When it comes to investing in real estate, housing market predictions play a significant role in decision-making. These forecasts provide insights into potential growth, rental yields, and overall investment performance.

WHAT ARE THE HOUSING MARKET PREDICTIONS FOR THE NEXT 5 YEARS.

With a new year comes a new year of real estate predictions. Both Savills and Knight Frank have dusted off their market analysis and their financial models for real estate and forecasted the state of the UK housing market for the next five years. As of January 2024, the following predictions are what they have forecasted for the next 5 years:

| 2024 | 2025 | 2026 | 2027 | 2028 | Total | |

| Average UK House Price (Savills) | -3.0% | 3.5% | 5.0% | 6.5% | 5.0% | 17.9% |

| Average UK House Price (Knight Frank) | 3.0% | 3.0% | 4.0% | 5.0% | 4.0% | 20.5% |

Savills UK | UK Cross Sector Outlook 2024: Residential

Understanding who uses these Housing Market Forecasts

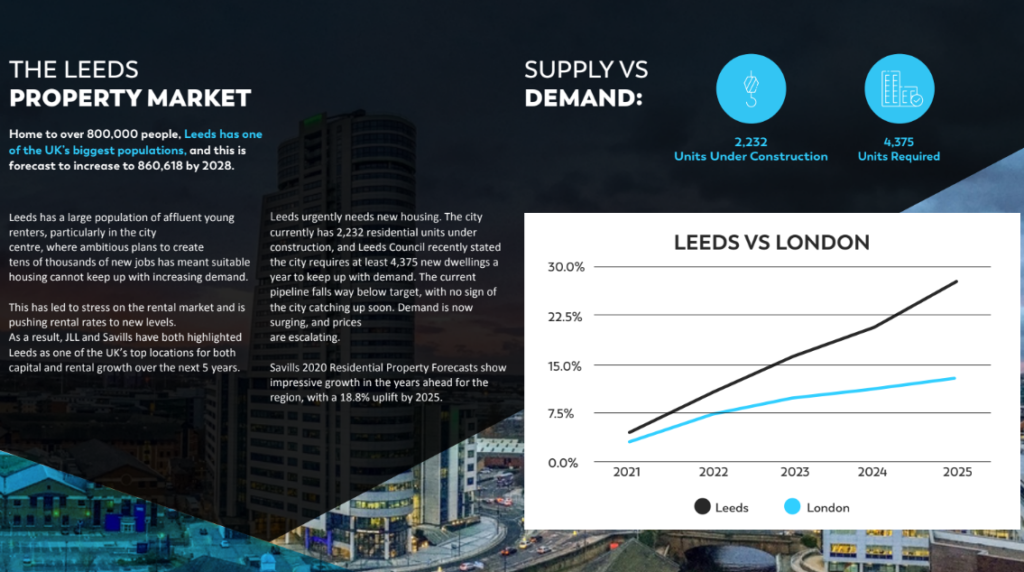

Investment packs from developers often highlight impressive forecasts, such as “24.3% forecasted growth by 2025” in a particular area. The reality is that these claims in marketing brochures largely stem from the Knight Frank’s and Savills 5-year projections we have shown above. A couple of examples of developers marketing brochures and how they use the housing market predictions are below. While these forecasts may seem enticing, the question arises: how often do these forecasts come true?

How reliable are housing market predictions?

These forecasts are great for catching headlines; however, it’s crucial to assess the reliability of such forecasts before making investment decisions. In the following, we will explore the reliability of professional housing market forecasts. Moreover, we will discuss the importance of conducting thorough research when evaluating each location or individual investment opportunity.

LET’S Challenge the accuracy of real estate predictions

Real estate market forecasts are predictions based on current market conditions, economic factors, and various assumptions. Predicting the future accurately is inherently challenging. External factors such as changes in the economy, government policies, or unexpected events can significantly impact market dynamics, making accurate forecasts difficult.

Comparing Historic Forecasts to Actual performance

To assess the reliability of real estate market forecasts, it is essential to compare them to actual market performance. Below, we compare the actual historic property data from the nationwide property price index to historic predictions from professional outfits for the UK.

| Location & time period | Time period | Savills Forecast | Knight Frank Forecast | Average Forecast | Actual according to Nationwide | Average Forecast |

| 2014 Forecast Report | 2014 | 9.5% | 7.2% | 8.3% | 8.3% | 0 |

| 2015 | 4% | 3.5% | 3.8% | 4.3% | +0.5% | |

| 2016 | 3.5% | 2.5% | 3% | 4.5% | +1.5% | |

| 2017 | 3.5% | 3% | 3.3% | 2.7% | -0.6% | |

| 2018 | 3% | 4% | 3.5% | 1.3% | -2.2% | |

| Total | 25.7% | 21.8% | 23.8% | 22.8% | -1% | |

| 2019 Forecast Report | 2019 | N/A | 1% | 1% | 0.8% | -0.2% |

| 2020 | 4% | 2% | 3% | 6.4% | +3.4% | |

| 2021 | 0.0% | 3% | 1.5% | 10.1% | +8.6% | |

| 2022 | 4.0% | 3% | 3.5% | 4.6% | +1.1% | |

| 2023 | 6.5% | 4% | 5.3% | -2.3% | -7.6% | |

| Total | 15.2% | 13.7% | 14.5% | 21% | +6.5% |

House prices will rise 25.7% by 2018 Savills predicts | This is Money

uk-forecast-2015-2664.pdf (knightfrank.com)

uk-housing-market-forecast-2020-6869.pdf (knightfrank.com)

Historic forecasts vs actual review

You can see how actual market conditions differ year to year with these forecasts. 4/9 years, the average predictions were within a percentage of the actual figures. 3 out of those 4 were within 2 years of the forecasts being made. Leading to the point that forecasting over a long period of time is a tricky game.

During the recent turbulent economy, there is a large disparity between actual and forecasted numbers. These make a huge difference to your investment return. Imagine not investing in 2019 due to the unappealing forecasts and missing out on capital growth through 2020, 2021, and 2022.

The two forecast examples are quite different in how close they are to the actual reported property price figures. This shows forecasts have a place, although in times of economic uncertainty, not even professionals can predict the future. Moreover, as we normally experience economic uncertainty once every 10 years, relying solely on market forecasts can be risky.

The Importance of Independent Research

To mitigate risk, it is essential to conduct independent research and evaluate the fundamentals of an area. Such as ongoing development, employment opportunities, transportation infrastructure, and income levels are key drivers that contribute to the long-term success of a property investment. It is crucial to identify areas with strong fundamentals rather than solely relying on uncertain forecasts.

Making Sense of the Deal

Ultimately, a sound investment decision should be based on thorough research and a comprehensive understanding of the property and its market. While an area with favourable predictions may present potential, there are no guarantees that it will outperform others. It is important to assess the deal’s viability based on its own merits and not solely rely on UK or city-specific housing market predictions to forecast your success.

Conclusion of UK housing Market predictions

In summary, and unfortunate to say, you can’t predict the future; don’t try. Investments are risky; make a decision based on the knowledge you have, not what other people are projecting.

By having the background knowledge that, when looking back over a long period of time, similar trends occur, the saying property doesn’t repeat itself, although it does rhyme. Meaning there will be bumps in the road and times of growth. Although the factors that stimulate it will change over time and are hard to predict consistently.

Professional housing market predictions can provide valuable insights into the potential of the market. However, it is crucial to approach these forecasts with caution and skepticism.

A successful real estate investment relies on:

- Conducting independent research

- Evaluate the fundamentals of an area.

- Thorough analysis of specific properties

- Compare forecasts to actual market performances.