Becoming a property mogul is a very subjective term and hard to define. Thus, they are known for their extensive portfolio of properties, which may include residential, commercial, or industrial properties. Moreover, a property mogul typically possesses a deep understanding of the real estate market, trends, and investment strategies that they use to grow their portfolio.

KEY FEATURES OF A PROPERTY MOGUL

Extensive Property Portfolio

A property mogul owns a large number of properties, often across various locations and sectors. Furthermore, these properties may be held for rental income, capital appreciation, or development purposes.

Wealth and financial success

They have built substantial net worth through successful property investments, often leveraging their expertise and market knowledge.

Strategic thinking

They analyse market conditions, identify lucrative opportunities, and make creative investment decisions to maximise returns. In addition, this requires a deep knowledge of the options available.

Networking and Relationships:

Successful property moguls have extensive networks, including real estate agents, developers, lawyers, and financiers. These relationships enable them to access off-market deals, negotiate favourable terms, and be collaborative and quick on joint venture opportunities.

Risk Management:

They apply risk management strategies to mitigate potential challenges. Henceforth, conduct due diligence, diversify portfolios, and adapt to opportunities.

Entrepreneurial Spirit

Property moguls seek out innovative and creative approaches to real estate investing. Furthermore, they are likely to partake in property development, renovation, or other value-adding strategies for their investments.

FUNDAMENTAL PRINCIPLES OF A PROPERTY MOGUL

Property moguls have fundamental principles that they follow to achieve this status. In the rest of this blog post, we’ll explore and compare these common principles.

The fundamental priority is investing rather than saving money. They want their money invested in generating value instead of sitting in the bank for security. Whether that’s in development or cash flow opportunities, they try to ensure their money is working as hard as possible. They do this by regularly reinvesting the cash flow and any additional savings as soon as they have a surplus amount.

SAVING VS INVESTING: WORKING EXAMPLE

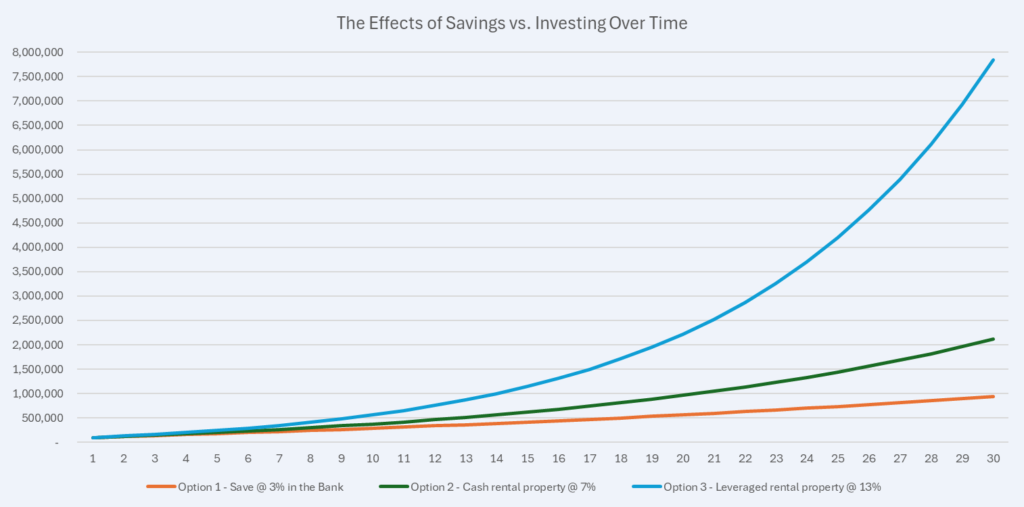

If you do the math, saving your way to financial freedom will take an extremely long time, and you still might not get there. Henceforth, as a comparison example, if you start with a lump sum of $100,000 and save $15,000 a year on average for the next 30 years. The following options will generate vastly different outcomes over the 30-year time period.

Option 1:

You continually add this money together over the time period in the bank and achieve an interest rate of 3% from the bank.

