As a passive property investor, accumulating property to build a property portfolio with limited stress is the key goal. Building a sizable portfolio can be incredibly rewarding, although the process requires planning and patience.

This comprehensive guide outlines a proven rinse-and-repeat strategy to help understand the process of growing a portfolio. This strategy is not a get-rich-quick scheme and will take time to achieve because of its passive nature. This example is for the low-risk investor who wants to build a portfolio over time with limited time to dedicate to the process. With the right mindset and consistent actions, you can establish a routine to acquire one property after another to set you on your path to your investment goals.

WHERE TO BEGIN WHEN CREATING A PROPERTY PORTFOLIO

The example specialises in one particular property type and area. This can take the temptation and time wasted away from the research process at the start. Building your knowledge of a specific property type and area will make you more comfortable and streamline your investments. The higher your confidence, the higher your chance of success in repeating the system.

Obviously, concentrating on one property type and area doesn’t do much for diversification. Although clarity at the start is the best way to build confidence. You can always spread your wings at a later date once you know your process.

When establishing the type of property, you want to purchase to start your investment career, setting key performance indicators is the easiest way. The following blog, How To Research The Ideal Property Investment Location, can help set your KPI’s for this strategy. This is your template to assess potential investments against; if they meet the criteria, you go for it. This template enables you to rinse and repeat the process and stay on track.

EXAMPLE PROPERTY ON WHICH TO BUILD A PROPERTY PORTFOLIO

The following example is the financial breakdown of a passive investment I have owned for a number of years now. This turnkey, hands-off investment has positively boosted cash flow for the duration of its ownership. It’s been fully passive, and I have never visited the property after the initial viewing to purchase it. By using the financials from this example property below, we can map out how to build a property portfolio from scratch.

The passive investment example is in Swindon. It was purchased in 2021 and is a 1-bed flat in the centre of the city. I have provided images below to give context to the condition of the property and the financials.

Purchase requirements.

| Expense Category | Total | % |

| Purchase Price | £96,000 | |

| Fees (legals and taxes) | £4,000 | |

| Deposit Amount | £24,000 | 25% |

| Mortgage Amount | £72,000 | 75% |

| Total Investor Capex | £28,000 |

Rental breakdown.

| Expense Category | Monthly | Yearly |

| Rent Payments | £725 | £8,700 |

| Management Agent | £73 | £870 |

| Maintenace Budget. (Average for 2 years of ownership) | £73 | £870 |

| Service Charge | £58 | £700 |

| Mortgage (estimated at 4.5%) | £270 | £3,240 |

| Net Rent Received | £252 | 3,020 |

| Net Yield | 10.8% | |

| Gross Yield | 9.1% |

This strategy requires that all profits be reinvested to grow the portfolio. Furthermore, this is helped by any additional savings from a day job and remortgaging currently owned properties. This allows your portfolio to grow exponentially over time through the power of compounding. Even reinvesting a portion of your returns can make a big difference in the long run.

Over the duration of the ownership, the mortgage rate figure in reality will change. It depends on the wider economy and whether you remortgage to release equity. For example, the first mortgage rate for the property was 2.5%, and since the latest mortgage renewal, it’s at 5.5%. Mortgage rates fluctuate over time, and your monthly returns can be higher or lower as a result. The mortgage rate for this example is 4.5% to base the model off. At the remortgage date, 2 years after the original purchase, the property was valued at 110,000. Resulting in the ability to extract 10,500 out to reinvest.

BUILDING A PROPERTY PORTFOLIO STEP BY STEP

Assumptions

This analysis assumes that the properties were purchased at 96,000 with a deposit of 28,000 and a cash flow of 250 a month or 3,000 per year. Furthermore, after 2 years, the property will be remortgaged and valued at 110,000 with just over 10,000 being made available for reinvestment. After which point the monthly cashflows have remained at 250 a month or 3,000 per annum due to the expectation that any extra borrowing costs would be counterbalanced with future increases in rent.

The second assumption is that you have 60,000 available to invest, either through savings or remortgaging your own home. Also, you save 500 a month from your household income for at least the next 10 years.

