As a real estate investor, you have a wide array of house types in the UK to consider in your portfolio. From city centre flats to sprawling countryside detached houses, each option comes with its own unique characteristics, pros, and cons.

What are the different house types you can buy in the United Kingdom. Moreover, what generates the best return are questions we hear a lot. Let’s dive in and explore the most common house types in the UK to help you make investment decisions.

WHICH HOUSE TYPES IN THE UK IS GROWING THE FASTEST?

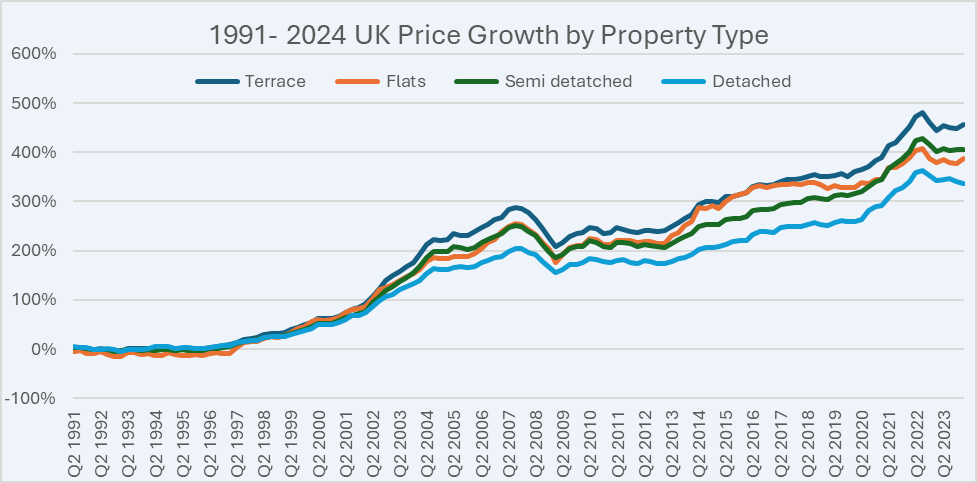

The graph below shows, on a UK-wide average basis, that terrace houses provide the most capital growth. This is between the periods of 1991 and Q1 2024. Within this period:

- Terrace houses grew by 456%.

- Semidetached houses grew by 407%.

- Flats grew by 387%.

- Detached properties grew by 337%.

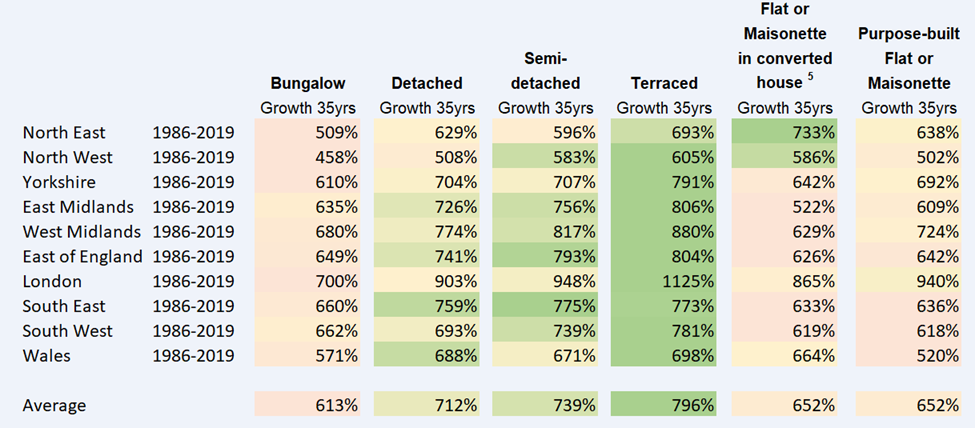

WHICH HOUSE TYPE GROWS THE FASTEST IN EACH REGION?

The UK is a big place, and we thought analysing each property type on a UK basis probably doesn’t show a fair reflection of how different property types perform in more localised markets. The following shows how the UK trend actually filters down into most of the regions. With a few exceptions, such as the northeast and southeast Terrace houses ran away with the growth trophy. Even in the northeast and southeast, terrace houses were a very close second.

This data set is from 1986–2019 and shows the differential growth rates during the period for the different property types in the UK.