Option 2

You use the initial 100,000 and buy real estate with cash. Moreover, you reinvest the cash flow alongside the yearly savings throughout the time period to buy more cash owned real estate. We are assuming over a 30 year period that the average total return is 7%.

Option 3

You use the initial 100,000 to buy real estate with leverage and reinvest the cash flow alongside the yearly savings throughout the time period to buy more leveraged property. Thus, we are assuming over a 30 year period that the average total return is 13%.

Furthermore, carrying out a development option is hard to map as the returns are disproportional and not linear. Although this method is regularly used by property moguls to turbo drive their returns above and beyond the options provided.

This graph shows the power of having an investor’s mindset over a saver’s mindset. Moreover, the difference between cash and investing in cash owned rental properties is 126% over 30 years. Furthermore, comparing cash with the riskier investment of leveraged rental property, it provides 740% more over 30 years.

There are plenty of other scenarios you can use to analyse this, such as whether you should buy a home or an investment property. This is obviously exemplar numbers, although the principle is clear. Property Moguls invest in assets that generate strong total returns instead of holding cash in the bank or buying a home to live to get ahead of the game. The difference in wealth generation is disproportional.

INVESTMENT APPROACHES OF a PROPERTY MOGUL

Property moguls use a combination of active, passive, and creative investing approaches throughout their portfolios.

Active real estate Investing:

Active investing is the creation of value above and beyond what the market would generate by carrying out improvements to a building. Furthermore, active investors rely on research and analysis to identify undervalued real estate opportunities. They aim to generate higher returns to scale quickly and reduce the amount of capital in each deal as soon as possible. In the following, we show how property moguls achieve this.

They leverage numbers 3-5 in the characteristics sector above. Strategic thinking, networking and relationships, and risk management are the key ways they enhance their portfolio through active strategies.

Passive real estate Investing

Passive investing is purely trying to match the returns the market generates over time. This can be achieved by investing in a diversified portfolio of real estate across different sectors and geographies. Alternatively, it could be within one specific market or sector. When real estate is in a passive stage, investors need to allocate less time to the specific investment. Being purely a passive investor suits people, such as those with separate businesses or jobs.

Key characteristics of passive investing:

a. They replicate the capital and rental performance of the specific market they are in.

b. Long-term hold for extended periods, reducing capital expenditure or disposal fees.

c. Reduced time commitment.

d. If you’re purely a passive investor, it’s very capital-intensive due to deposits.

To replicate, it is suitable for people with limited time who want to combine savings from, say, a job with the cash flow from current investments to build a property portfolio on the side.

Creative real estate investing.

We have gone into detail on a few investment techniques that property moguls use to gain a competitive advantage. The three blogs below provide in-depth overviews of lease options, joint ventures, and seller finance.

PULLING THE PROPERTY MOGUL APPROACH TOGETHER

Property moguls use a combination of these approaches. One property investment might incorporate all of these:

They would first structure the deal in a creative manner to purchase the property with as little cash involved in the deal as possible.

Secondly, they might actively carry out a redevelopment, refurbishment, or rent review on the property. After which, they would remortgage the property, release the value generated through the active stage, and leave as little money in the deal as possible. The money released through the remortgage can be recycled into the next project.

After which point, the third stage would be moving the property into the passive stage. It would be rented out and track the returns of the market over the long term. Furthermore, providing very appealing returns due to having very little money in the deal as a result of the creative and active approaches at the start of the ownership.

A Summary of How to Become a Property Mogul

Understanding the differences between active investing, passive investing, and creative investing is essential for becoming a property mogul and developing an investment strategy that aligns with your goals and risk tolerance.

Active investing involves time and effort to outperform the market, while passive investing seeks to match market performance with lower costs and time commitment. Creative investing leverages knowledge and expertise to identify investment opportunities. Each approach has its advantages and disadvantages.

The most suitable strategy depends on individual preferences and financial objectives. It’s crucial to conduct thorough research, seek professional advice if needed, and continually evaluate and adjust your investment approach as circumstances change.