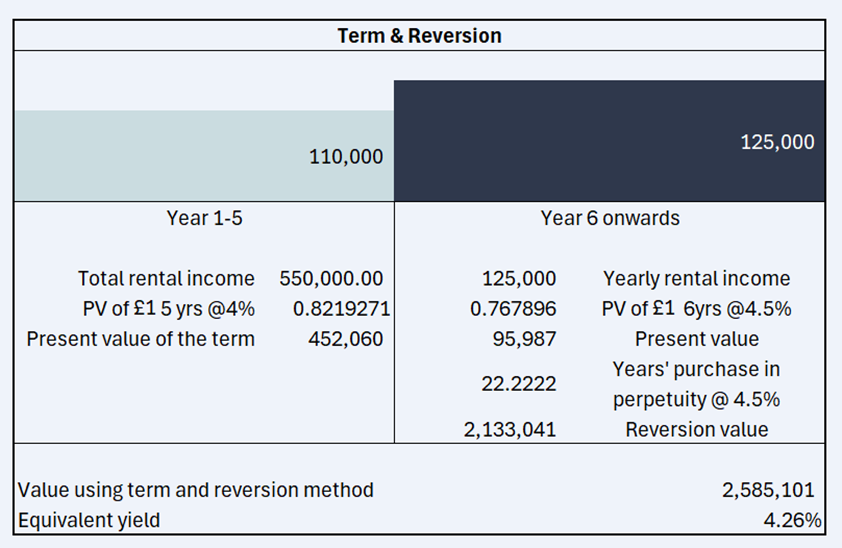

The term & reversion method

The term-and-revision investment approach is best for when the last review was over a year or more ago. After this period, rental levels will move, and many investments will have a current rent that is less than the market rent.

Valuing an under rented property

In this situation, the investor expects a rise at the next review or lease renewal date. The rental comparison between what is being paid now, and the market is done by assessing recent lettings of similar properties.

Like the capitalisation method, the yield is calculated using market data, usually from rack-rented investments. This yield is to value the reversionary rent, which accounts for most of the value in this valuation method.

The term yield is reduced by 0.5–1.0% to reflect the tenant’s contractual agreement to pay the set rent, reducing the risk for the investor.

The example calculation below shows how to separate income flows for the term and reversion for valuation purposes:

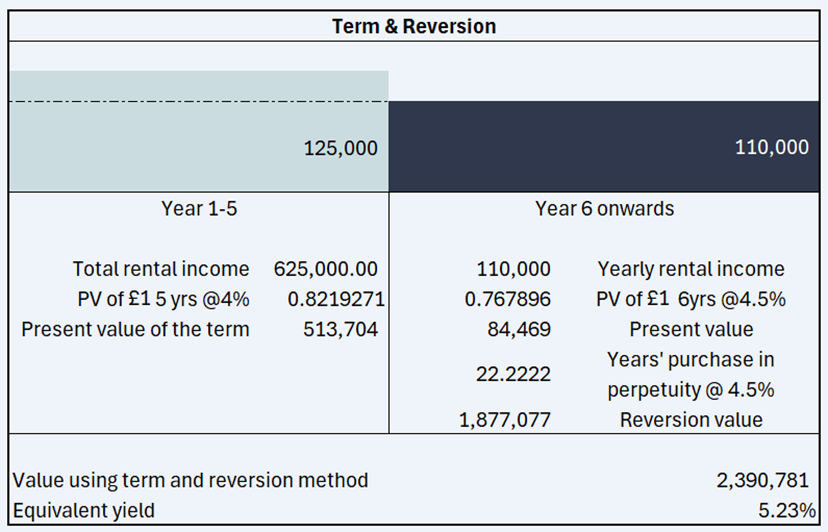

Valuing an over rented property

For situations where the current rent is above market and at review or lease renewal the rent is likely to reduce, you use the same term and reversion calculation. This can be where a property crash is happening, and tenants are committing to a specific term at the top of the market. As a result, factoring this in has a significant effect on investor value. The following shows an example calculation.

The PV Values and Years’ purchase values are from TABLE OF CONTENTS – Parry’s Valuation and Investment

You can see the influence the lease has on the overall property value. Relying solely on the capitalisation rate method without assessing the current rent’s alignment with the market may result in offering either above or below market value, potentially jeopardising the acquisition of the property. This becomes notable when another investor recognises the lease’s value and competes to secure the property.

FAQ’S

What is a tenant covenant?

A tenant covenant is essentially the reputation of a business. It includes the size and scale of the business, their finances, the type of business conducted, their brand, the age of their business, etc.

A good tenant covenant would be for companies like a government entity, a bank, or a multinational company such as McDonald’s.

A riskier tenant covenant would be startup companies, small-scale fast-food restaurants, or hairdressers.

What is a cap rate?

The capitalization rate is a multiplier used to determine the market value of an investment by multiplying the rental income. This multiplier is from the market yield from in comparable transactions of similar properties in a specific location. This market yield is from comparable transactions of similar properties.

You can the yield/cap rate in 2 ways to calculate the property value: (current annual rent of the asset) / (market yield) = market value.

An alternative way to calculate it is: (current annual rent of the asset) x (100/market yield = cap rate) = market value.

The difference the yield and cap rate make to the capital value is huge. For example, an apartment building rents out for £50,000 a year. If the market yield is 5%, you divide 100 by 5 to get a 20-cap rate. The value of the asset is worth £1 million.

Although if the market yield was 10%, the cap rate would be 10, so the value would be £500,000. Moreover, if the market yield was 2%, the cap rate would be 50, and the value would be £2.5 million.

The yield of a property has a huge impact on the capital value of the property.

How to make money from the investment approach

Having gained an understanding of how to value commercial property, it becomes evident that there are plenty of opportunities to enhance value. One prominent method for investors is altering the yield an asset commands. Using the previous example in the cap rate explanation, purchasing a high-yield asset associated with high risk and subsequently restructuring it to reduce risk, thereby dictating a lower yield, can generate value.

For instance, acquiring a property with an annual income of £50,000 at a 7.5% yield would entail a purchase price of £666,666. During the initial two years of ownership, a combination of the following actions can be undertaken:

- Lease renewals

- Rent reviews

- Acquistion of a new tenant with a good covenant

- External repairs to the property

- Extended the term of leases so the next expiry is 3+ years away.

Implementing any of these options can effectively decrease the investment risk and potentially lead to an increase in annual rent. As an example, assuming that a combination of these actions results in a rent of £60,000 and a yield of 6.5%. The property’s value would rise to £923,076, representing an increase of £256,410.

I call this approach knowledge investing. It involves leveraging your market knowledge to add value instead of undertaking extensive property refurbishments.

Summary of the investment approach

Valuing a property using the investment approach allows investors to assess its worth based on its income-generating potential. By considering factors such as the property’s current and future income potential, the prevailing capitalization rate (cap rate), and additional market factors, investors can estimate its value.

Consulting with professionals or appraisers can provide further insights and accuracy in property valuation. By utilising the investment valuation approach, investors can make informed decisions when evaluating income-generating properties.