Buying in UK property can be a rewarding endeavor. Although identifying the right UK property hotspots requires careful assessment of your personal investment goals.

Whether you’re looking for capital growth, rental yield, or a mix of both, understanding the dynamics of various locations is essential. Fundamentally, everything in property comes down to supply and demand.

In this blog, we’ll explore how to assess your investment objectives and identify the best hotspots in the UK for expat investors.

How to establish your property goals

Before diving into specific areas, take a moment to clarify your investment goals. To identify the right UK property hotspots requires a strategic approach based on individual investment goals.

Understanding these goals helps narrow down potential areas that align with your priorities, whether you aim for rental yields, capital growth, or holiday rentals.

These will dictate what your hotspots are because if you’re looking for a holiday let by the beach, your hotspot isn’t going to be Birmingham. Likewise, if you’re looking for a high-yielding student HMO, you’re not going to be looking in St. Ives, Cornwall.

Here are some common long-term goals to consider:

- Capital Growth: Are you seeking long-term appreciation in property value?

- Rental Yield: Do you want to generate monthly cashflow from buy-to-let or HMO’s?

- Holiday Lettings: Are you interested in a property that you can use for personal holidays while also generating income when you’re not using it?

Once you establish your overarching goals, you can narrow down and identify specific UK property hotspots that meet your criteria.

Where should investors look for established Capital Growth hotspots

For those prioritising capital growth, consider investing in UK property hotspots such as the largest economic cities like Birmingham, Manchester, Leeds, London, and Bristol. These cities typically experience predictable and sustained growth due to several factors:

Strong Job Markets

Major employers and multinational corporations provide job security, contributing to a stable economic environment and investment. These cities host large universities, and thanks to major employers, they retain a significant percentage of students in the local workforce. This often leads to students becoming first-time buyers in the area, generating demand for new quality building stock.

Quality Stock & Transport

These cities offer a mix of quality housing options and transport due to the demand of residents. This demand attracts investors to the cities.

Ongoing Development

Continuous regeneration and development projects enhance property values. For instance, Birmingham’s Big City Plan aims to transform the landscape of the city significantly. Manchester’s Northern Gateway, which is aiming to revitalise underdeveloped areas and attract new residents. Leeds South Bank is set to become a vibrant mixed-use district with residential, commercial, and recreational spaces.

Population Growth

The largest economic cities also drive the population growth forecast for the next 10 years. This is due to job opportunities, modern living through new development, and convenience through transport. With a healthy and consistent rate of population growth, it drives demand for housing. It’s no coincidence that the top 5 cities based on a GDP output are the cities projected to have the largest population growth over the next 10 years:

- London’s growth forecast Approximately 1 million additional residents due to cultural diversity and global attraction for jobs in finance, technology, and creative industries.

- Birmingham growth forecast: Around 200,000 residents due to large regeneration projects and job creation, appealing for families and young professionals.

- Manchester growth forecasts: approximately 150,000 residents. A booming tech sector, culture, and job opportunities draw young people from other areas.

- Leeds growth forecast: About 130,000 residents because of strong financial and digital sectors and affordable housing compared to other major cities.

- Bristol growth forecast: approximately 100,000 residents. A thriving tech and creative sector, combined with high quality of life and universities.

The ripple effect on UK property hotspots

Growth tends to go through cycles in a ripple effect. It comes first to the centre’s most prime areas, and then affordability becomes unattainable, and so demand starts rippling out to the suburbs in the city. If you have the budget to buy prime central locations, that has historically obtained the best growth a city has to offer. Buying a prime central location in the main cities in the UK isn’t guaranteed growth but will provide a strong chance.

Where should investors look for up-and-coming UK property hotspots?

If you don’t have the budget to buy prime central residential locations in the major UK employment cities or want the opportunity of more explosive growth than the “safe bets”. Understanding the key drivers of real estate growth is important to identify up-and-coming UK property hotspots that can offer aggressive growth potential.

