Real estate is a key aspect of the asset allocation matrix for endowment funds. As a result, it’s helpful to understand how this investor group constructs their property portfolios. A meaningful portion of the strong returns generated by endowments stems from their allocations invested in real estate.

The average UK endowment had 39% of its holdings in real estate. Alternative investments, such as real estate, serve as powerful diversifiers. Moreover, it generates uncorrelated returns with other traditional assets, such as public stocks. Furthermore, real estate is also unlike commodities or natural resources in that it generates income.

THE ASSETS OF THE OXFORD COLLEGE THAT ARE INVESTED IN REAL ESTATE

The Oxford Colleges have a rich investment history in property. We will summarise their portfolio’s yields for various sectors of property. Moreover, examples of properties owned and the scale of the portfolios. Lastly, we look at their allocations of their property holdings and compare them with those of other institutions.

The college’s property ownership is a balance of historic endowment gifts throughout the lifetime of the endowment. In addition, through strategic purchases commonly in advantageous areas highlighted by their advisers. Benefits such as capital growth potential, abilities to achieve planning gains, or other value-adding opportunities. Endowments have the benefit of long-term horizons (25–50 years) when evaluating investments. Preserving patience for events such as development pressures builds on strategic land held on the outskirts of towns.

HOW MUCH LAND DO OXBRIDGE COLLEGE’S HAVE INVESTED IN REAL ESTATE

In 1871, which was the reported peak of Oxbridge College’s allocation to their rural property assets. Their approximate combined total was 319,000 acres. This aided the story that you could ride between Oxford and Cambridge without leaving college-owned land. Furthermore, Trinity College Cambridge could continually inspect college land from Cambridge to Dover.

In 2018, the Guardian reported that Oxbridge Colleges had significantly divested away from rural land. Moving from 1871 levels of 319,000 acres to 126,000 acres of land in 2018. This is still four times the size of Manchester and more than the ownership of the Church of England. Of those 126,000 acres, approximately 85,000 were from Oxford Colleges. The main protagonists with significant land holdings are Merton, Christ Church, and All Souls Colleges.

WHAT WELL-KNOWN PROPERTY DO OXBRIDGE COLLEGE’S OWN?

With these vast swads of land, Oxford and Cambridge University colleges own some well-known landmarks.

Queen’s College, Oxford, owns the freehold of the Ageas Bowl. This is the home of Hampshire Cricket Club and holds international cricket games as well.

St. John’s College, Oxford, owns Millwall Football Club’s training ground.

Balliol College, Oxford, owns Buittle Castle, built in the 12th century and later captured by Robert the Bruce in the 14th century.

Trinty College, Cambridge, owns arguably some of the most well-known assets held by Oxbridge College’s. One of which is the O2 Arena in London, and the other is Dunsfold Aerodrome which was the Top Gear racetrack in Surrey.

HOW MUCH OF YOUR PORTFOLIO SHOULD BE INVESTED IN REAL ESTATE?

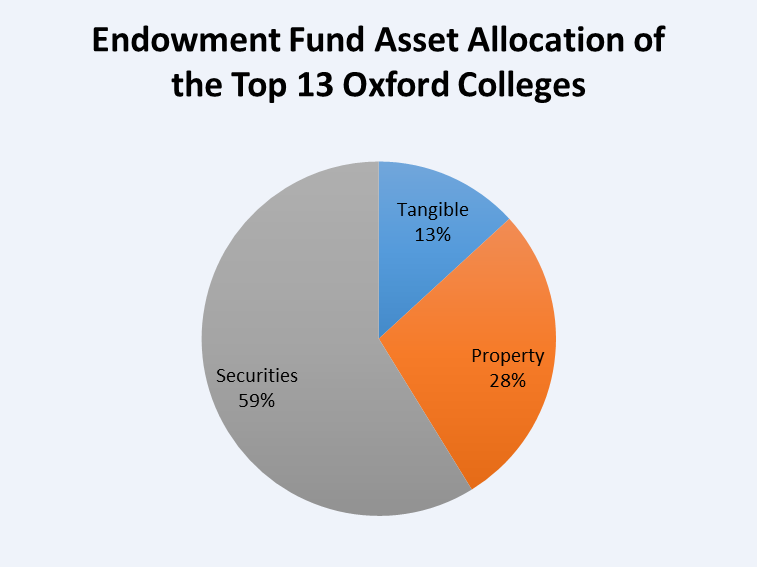

The following shows the combined average of the top 13 Oxford College endowment portfolios. As you can see, 41% relates to property, whether that’s investment property or tangible property. Tangible property relates to the running of the educational services of the colleges.

It’s worth noting that this is just property that they declare on the individual college financial reports. Some colleges own large estates, known as ‘operational’ assets, which the annual reports don’t include. Therefore, it’s likely that the college’s total ownership of property is actually higher than 41% of its wealth.

