Financial recessions occur on average every 8–10 years. Recessions continuously drive investors to ask questions about their portfolio allocation: How futureproof is my portfolio? How exposed is my portfolio to a specific asset class? How can I diversify my portfolio to the fullest extent?

Family offices/ultra-high net worth (UHNW) investors, investment companies, and endowment funds have understood the benefits of diversification. They have invested in a broad range of uncorrelated investments for years and, in some instances, generations. We explore the balance of your portfolio and consider the merits of direct real estate, stocks, alternative assets, and bonds. We show how they are allocated to balance volatility and ensure the stability of your portfolio.

DIVERSIFY BY LIQUIDITY OR STABILITY?

The recent market fluctuations due to COVID-19 and inflation have shown that optimal asset allocation is critical for long-term success. Family offices, endowment funds, and investment companies are seeing the benefits and stabilising effects of illiquid assets. They are moving away from high allocations of liquid assets such as stocks and bonds. Moreover, illiquid assets such as real estate and alternative asset classes benefit from their longer-term time horizon. Meanwhile, the typical individual investor deals largely in liquid investments because of their ease of access. Individual investors prefer this because you can trade in and out of positions and move money elsewhere as required. But investors often don’t recognise that liquidity increases the volatility of their portfolio. Less liquid assets stabilise a portfolio, resulting in individual investors having significantly more volatile portfolios.

Real estate provides a stable anchor to a portfolio because values move slowly and it provides built-in inflation hedging. An inflated market is tough to negotiate for investors trying to maintain their returns with inflation. Real estate will continue to produce income and benefits from built-in rental increases that maintain the value of the portfolio with inflation.

Furthermore, by boosting your allocation to illiquid assets, it reduces the average investor’s ability to make rash/emotional decisions. Liquid assets give investors the ability to buy and sell at the click of a finger. The majority of the time, this is done at the wrong time as the market ebbs and flows. Inevitably producing sub-par results.

