After the generational ownership of central London by aristocratic families, The Crown, and The Church since the 16th century, they were named the Great Estates of central London. The creation of the Great Estates through time provides lessons on property investment and some historical context. We highlight their change in estates throughout their circa 400 years of ownership. The diversification of property types within their estates which has enabled them to thrive over the centuries.

THE BRIEF HISTORY OF THE GREAT ESTATES OF LONDON

In the 17th century, the city of London was a tightly packed residential and commercial center. The great plague and fire of London in 1665 and 1666, respectively, increased demand for housing away from the city. This created great opportunity for the landowners to develop their agricultural fields and increase their fortunes. Through the next couple of centuries and in-between wars, the West End Estates developed the streets we know today.

BUILDING THE GREAT ESTATES OF CENTRAL LONDON

The key was the system of leasehold land tenure, which aided the growth of London. This involves the owner leasing the land to a developer, who in turn develops the land at their own cost. At the end of the lease term, the land and property revert to the owner. These leases were commonly for 99 years, which gave the Estates the ability, in the short term, to receive the ground rent from the lease and, in the long term, gain fully developed estates without the risk or capital expenditure.

WHO OWNS CENTRAL LONDON?

The foreign investors are overtaking the inheritors in recent years for the crown of the wealthiest property magnates in London. The Great Estates still have significant ownership of central London and so still hold significant influence over the heritage and landscape of London today.

THE GROSVENOR ESTATE

The estate’s history dates back to 1677. The Grosvenor family inherited the Manor of Ebury, 500 acres of land north of the river Thames. Today, the estate includes much of Mayfair and Belgravia. The Family has diversified globally and become leading property investors with properties in 43 cities across the world.

The Grosvenor Estate Global Portfolio

| London (UK) | Regional (UK) | North America | Asia Pacific | Europe | South America |

|---|---|---|---|---|---|

| 52.9% | 3.3% | 28.0% | 9.0% | 6.1% | 0.7% |

The London portfolio is the most expensive property on a Monopoly board. Although has reduced in size from approximately 400 acres in 1925 to 300 acres in recent times. This is due to the sale of 100 acres of Pimlico in the 1950s. The wider portfolio is a pioneer of diversification, shown in the 2023 annual report. The total portfolio value is 10.8 billion and a development pipeline of nearly 14.9% of the total portfolio value.

The Grosvenor Estate Asset Allocations 2023

| Property Portfolio (m) | Rural/Strategic Land | Office | Retail | Industrial | Student Accommodation | Residential |

|---|---|---|---|---|---|---|

| £10.8m | 4% | 37% | 26% | 9% | 1.8% | 23% |

THE CADOGAN ESTATE

The Cadogan Estate lies roughly adjacent to the Grosvenor Estate in Chelsea. In 1720, Sir Hans Sloane purchased the Manor of Chelsea and is still in the hands of his ancestors now. In the annual report for 2020, the total value of the estate was 4.8 billion. The 2020 estate value was 14.2% lower from its value before the COVID-19 pandemic a year earlier. The estate has significantly reduced from its former ownership of approximately 200 acres in 1925 to 93 acres. It still stretches across Kensington and Chelsea, owning prime residential, retail, office, and leisure properties that vary in age, as well as 15 acres of gardens allocated as below. Their pipeline for planned expenditures and redevelopment is 10% of the total value of the portfolio.

The Cadogan Estate’s Asset Allocation 2020

| Sector | % Capital Value | % of Rental Income |

|---|---|---|

| Retail | 44% | 50% |

| Office | 15% | 21% |

| Residential | 31% | 19% |

| Leisure & Other | 10% | 10% |

THE HOWARD DE WALDEN ESTATE

Owned directly and indirectly by members of the Howard de Walden family since 1710. The estate neighbours The Portman Estate and comprises most of the eastern side of Marylebone. It runs from Marylebone High Street in the west to Portland Place in the east. Like other Great Estates, the Howard De Walden Estate has significantly reduced in size in recent years. The approximate size in 1925 was 292 acres, now it’s in the region of 92 acres. Within these 92 acres, the estate still comprises of around 850 buildings in central London. The annual reports for 2022 show the portfolio value at 4.6 billion and the portfolio as below.

The Howard De Walden Estate Asset Allocation 2022

| Sector | % of Capital Value | % of Rental Income |

|---|---|---|

| Healthcare | 40% | 40% |

| Residential | 22% | 21% |

| Office | 19% | 19% |

| Retail | 14% | 14% |

| Educational & Other | 5% | 6% |

THE PORTMAN ESTATE

Located on the western side of Marylebone between the Manchester Square to Edgware Road, the Portman family has owned The Portman Estate since 1532. After 200 years of ownership of the London estate, the Portman family started developing the 11 fields in 1755. The family has always owned property in the West Country amassing 30,000 acres at it peak. Death duties forced the family disposed of it all in the early 1900s. Many of these estates led to the naming of many of the roads developed in Marylebone.

