Residential property is the most well-known form of property investment. It is the most common entry into the world of property investment for many new investors. This complete guide will help you gain a fundamental understanding of the UK residential market. Including, how it performed over the long term and the specific characteristics of residential subsectors possess. Furthermore, the methods and strategies that are relevant if you’re buying investment properties or your own home.

FACTORS THAT AFFECT THE RESIDENTIAL PROPERTY MARKET

With the exception of cottages and farmhouses found in the rural portfolio. Residential portfolios can be any property although the best performing tend to be located within large, well-connected cities. These cities commonly have an abundance of employers, educational facilities, and a pipeline of development and regeneration projects. These locations benefit from the best wage growth and housing supply, which are key drivers of rental and capital growth in residential property.

Other broader economic factors that have an effect on the residential market are:

Inflation: this provides high growth prospects as rent and asset prices tend to match inflation rates.

Interest rates: residential property is commonly a highly leveraged investment, both as an owner occupier and as a landlord. Shifts in interest rates are a key barometer of how affordable owning property is month-to-month. This affordability change also has a knock-on effect on the capital values of property.

Financing opportunities: these are the parameters that lenders require in order to take out mortgages. These come in the form of rental stress tests or multiples of your income that you are able to borrow. Similar to interest rates, although it doesn’t have such a pronounced effect on capital values.

Government regulations: changes imposed by the government can cause significant fluctuations in the demand for residential property. Any government change can have a large influence on capital values. The stamp duty holiday that was imposed during the COVID-19 pandemic created a large stimulation and motivation to buy. Whereas, the introduction of section 24 of the finance act in 2017, had the opposite effect on the market. Investors with property in their own name are unable to offset their mortgage interest payments against their rental income to reduce their tax bill. This has created motivation for investors to gradually dispose of investment property in their own names.

RESIDENTIAL PROPERTY HISTORIC CAPITAL GROWTH

As housing is consistently in high demand as everyone has the need to live somewhere, residential assets are typically less impacted by market conditions than other property types because of this underling demand. Leases are shorter in duration in comparison to commercial leases, commonly fixed for an initial term of 6–12 months, which gives less security to landlords, although quality stock in a quality location drives demand in all conditions, which limits void periods to a minimum.

THE UK RESIDENTIAL PROPERTY MARKET FROM 1968–2022

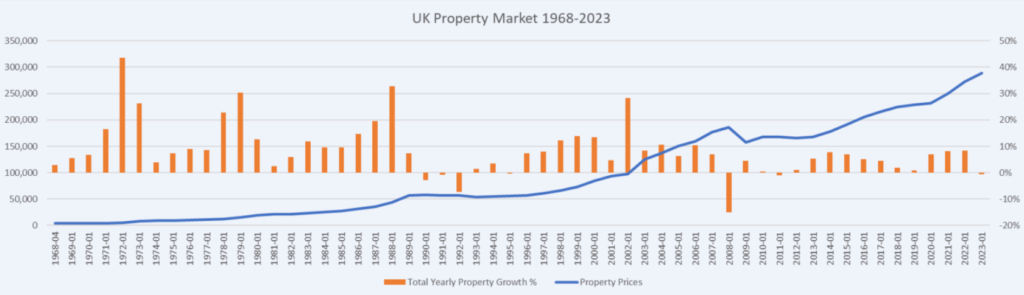

The following graph shows the average capital growth for UK residential property between 1968 and 2022. Also indicated is the yearly change in prices, represented as a percentage. This graph shows just how strong residential property has been over the last 54 years. Running from October each year, you can see that out of the 54 years modeled, only 6 of them recorded negative growth for the calendar year, which equates to 11% of the timeframe. This type of consistency in positive returns is hard to replicate in other asset classes.

THE EFFECT OF THE FINANCIAL CRASH OF 2008 ON THE UK PROPERTY MARKET

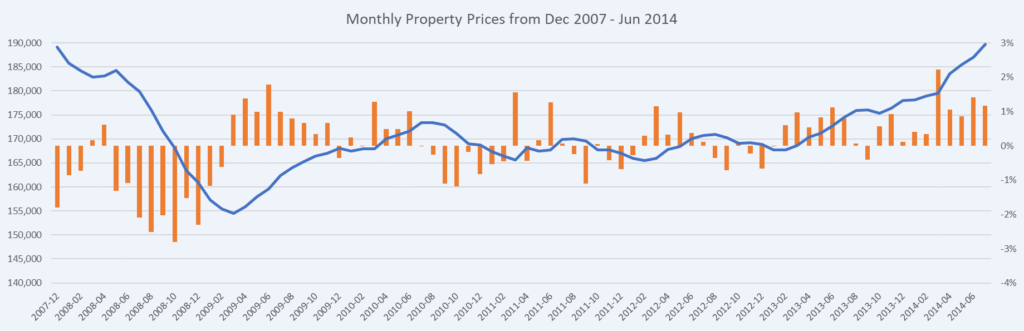

The largest downturn in the last 54 years was during the financial crash of 2008. The graph below shows that in 18-months from the peak in October 2007 to the trough in April 2009, the market fell 18%. It took until July 2014 for prices to rally back to the original peak of the market in October 2007. This is a significant amount of time, although during this time, investors would still be receiving their rental income. This rental income would service the debt and provide cashflow from the property.

In hindsight, buying into the market at the start of 2007, you would have bought at the peak of the market. Although, by having a deposit of over 20%, your property would not have fallen into negative equity during this period. Meaning the bank would be unlikely to call in the loan and force you to realise the losses. Buying at the top of the market is known as the buyer’s curse. I will explain this further in the deep dive into the history of property growth through recent history and the established theory of the 18-year property cycle.

In hindsight, buying into the market at the start of 2007, you would have bought at the peak of the market. Although, by having a deposit of over 20%, your property would not have fallen into negative equity during this period. Meaning the bank would be unlikely to call in the loan and force you to realise the losses. Buying at the top of the market is known as the buyer’s curse, which I will explain further in the deep dive into the history of property growth through recent history and the established theory of the 18-year property cycle.

Residential property investment strategies

Residential property summary

Residential real estate has long been considered a sound investment, and for good reason when assessing the market’s historic performance presented above. It provides passive investment options that enable investors to sit back and achieve the consistent attractive returns of the market, as well as opportunities to actively invest in property and/or create a business without the need to buy physical property and still benefit from the property market.