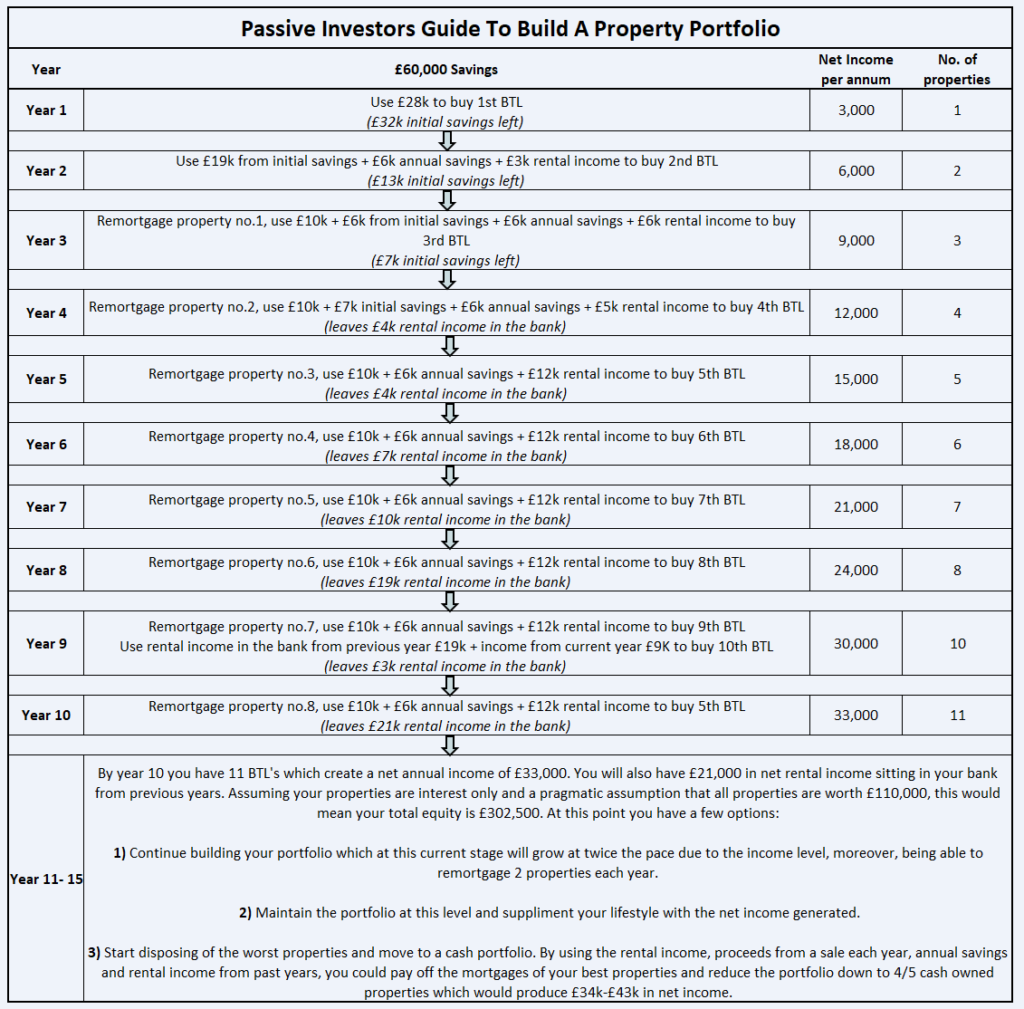

Year-on-year purchase flow chart

This flow chart is an estimate of what can happen. Investing in property, especially mortgaged property, has its risks, as property and rental values can go up or down. Depending on the strategy you choose to take after 10 years, you have the ability to take this portfolio in any direction you prefer.

ASPECTS INVOLVED IN BUILDING A PROPERTY PORTFOLIO SUCCESSFULLY

To start your passive property investing career, there is more you need to be aware of than just what good looks like. Firstly, understand and confirm that this strategy is right for you and your lifestyle. This is key, so you can commit the time required to make it a success.

Secondly, the knowledge of your person’s finances and how to stay on track from month to month. The example above requires saving of 500 a month for 10 years, which requires consistency of routine.

Thirdly, with more and more properties, management will become a large factor to contend with. As a passive investor, using a managing agent will be the simplest way to control this issue. The managing agent will ensure the properties are maintained in good and compliant condition. Even though management can be outsourced, a passive investor should be aware of the landlord’s obligations. The following articles cover the aspects new landlords need to be aware of when owning property.

PROS & CONS OF THE PASSIVE INVESTORS GUIDE TO BUILD A PROPERTY PORTFOLIO

There is obviously advantages and drawbacks to each investment strategy. The key is making sure it suits your goals and lifestyle. The pros and cons of this passive portfolio-building strategy are as follows:

Pros

- Simple to understand

- Set parameters, making repeatability easy.

- Achievable for all ages, such as early 20s and 30s, middle age, or nearing retirement.

- Low time requirement and easy to execute while having a full-time job.

- Small reoccurring savings are required to maintain momentum.

Cons

- A detailed understanding of a specific area is required.

- Patience is required, as initially it’s slow to get to a full level of income.

- Low diversification if you keep buying properties in one location.