Over the last 4 years, property prices have been on the rise in the UK and then took an abrupt pause when interest rates rose. Although you might expect this to be a UK-wide trend, it’s not. What may start as rapid price appreciation in a select few desirable neighbourhoods quickly turns into a city trend or regional surge in house prices. This phenomenon is known as the ripple effect in the property market.

THE RIPPLE EFFECT BEGINS IN HIGH-DEMAND AREAS

The ripple effect originates in the most sought-after and affluent neighborhoods. These areas tend to have good schools, low crime rates, and proximity to natural and built amenities, which create desirable lifestyles.

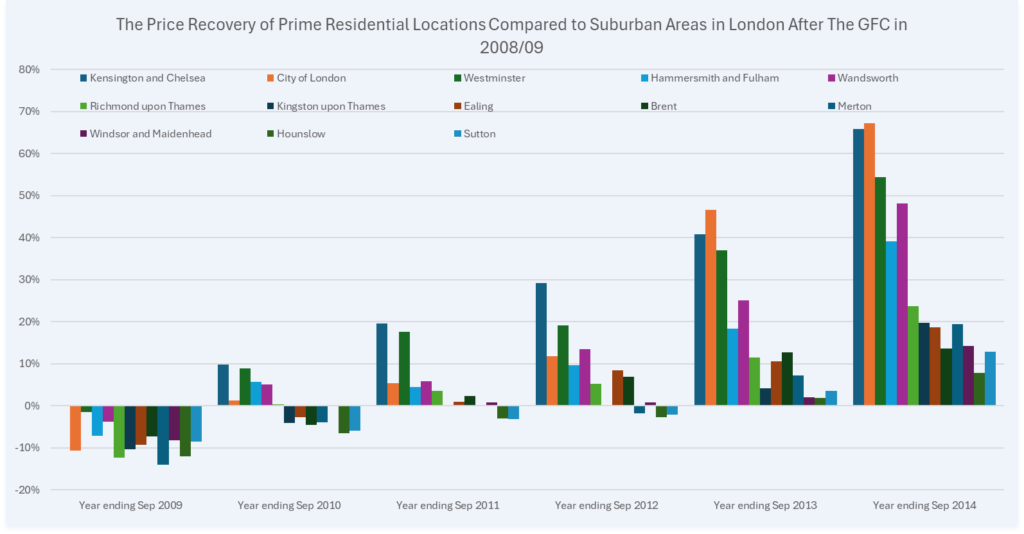

After a market downturn, these areas commonly rebound the quickest as these quality areas become more affordable. Moreover, providing the security of safe, long-term investment locations. Therefore, early in a market cycle, buyers with cash often experience a flight to quality. As market pessimism subsides and eager purchasers start to compete for the limited prime housing stock, prices start to rise.

For example, let’s look at the premium housing markets in London. As the wealthy snap up properties in the central locations, the laws of supply and demand take over. Prices in the prime city centres begin escalating, sometimes at double-digit annual rates.

The following shows Kensington & Chelsea, the City, and Westminster districts recover significantly quicker after the global financial crisis (GFC). When you compare them with the price recovery of the suburban west of London, such as Kingston and Hounslow.

THE RIPPLE EFFECT ON SURROUNDING NEIGHBOURHOODS

Over time, prices in the initial high-demand and prime areas become increasingly unaffordable to buyers. As buyers are priced out of the city’s prime locations, they start looking to nearby, slightly more affordable areas. This action starts the ripple effect throughout a city. This increased demand in secondary suburban areas causes prices there to start rising.

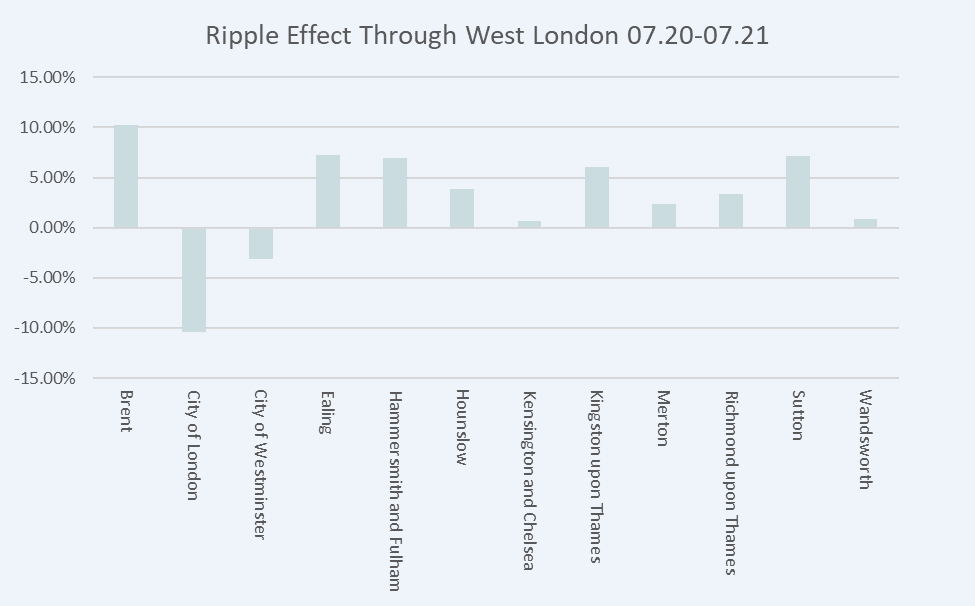

In some cases, the price ripple moves outward from central cores, spreading to adjacent towns and cities. An example of this is the following graph: It shows the property growth between July 2020 and July 2021 in the same districts in London. This time, later in the cycle, the suburban areas such as Ealing and Brent are the best-performing locations. Whereas prime areas like the City and Westminster are in the negatives. This is due to the inflated prices creating a lack of demand.