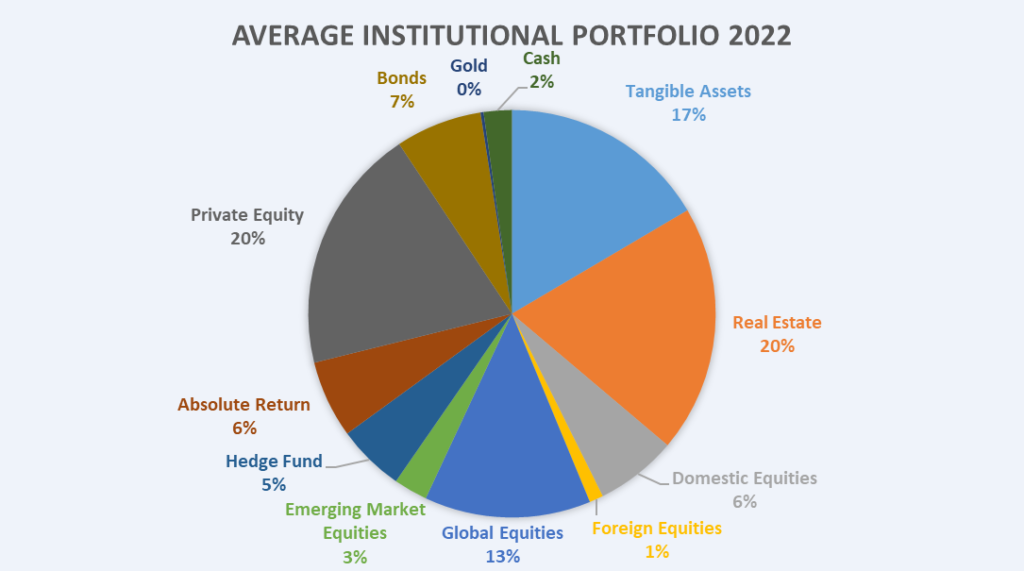

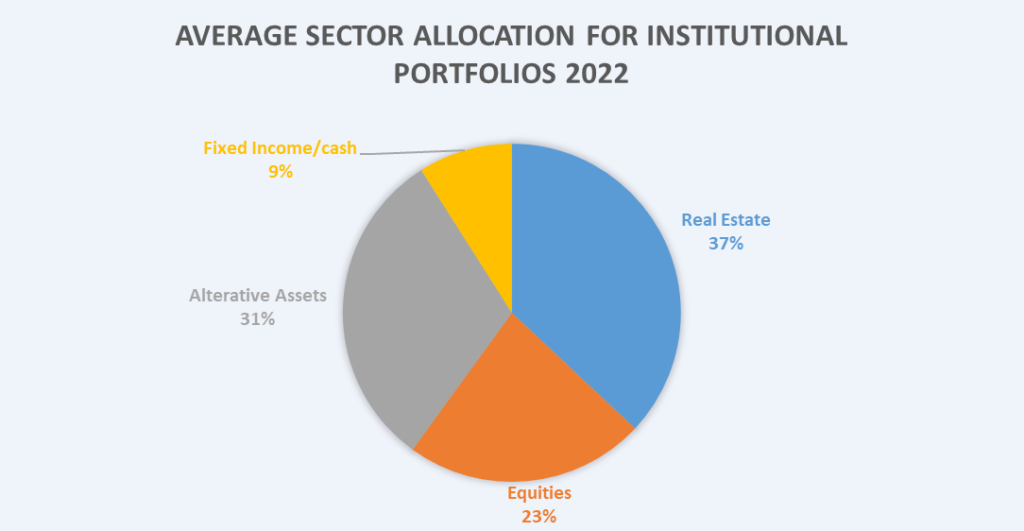

INSTITUTIONAL VIEW ON LIQUID & ILLIQUID ASSETS

The following shows a table of the largest institutions and how they approach liquid and illiquid assets. By taking Yale’s endowment fund as an example, their portfolio in 2022, according to the financial reports. Their portfolio consisted of 33.4% liquid assets and 66.6% illiquid assets redeemable within 1 to 25 years’ time. It seems Yale’s policy is that two-thirds of the investment portfolio should be in illiquid investments. Trinity College, Cambridge, and the average of 18 institutions surveyed are slightly different from this rough rule of thumb. Although both show the ethos that at least 60% of the portfolio should be locked up in long-term investments.

| Sector | Time limit | Trinity College, Camb | Yale University | 18 Institution Average | |||

| Equities | No limit | 21% | 26% | 20% | 33% | 23% | 38% |

| Bonds | No limit | 2.50% | 7% | ||||

| Cash | No limit | 2.50% | 2% | ||||

| Marketable Alternatives/Absolute Return | No limit | 14% | 6% | ||||

| Real Estate | 1-25 Years | 52% | 74% | 15% | 67% | 37% | 62% |

| Private Equity | 1-25 Years | 12% | 20% | ||||

| Leveraged Buyouts | 1-25 Years | 23% | |||||

| Venture Capital | 1-25 Years | 29% | |||||

| Hedge Funds | 1-25 Years | 10% | 5% | ||||

to diverify is the spice of life

The key to long-term resilience and wealth creation doesn’t lie in one asset class. Diversification is crucial to ensuring that your portfolio is balanced enough to withstand the peaks and valleys of the market. The following articles provide a detailed understanding of how the top investors diversify to gain the optimum portfolio balance.

How to diversify like an institution

DIVERSIFY THROUGH EQUITIES

Equities provide strong growth capabilities, although with that comes high volatility. Equity investments are recommended to be in highly diversified funds, such as index funds. By following the lead of institutional investors, the majority of funds should have global coverage. Further, by spreading across developed markets, emerging and small-capital markets provide strong diversification. The benefit of this is to diversify geographically and within equity asset classes.

DIVERSIFY THROUGH REAL ESTATE

According to the research, property plays a significant role in balancing a portfolio’s exposure to volatile markets. Real estate investments should be made in direct real estate, which is one of the main illiquid asset types within a portfolio. Moreover, by investing across multiple asset types, geographical locations, asset classes, strategies, and elements of joint ventures/syndicates investment provides variety. If executed well, to diversify in these 5 ways gives great security and balance to a portfolio.

DIVERSIFY THROUGH FIXED INCOME

Fixed income, such as bonds and cash equivalents, are loans investors make to companies in the form of corporate bonds or to the government. Institutional portfolios hold low allocations to fixed income due to the fact that there are superior options available to them that provide the same amount of diversification and uncorrelated returns from the balance of the portfolio. The fixed income allocation is liquid and is used for short term cash to service the requirements of the portfolio or the functional running of the entity.

DIVERSIFY THROUGH ALTERNATIVE ASSETS

These investment vehicles packaged in a portfolio have historically delivered competitive total returns based on steady income and an illiquid outlook, generating long-term growth. Alternative assets are hedge funds, private equity, absolute returns, venture capital, and leveraged buyouts. Alternative asset class investments benefit from a low correlation to stocks and bonds, which helps maintain stability.

For the individual investor, investments in alternative asset classes such as private equity are hard to replicate. This is because most alternative assets require superior active management, which the casual investor may find hard to access and achieve acceptable risk-adjusted returns.

Diversified portfolio example

how to diversify and sustain it over a long period of time

This comes down to your personal financial goals, what will allow you to sleep at night and what you understand, enjoy and have most confidence in. Investing is just as much about the phycology of being able to commit and maintain a plan consistently as it is to pick the best investments. Quote from the Book The Psychology of Money:

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave.“

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness.

Morgan Housel’s The Psychology of Money shares short stories highlighting the strange ways people think about money and teaches you how to understand of one of life’s most important topics.

For me, it would be higher in property, as I have been around the industry for a longer time; I understand the various sectors within property and genuinely love playing the game. Although I see the benefits of stocks and other financial instruments, I invest to create balance in my portfolio. Everyone is different, just like the largest institutions and investment companies are quite obviously different in their portfolio make-up. Although the principle is clear, having a balanced coverage of assets is essential. Furthermore, having an allocation you can psychologically commit to and maintain is half the battle.

Start small and maintain variety in order for your portfolio to stand the test of time.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Disclaimer: This post contains affiliate links. This means we may earn a commission if you choose to sign up or make a purchase of a product using the link. We independently evaluate all recommendations and love all the companies we promote to you.