Infrastructure & regeneration projects

Areas undergoing transport upgrades or new business developments that will attract large employers often see property values rise. Areas with significant public or private investment in redevelopment present opportunities for growth.

These areas aren’t just in the major cities; there’s lots of smaller towns and cities with regeneration projects that present great opportunities. For example, Corby underwent a major redevelopment between 2005 and 2015, during which time it had an incredible effect on the growth of average house prices in the area.

From the buildup of the masterplan for Corby’s regeneration in 2000 to post completion in 2019, little old Corby’s average house price grew 362%. When comparing that to every other area in the UK over that period, Corby was 6th. It beat the City of London and was contending with other major London growth spots. I’m not saying Corby is the place to invest now, but an example of the returns could be if you identify the next Corby.

| Name | Region | Average house price year ending Sep 2000 | Average house price year ending Sep 2019 | Average property growth 2000-2019 |

| Manchester | Northwest | 25,500 | 137,000 | 437% |

| Newham | London | 67,500 | 340,498 | 404% |

| Waltham Forest | London | 72,000 | 360,000 | 400% |

| Hackney | London | 89,995 | 430,000 | 378% |

| Lewisham | London | 72,500 | 340,000 | 369% |

| Corby | East Midlands | 34,000 | 157,000 | 362% |

| City of London | London | 160,000 | 725,000 | 353% |

| Southend-on-Sea | East of England | 49,000 | 220,000 | 349% |

| Greenwich | London | 78,000 | 350,000 | 349% |

Supermarket Expansion

Monitor where new Waitrose & M&S stores are being established. These supermarkets have excessive research capabilities compared to average investors, and they often choose locations based on growing affluence, which is the same demand property investors want when looking for growth. Waitrose is planning to open 100 new convenience stores across the UK over the next five years. The first is in Hampton Hill; the other 100 new stores will be in highly strategic locations targeting growing wealth areas. Feels like a sensible company to follow as investors for capital growth.

Earnings to house price ratio

Areas with a high average income to house price ratio present significant opportunities for property growth. Locations with strong multinational corporations (MNCs) offering secure, well-paid jobs but house prices are low in comparison, resulting in favourable affordability, which can drive property demand and value appreciation. The average for England is 8.14 x the average annual salary to buy the average property in 2023.

For example, Derby boasts some of the largest manufacturing plants in the UK, including:

- Rolls-Royce: A leading aerospace and defence manufacturer.

- Bombardier: Known for producing trains and aerospace components.

- Toyota: Their manufacturing facility is one of the key sites for vehicle production.

These companies provide strong salaries, with the average income in Derby being around £47,000. In contrast, the average house price in the area is approximately £244,000, resulting in 5.2x annual salary to buy the average property, 3 years below the UK’s average. This enhances local affordability and potential for property growth, as higher prices are affordable when comparing the rest of the country. There are other cities that provide this affordability compared to England on average.

Identifying UK Property Hotspots for Holiday Lets

If your goal is to invest in a property for holiday lettings—perhaps one you can still use from time to time—you should look for areas with high demand for short-term rentals. Short term rentals have varying demand and appeal to different target markets. These include:

Tourists: Individuals or families visiting for leisure or sightseeing. For example, London, York, and Bath.

Business travellers: professionals travelling for work-related purposes, often near business districts. Corporate visitors in cities like Birmingham, Manchester, and London.

Weekend getaway seekers: people looking for short breaks, often seeking relaxation or adventure. Such as visitors to coastal areas like Norfolk or rural retreats in the Lake District.

Families: families on holiday, needing larger accommodation with amenities for children like Cornwall or the Cotswolds.

Festival and event attendees: individuals attending specific events like weddings, concerts, or festivals such as Edinburgh during the Fringe Festival.

The unique characteristics of each location contribute to their popularity in the short-term rental market. Sometimes holiday lets become a blend of an investment and a passion project; the more passion project it becomes, the lower the ROI tends to be. You need to establish what you’re after, and then identifying the hotspot for such a property will become apparent.

