In the property development world, residual valuation skills are key to understanding the viability of projects or developments. This valuation and appraisal method provides a thorough approach to analysing the potential of development sites. This includes budgets, contingencies, end values, professional costs, and purchase prices before acquiring the site.

Leaving development to chance by not scoping out the finances first is a recipe for disaster. Therefore, we set out the RICS’s Red Book methodology for residual valuations as a blueprint to assess development opportunities.

RESIDUAL VALUATION & DEVELOPMENT APPRAISALS

A residual valuation estimates a property’s value based on its potential future worth, used in development and investment analysis. It involves determining the gross development value (GDV) which is the total value the finial project would achieve. Then subtracting the costs associated with the development of the site from that specification. The value left represents the residual value of the property. In investment analysis, the figure represents the maximum purchase price for the property while still achieving the desired return.

WHEN DO YOU USE THE RESIDUAL VALUATION METHOD?

Residual valuation is an invaluable tool for evaluating land and buildings that possess planning permission or align with permitted development rights. This method is particularly useful for properties with redevelopment potential or income-generating properties that offer room for value enhancement.

However, if the property doesn’t have the guarantee of planning permission, the official valuation is conducted via one of the other RICS Red Book valuation methods, depending on the property type. Residual valuation method is for properties with planning permission.

Residual valuation remains advantageous for investors and developers when acquiring properties without planning permission. It provides insights into the potential value and costs of obtaining planning permission, serving as an additional appraisal method for evaluating development sites.

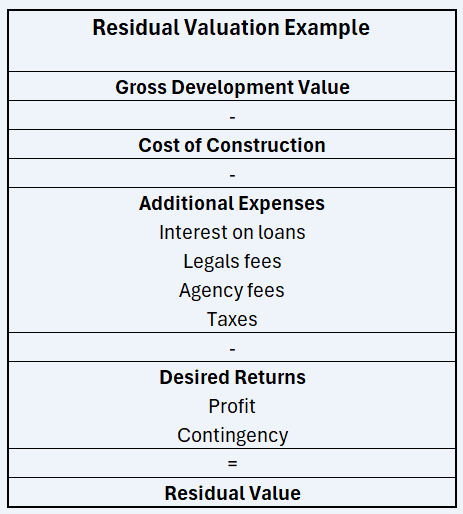

THE EQUATION FOR A RESIDUAL VALUATION

Aspects and explanations of the elements included:

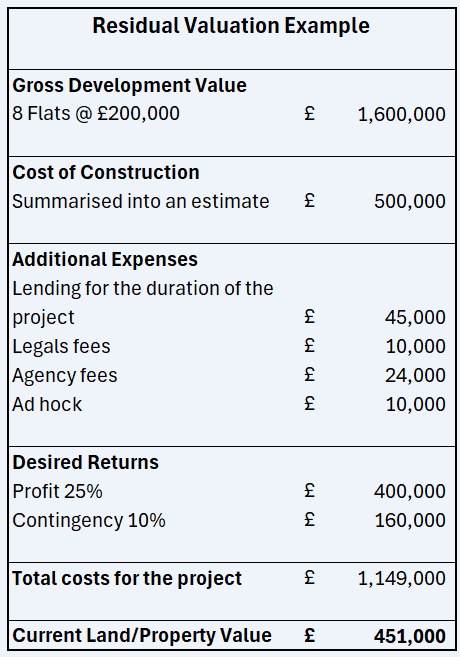

Gross Development Value (GDV): the total value of the scheme once the work is completed. For example, the development of eight flats that will cost £200,000 equates to a GDV of £1.6 million.

Lending costs: whether private or bank lending, what is the total interest for the build time.

Construction costs: how much is the cost of the work that is required to build out the development.

Professional fees: includes legal fees, agency fees, building surveyors, and project managers.

Taxes: this includes stamp duty, VAT if required, and capital gains if you want to go that detailed.

Contingency: the slice of money aside for when things go overbudget, which, if you’ve seen grand designs, you’ll see it normally does.

Profits: this is the planned profit for the developer from carrying out the job and taking on the risk.

THE STEP-BY-STEP APPROACH TO A RESIDUAL VALUATION

Carrying out a residual valuation for real estate involves several steps that allow you to estimate the property’s value based on its future income potential and associated costs. Here is a detailed breakdown of the process:

1. Establish the gross development value.

The first job is to value what the scheme will be worth once completed. This is primarily accomplished using a comparable method. If planning is for the building of eight apartments in Derby, then you would be looking for new apartment transactions in Derby. This will give you the total value of the development.

If you’re looking to exit via a refinance model and rent the properties out, establishing the property’s rental potential is key to understanding the building’s viability for a mortgage and your monthly returns after completion.

2. The cost of construction:

You will need to research or obtain quotations from contractors to determine the costs of developing or constructing the property.

On top of this, you will need to make an allocation or obtain actual figures for professional fees such as planners, architects, quantity surveyors, and project managers. The extent of who you need is dependent on the project.

3. Additional expenses for the project

The additional expenses would include the costs that are applicable to facilitate the project. Examples of these would be the lending costs, which would be the monthly or quarterly payments to finance the building.

Moreover, there are fees to acquire and dispose of the property. These include legal fees, agency fees, taxes, furniture for show rooms, etc.

4. Establishing the desired returns

A developer would obviously not do all this work and take on this risk for nothing. So there needs to be a goal for the project and a security pot aside in case things go over budget. Commonly, the profit margin most developers look for is 25%, and the contingency (safety pot) is 10%. This obviously changes depending on the developers’ preferences and specific projects.

5. Calculate the residual value:

To calculate the value of the land in its undeveloped state, you need to do the following:

Subtract the cost of construction, the additional expenses, and the desired returns from the estimated gross development value.

The figure left represents the residual value of the property. This residual value indicates the maximum amount that can be paid for the property while still achieving the desired return on investment and risk.

EXAMPLE OF A RESIDUAL VALUATION

RESIDUAL VALUATION SENSE CHECK

Development is one of the riskier strategies in real estate, but it also generates the best returns for investors. When doing a residual valuation for a development, whether that’s a desktop valuation to support an offer or you’re conducting an actual RICS Red Book valuation, doing some sort of sensitivity analysis is advisable.

Firstly, by considering different scenarios and adjusting key variables such as the end GDV, construction costs, or lending costs, for example. By doing this, you can assess the impact of these changes on the residual value and understand the property’s sensitivity to various factors.

Secondly, you can establish the risk of the project. Evaluate potential risks and uncertainties associated with the property, such as changes in market conditions, regulatory changes, or inflation of construction costs. This is what contingency is for, but by establishing the risk and the likelihood of something happening, you can adapt the contingency up or down to reflect that.

PROFESSIONAL ASSISTANCE

Their knowledge and experience can provide valuable insights, help validate assumptions, and guide you through the complexities of the valuation process. It’s normally helpful to get a second pair of experienced eyes on the numbers.

RESIDUAL VALUATION METHOD SUMMAY

By following these steps and considering all relevant factors, you can carry out a comprehensive residual valuation for real estate. It allows you to assess the property’s potential profitability, make informed investment decisions, and understand the value of the property based on its future development potential and the costs required to achieve that potential.