We look to understand how large institutional investors implement their real estate strategy for their internal operations. By internal operations, I mean the university buildings or office buildings that those institutions are run from. Institutional investors have a similar debate as individuals on whether they are better off renting or buying their “home”. The situational decision considerations are the same, although with more money involved. This article will help get a perspective on how different types of endowments tackle the debate. Furthermore, the reasons why their allocations are different depend on the organisation’s operational requirements.

WHAT ARE TANGIBLE ASSETS?

Tangible assets are physical things such as buildings, vehicles, equipment, and machinery that an entity owns for its own use. We have pulled the tangible assets from the financial statements of 46 institutions in the UK and the US. In order to compare apples with apples. The tangible assets below relate solely to the land and buildings that institutions own outside of the endowment fund.

WHY COMPARE THE INSTITUTIONAL INVESTORS WITH INDIVIDUAL INVESTORS.

In previous articles, we looked at endowment fund portfolios and what lessons could be taken from their allocations. We include tangible assets owned by large institutions to understand their allocation to their “own house” versus their investments. These tangible assets (land and buildings) require routine maintenance and repair. Furthermore, they don’t generate direct income for the entity and purely benefit from long term capital growth.

These 3 characteristics sound very familiar, don’t they, to the individual investor’s situation? They buy their own home to live in; they have lots of costs to maintain and run the property without any direct income. This is the reason it’s interesting to understand the institutional ethos and see how it correlates to individuals.

UNIVERSITY INSTITUTIONAL INVESTORS vs. OTHER INSTITUTIONAL INVESTORS.

UNIVERSITIES

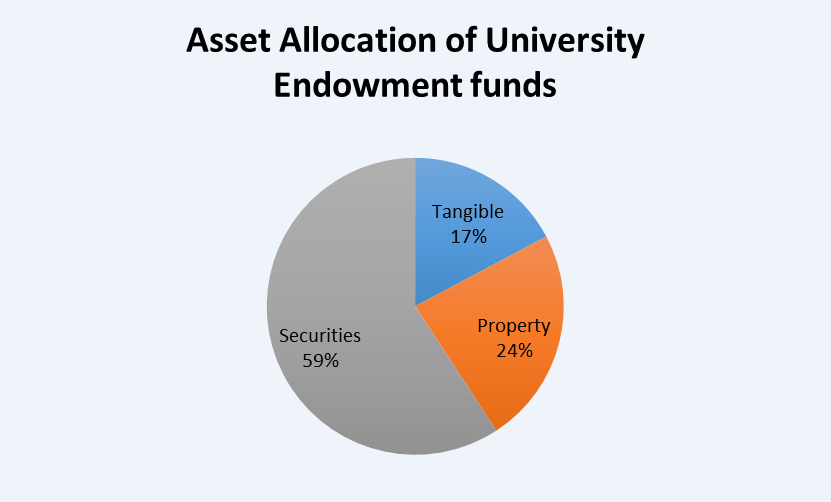

We analysed the tangible assets of the 33 largest institutional universities in both the UK and the US. Moreover, how they allocate funds to their campuses for student housing, education, and internal operations. The table below shows the US and UK’s largest institutional universities average allocation to tangible assets. It paints an amazingly clear picture that 17% is the average level that they require for their own operational facilities. The pie chart shows the average allocation balance for the 33 universities, split into property, securities, and tangible assets.

| Country | Tangible Asset % |

|---|---|

| US | 16.74% |

| UK | 17.77% |

OTHER INSTITUTIONAL INVESTORS

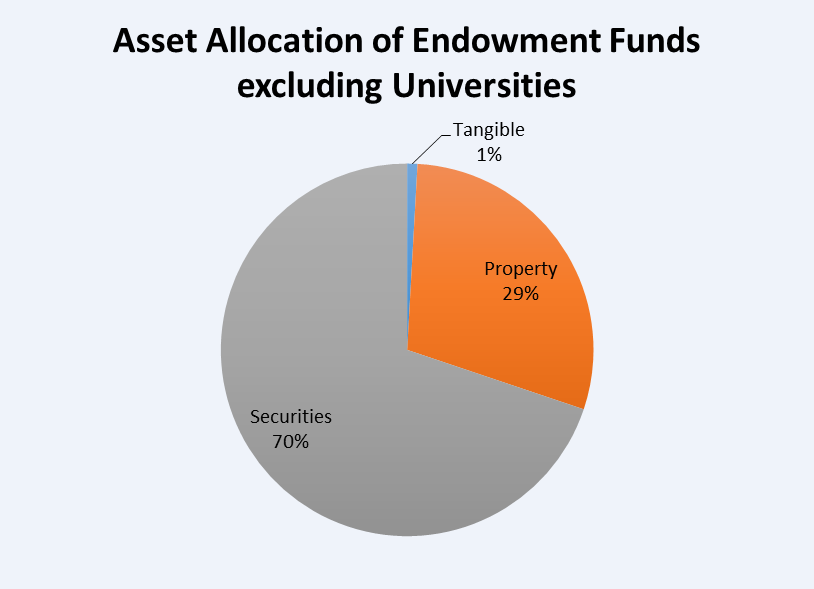

In contrast, when looking at the other large institutional investors in the survey. There is a significant and distinct difference in allocation towards owning buildings for their own operations. The graph below shows how the other institutions allocate their assets between investments and operations.

THE INSTITUTIONAL INVESTORS’ PERSPECTIVE ON RENTING VS. BUYING A “HOME”

There is a clear reduction in allocation to tangible assets for endowment funds that aren’t universities. This is hardly surprising considering the reduced operational requirements that these entities have compared to universities. These organisations have in the region of 99% of their wealth invested in assets that achieve a yield. Moreover, they benefit from conventional market growth with positions that can be relatively easily traded in and out of. This gives them the most flexibility and the ability to grow their portfolio value faster.

Whereas universities have, on average, invested 83% of their wealth in high performing assets. The other 17% held as tangible assets would appreciate in value, although at a slower rate due to niche market demand. Furthermore, tangible assets do not achieve a consistent yield.

It’s interesting that there is such a distinct difference between the entities. It shows that if you have an absolute requirement for security of tenure, in a certain location, you must satisfy that requirement. Owning is the only way to achieve that safety. A university needs certainty, as it would be beyond inconvenient for a university to be moving continually when leases come to an end.

If there is no distinct requirement to be in an exact location and there are various alternative buildings within the area, that would suffice. A largely rented model, such as the one other institutions adopt, is the most beneficial way to have the majority of the wealth exposed to the best returns in order to grow the portfolio in the most efficient way.

BUY VS LET PROPERTY: SUMMARY OF MY THOUGHTS

Hopefully, this gives you a helpful insight into how long-standing entities manage their operations. Moreover, providing a different perspective on how to compare whether renting or owning your residence is the right decision.

In reality, it comes down to what you enjoy, understand, and where you are in life. For me, I’m not jumping to own my own house, as it slows your ability to grow your wealth. Also, I have no ties to a specific location at the moment. If I were going to buy a property to live in, I would always look for some sort of project, as I love playing the game of property. Although I might be overruled by my partner, who just wants a chaos-free home.

Every Englishman/woman’s home is their castle, and whether that home is rented or owned comes down to what suits you best. If you’re still stuck on whether to invest in a university or other institutions. Then please continue reading the other articles in the series with financial templates to aid you with your decision making.