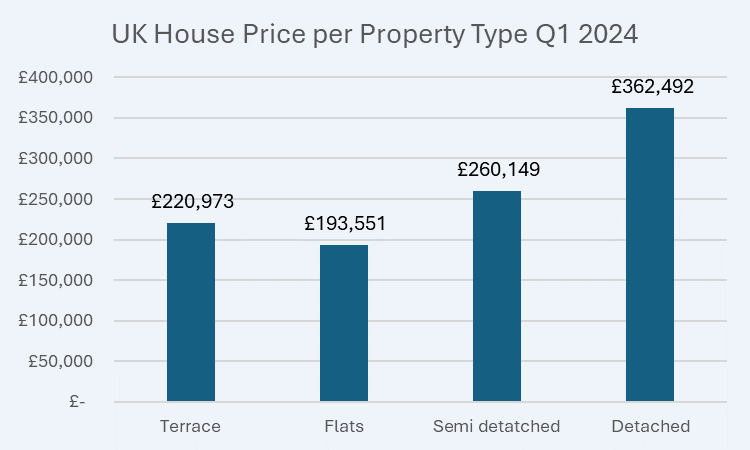

WHAT BUDGET DO YOU NEED FOR EACH PROPERTY TYPE IN THE UK?

Before delving into the pros and cons for each house type, you may want to consider the price entry points for each of the house types in the UK. The following is a pricing chart that contains the average price by property type for the UK as of Q1 2024.

THE PROS AND CONS OF THE 7 PROPERTY TYPES

1. Terrace Houses

Terraced houses were built in a row and shared walls on both sides with neighbouring properties. These compact, multi-story homes are often found in urban areas and can offer good rental yields due to their efficient use of space. This housing became popular in the 19th century to house the working class in space efficient properties.

The main advantages include affordability, low maintenance, and the potential for steady rental income without the management charge of a flat.

However, you may face challenges with shared walls, limited outdoor space, smaller internal space, and less privacy if you live on the property.

2. End-of-Terrace Houses

End-of-terrace houses, situated at the end of a row of terraced homes, can be an attractive investment option. These properties often benefit from additional side access and outdoor space compared to their mid-terrace counterparts.

Investors may enjoy the potential for capital appreciation and flexibility in layout with the potential to extend sideways. Furthermore, it benefits from more windows due to the three open elevations and sometimes large garden plots.

Drawbacks may include the fact that the internal space will still be small and won’t be comparable to other semidetached properties because of access points and plot size.

3. Semi-Detached Houses

Semi-detached properties are homes that share one wall with an adjacent house. They provide a middle ground between the privacy of a detached home and the cost-effectiveness of a terraced house. In the late 18th century, semidetached houses were systematically designed in the suburban areas of cities.

Semi-detached homes often feature larger floor plans, more outdoor space, and potentially car storage on a driveway or in a garage.

Whereas the tradeoffs include slightly higher costs and increased maintenance compared to a terrace property, but you still have the noise issue with one neighbour being close.

4. Detached Houses

Detached houses stand alone, with no shared walls. They are commonly found in rural or suburban areas and benefit from larger land areas. Moreover, larger land plots provide space for drives, privacy, and gardens. Although you tend to be more detached from local amenities.

This housing type offers the most privacy and flexibility to renovate. Investors may enjoy the ability to customise the property and accommodate larger families, and tenants tend to stay for longer periods of time.

However, detached homes typically carry higher purchase prices, maintenance costs, and taxes such as council tax compared to other options. Moreover, they seem to be in more decentralised locations.

5. Cottages

Charming country cottages, with their cosy ambiance and picturesque exteriors, can make for excellent investment properties, especially in popular tourist destinations. Historically built for rural estate workers, they have thick walls and small windows to withhold winters in the Middle Ages.

These smaller, historic homes often feature unique architectural details and serve as attractive short-term rentals or vacation homes.

Whereas main considerations include the potential for higher maintenance costs, seasonal fluctuations in occupancy, and the need to balance historic preservation with modernization.

6. Bungalows

Bungalows are single-story homes, often with an open floor plan and accessible features like ramps or no stairs. This style appeals to retirees, families with mobility concerns, and those seeking a low-maintenance lifestyle. It’s a style of home that’s going out of fashion as developers opt for multi-story developments.

Bungalows can be a wise investment, particularly in areas with ageing populations, as they provide desirable living spaces for older tenants. They are cheaper, easier to maintain, and as less and less is being built, they hold their value well for their target market.

The drawbacks may include limited space, higher land costs as the property is spread across more land compared to a double story building. Moreover, there is less of a buyer pool when reselling compared to multi-story homes.

7. Flats/Apartments

Investing in individual flats or entire apartment buildings can provide a steady stream of rental income. Converted flats are also common in the UK, where homes have been converted into flats.

Flats offer affordability, lower maintenance responsibilities, and the potential for higher yields in densely populated areas.

However, you’ll need to navigate factors like shared amenities, homeowners’ association (HOA) fees, and the management of multiple tenants. Moreover, you need permission to remodel flats.

Summary

When selecting house types in the UK for your real estate investment, it’s crucial to consider factors such as your historical financial performance, investment goals, target tenant demographics, and the local market conditions.

Therefore, by understanding the unique characteristics and tradeoffs of each of the house types in the UK, you can make informed decisions and build a diversified, profitable portfolio.