HOW THE AVERAGE PORTFOLIO INVESTS IN REAL ESTATE?

Below is research into the balance of the property portfolios for the top 13 Oxford Colleges. Additionally, compare them with the Church Commissioners and Winchester College’s portfolio for reference.

| Winchester 2021 | Church Commissioners Returns 2022 | Top 13 Oxford Colleges 2021 | |

|---|---|---|---|

| Property Portfolio Value | 182,370,000 | 2,312,900,000 | 1,247,299,000 |

| Rural | 63% | 61% | 27% |

| Commercial | 3% | 12% | 39% |

| Residential | 7% | 22% | 6% |

| Tangible Buildings | 27% | 5% | 25% |

The Oxford Colleges have a greater concentration on commercial property, including office, industrial, and retail properties. They are more diversified as no one category dominates the portfolio with over 40% exposure.

They are lower in residential assets than the Church Commissioners and similar to Winchester College. There is significant exposure to residential properties in the rural portfolio, such as farmhouses and cottages. Furthermore, the tangible assets will likely have student accommodation involved within the 25% as well. Both of these factors could explain why specialised residential investment is significantly lower.

The Church of Commissioners, which owns in the region of 100,000 acres across the UK. Along with Winchester College, they both have large exposures to rural areas, accounting for over 60% of their total property portfolio. Rural property is a less volatile asset class, which we cover below in the average yields achieved. It naturally provides diversification and a proven track record as a hedge against inflation. The diversity is due to a variety of different types of property subsectors that fall into a rural portfolio.

POSSIBLE STRATEGIES BEHIND DIFFERING ALLOCATIONS INVESTED IN REAL ESTATE

It’s hard to tell the investment strategy behind the two entities allocating significant amounts to rural assets, although when looking at their wider portfolios,

For the Church Commissioners, property represents 30% of their total portfolio. Having a large proportion of that in low-risk rural property is likely the main storehouse of value. Furthermore, provide balance and stability against other more aggressive investment positions held in the wider portfolio.

Whereas, Winchester College property investment holds an 80% allocation of the total portfolio, and rural property is 50% of the total portfolio. The 80% allocation to total property could be a result of a potential endowment bias to property due to historic returns achieved and lower volatility provided. One possible explanation why there is low divestment into other property sectors is that rural assets could be located in advantageous locations with a high likelihood of achieving planning gains in the future. This would result in unconventionally high returns with significant capital value uplift. If sold before any gain is achieved, to facilitate a rebalancing of the portfolio similar to the Oxford Colleges, would be a poor strategic move in their situation.

Rural property has the ability to play a couple of roles within a portfolio. It is mainly driven around the location of the assets and the planning laws for that district. Once you have an understanding of the properties a portfolio holds, you can understand the role each property plays and establish an acquisition plan to maintain balance because, as previously stated, property has the ability to play a variety of roles within a portfolio.

THE AVERAGE PROPERTY PORTFOLIO YIELDS

Below is the combined average of the 13 Oxford Colleges and the net yield they achieved for the portfolio as a whole, rural, commercial, and residential. The tangible assets are removed as, typically, colleges do not account for residential income from members or income derived from conferences and other such functions as part of endowment income, which would have been achieved through the operational property held as tangible assets.

| Oxford College Property Yields | Net Yield |

|---|---|

| Total Property Endowment Portfolio | 4.14% |

| Rural | 1.71% |

| Commercial | 5.18% |

| Residential | 4.41% |

SHOULD I REBALANCE MY PORTFOLIO?

Everyone’s portfolio will be different, just like the largest institutions above obviously have a different balance to their portfolio, although the principle is clear that having a diversified coverage of assets within a property portfolio is essential. The specific allocation is dependent on four things:

Risk tolerance?

What are your current owned assets?

What are your goals?

How are you going to execute them?

WHATS THE BEST ALLOCATION?

Once your answers to these questions are established, the property allocation can play various roles in your portfolio to create the desired balance. As explained in the permutations of the Winchester College and the Church Commissioners portfolios, for example, the rural property allocation could play two very different roles in the broader balance of the two portfolios depending on the location and type of rural property held. The main key is to understand what that role will be in your portfolio to streamline your risk tolerance and goals. Then you can understand the type and scale of properties you want to add or remove to establish the perfect mix.

Make sure you have the right team around you that complements your goals and has knowledge in areas where you are weakest. This is key to gaining complete understanding, confidence, and efficiency in achieving the right path for your portfolio.

SUMMARY

Property is regarded as the Colleges’ historic endowment, which may cause a bias for the Oxford Colleges, and any major divestment of the property holding would go against the century’s old track record of property investment. There are few other groups of investors that have been invested in real estate for such a long period of time, and so the above should serve as an informative source to benchmark your net yield expectations and an example of your percentage balance between commercial, residential, and rural for your own property portfolio.