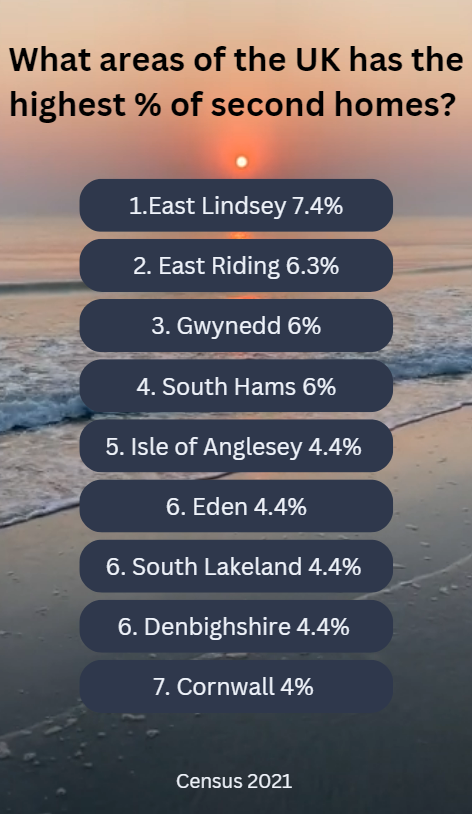

For example, if it’s largely a passion project and you want a second home that you can rent out from time to time. Largely in order for the property to wash its face and not cost you money monthly. Then you should identify if there are any sentimental areas to you where you would like to regularly spend time. Alternatively, you can follow the crowd; this is a list from the latest Census report in 2021 that shows the UK property hotspots for the largest percentage of second home ownership.

How to find UK property hotspots for high yields

If your primary goal is to maximise rental yield and generate meaningful cashflow each month, then consider the following strategies to highlight property hotspots:

Supermarket Locations

For growth, we looked at Waitrose, but for yield, you want to look at areas where supermarkets like Tesco and Aldi are or are establishing new locations. These tend to be more affordable, which generate stronger yields. These neighbourhoods often attract families and young professionals looking for convenient amenities.

Houses in Multiple Occupation (HMOs)

Investing in HMOs can provide higher yields than conventional buy-to-let. HMOs are especially good in cities with growing student populations or young professionals. To identify cities that suit HMOs, the following is key:

Student Market: Identify cities with increasing university enrolments and a shortage of student housing. For instance, cities like Nottingham and Southampton have seen rising demand due to their expanding student bases.

Young professionals: analyse the rental costs of 1- or 2-bedroom apartments compared to the average graduate salary in the city. If rent exceeds 35% of the average salary, there’s a strong argument for HMO’s. As they offer cost savings on rent and a social living environment, which most young professionals are after.

UK property hotspots that maintain a strong tenant demand

The key to achieving a high yield is making sure your property is always full and limiting voids. To ensure your property has the best chance of maintaining a strong tenant demand, the following factors are essential when buying a property:.

Commute: Ensure the area has good transport links to the city centre, as tenants prioritise accessibility work.

Local Amenities: Proximity to shops, cafes, and recreational facilities can enhance rental appeal.

Condition: I know it feels counterintuitive to spend money on your properties to achieve cash flow. Although maintaining a great condition of your property reduces voids and allows a higher rent to be charged.

Postcode yield data

There are plenty of property websites that supply property yield information. The one I found as the best is The Property Data website.

Summary of how to establish UK property hotspots that are right for you

Establishing UK property hotspots for investors hinges on clearly defined investment goals. First, you need to assess your priorities, whether for holiday lettings, capital growth, or rental yield. Thereafter, you can use the tricks in this blog to identify and compare the most suitable locations in the UK. From established cities like Birmingham and Manchester to finding the emerging area like Corby was 20 years ago.

Understanding the market dynamics will empower you to make informed and confident decisions. With the right approach, you can position yourself for success in the UK property market. Although, remember, you can do all the research in the world, but you need to pull the trigger to make the money. Good Luck!