The family purchased two rural estates in 1948, one in Herefordshire and one in Buckinghamshire, which totaled approximately 3,000 acres. After the sale of the northern part of the estate, the estate now comprises approximately 110 acres, which is down from its previous 270 acres in 1925. The list below shows the current breakdown of the estate including the famous Selfridges on Oxford Street.

- 255 Office Units

- 175 Retail units

- 700 Residential units

- 30 Hotels

- 8 Pub

THE CROWN ESTATE

The Crown Estate’s ownership dates back to the Norman Conquest of 1066. The estate owns Regent Street, large columned houses/commercial buildings surrounding Regent’s Park, the Pall Mall and Piccadilly. After nearly 800 years of ownership, The Crown completed the Regent Street development in 1826. The London Estate continues to be developed and improved, with 0.5% of the capital value spent in 2021 was on redevelopments. The Estate extends throughout Britain, comprising urban, rural, and marine assets that total 175,000 acres.

The Crown Estate Asset Allocation & Yields for 2021

| London | Regional Cities | Regional Land | Marine | |||

| Allocation | Yield | Allocation | Yield | Allocation | Yield | Allocation |

| 48.70% | 3.06% | 9.67% | 7.17% | 8.38% | 2.71% | 33.26% |

THE CHURCH COMMISSIONERS

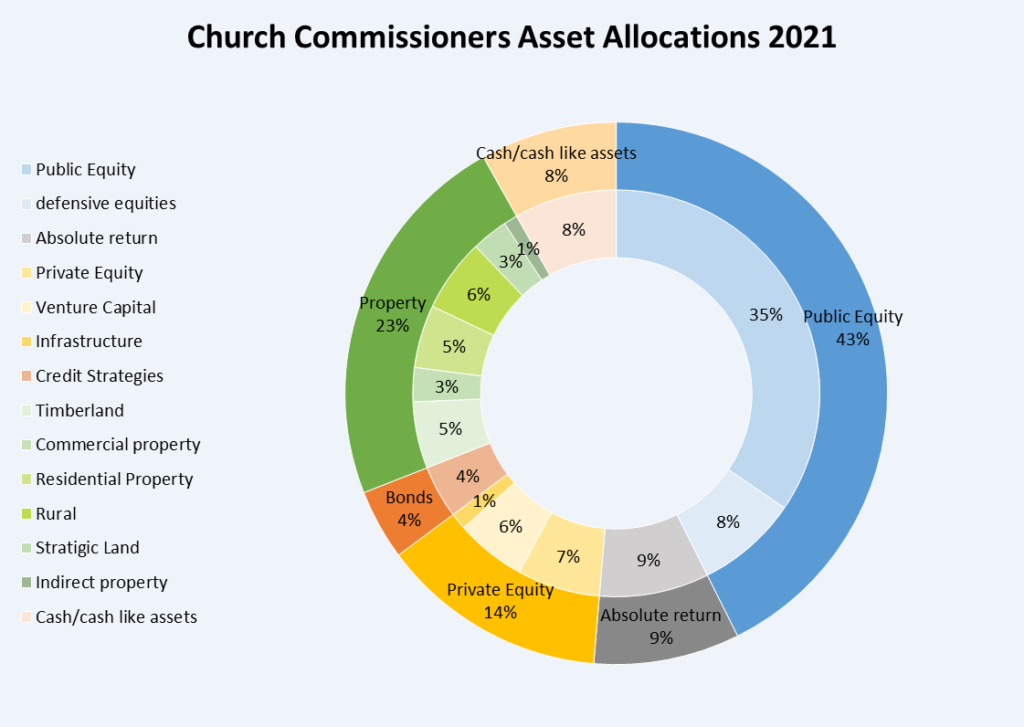

The Church Commissioners owned and developed the Hyde Park Corner Estate, which was built in the 18th century and ran up to Paddington station. A number of assets were sold off from the estate, along with wider London assets over the years. The Church retained approximately 90 acres of the Hyde Park Corner Estate along with the other individual assets across the capital. The Church Commissioners own’s a vast amount of land across the UK, US, and Australia, plus a diversified securities portfolio, which I set out below.

the church COMMISSIONERS’ Asset allocation for 2021

HONOURABLE MENTIONS

There is an honorable mention to the Eyre Estate purchased in the 18th century that created what is modern London living. In 1794, the estate was the first to develop semi-detached houses in any town or city in the world and still owns a part of the original estate, which was in St. John’s Wood.

The Bedford Estate was also a key developer of the early West End, developing Covent Garden in the 17th century and Bloomsbury in the 18th century. The Russell family has owned the area since the 16th century and, in 1925, owned approximately 250 acres. Although now this has been significantly reduced to around 20 acres.

THE TAKEAWAYS FROM THE GREAT ESTATES

The estates have reduced in size largely due to the 1967 Leasehold Reform Act and death duties, resulting in large numbers of properties being sold off. Although the growth and survival of over three hundred years in London provides a useful lesson on prioritising the location of assets, understanding the market, getting the right team around you, long term view, and that risk management are key. Their longevity shows an example of sustainably designed environments through a mix of property types, that provides a long-term guide to quality portfolio stewardship.