Neighbourhoods that were once considered reasonably priced suddenly find themselves caught up in the frenzy, and prime areas that were once unobtainable start to plateau as the buyer pool looks at other areas and reduces the demand. And so the ripple continues until the next property cycle starts.

THE RIPPLE EFFECT OF PROPERTY ACROSS BROADER GEOGRAPHIES

Over time, the ripple effect continues to spread through wider regional and even national property markets. Areas that were previously viewed as affordable alternatives start to see their own price surges as the wave of demand reaches them.

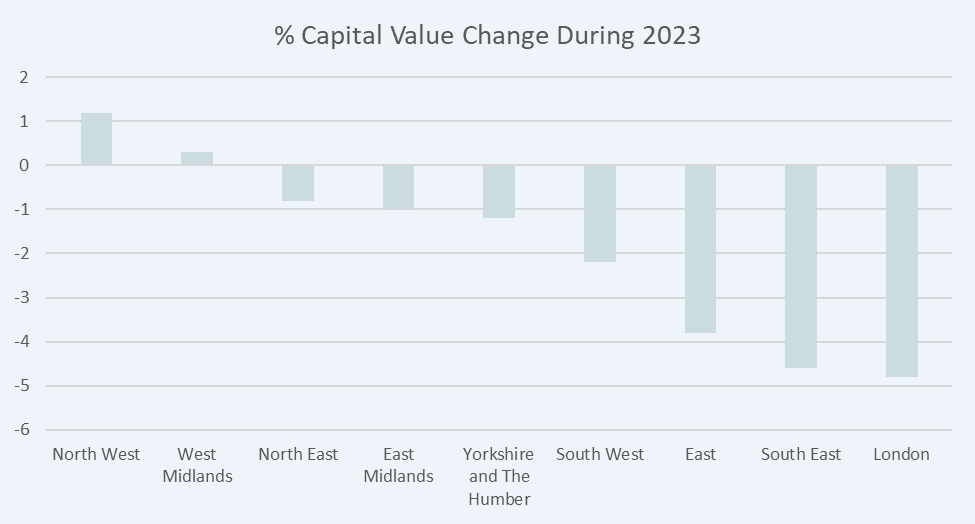

For instance, as prices skyrocket in London, buyers look to commuter towns and rural areas in the surrounding South East region of England. This, in turn, drives up prices in places like Kent, Surrey, Oxfordshire, and Berkshire. Eventually, the effects are felt as far afield as the Midlands and the North of England.

At the other end of the cycle, the prime areas tend to get hit by price reductions first, and then this ripples through the regions and further afield. As you can see, during 2023, the south of the country suffered the most significant reductions in price, whereas the north was more subdued. In the northwest, it was the only place to post a positive average annual return for 2023. So the process starts again. If I had a crystal ball, in a couple of years’ time, I imagine the following graph will show that the south is starting to pick up again and show strong early cycle returns.

VARYING INTENSITY OF THE UK PROPERTY MARKET

It’s important to note that the intensity of the ripple effect can vary considerably based on a range of factors.

- The strength of the initial price surge

- Economic conditions

- Mortgage rates

- Government policies

- Specific local market dynamics

They all play a role in determining how far and how quickly the ripple effect takes hold of a neighbourhood, city, or region.

For instance, periods of low interest rates tend to amplify the ripple effect, such as the period after the GFC and COVID-19 outbreaks. In this low interest environment, buyers can stretch their budgets and push purchase pricing. Conversely, rising rates and tighter lending standards, such as what we have seen in 2022 and 2023. This can dampen the market and slow the spread of price appreciation.

There are some markets that are less affected by the ripple effect. These tend to be areas with strong local economies and barriers to new construction that generate a more sustained price demand. An example of this is Jersey.

UNDERSTANDING THE RIPPLE EFFECT IN PROPERTY

Recognising and understanding the ripple effect is crucial for homebuyers, investors, policymakers, and anyone with an interest in property.

For prospective homebuyers, the ripple effect highlights the importance of timing and location. Property is cyclical, and trying to get ahead of the wave by purchasing in up-and-coming areas can pay off in the long run and could be your retirement tick. It also means being willing to go to a neighbourhood early when other people are flocking to the fashionable areas.

Investors, meanwhile, can use the ripple effect to identify emerging markets with growth potential to invest in. Moreover, the locations, that may be nearing the peak of a price cycle are worth waiting for before you invest.

THE SUMMARY

Ultimately, the ripple effect is a powerful model that shows the interconnectedness of property markets within a country. What starts as a local surge, can quickly transform into a broader regional or national phenomenon.

Keeping an close eye on these ripple patterns can help everyone with an interest in property navigate the ebbs and flows of the real estate landscape. Moreover, helping explain the majority of market moves allows for more informed decision-making.