In this blog post, we will provide a step-by-step guide on how to value real estate using a replacement cost valuation method. By understanding and applying this approach, property owners, buyers, and industry professionals can effectively estimate the value of a property based on its replacement or reproduction cost.

WHAT IS A REPLACEMENT COST VALUATION?

The replacement cost valuation method is a commonly used approach to determining the value of real estate based on the cost of constructing or replacing the property. Moreover, this method considers the cost of land acquisition, construction materials, labour, and other associated expenses.

WHEN TO USE A REPLACEMENT COST VALUATION?

The replacement cost method is used in 3 main ways:

Valuing irregular assets

The most common is to value property such as churches, schools, or libraries. These assets don’t transact regularly. Moreover, they don’t generate income or profits, so the cost depreciation method is the only way to establish the value of these assets.

New construction

The replacement cost approach is also for new construction projects. Development loans or construction lenders require appraisals to establish value throughout the project. Therefore, commonly, you reappraise projects at various stages of construction to enable the release of funds for the next stage of completion of the project.

Insurance

Insurance appraisals tend to use the replacement cost approach to establish rebuild values to underwrite homeowners’ policies. Subsequently, only the value of construction is insurable, and so the land value is separate from the total value of the property construction. The choice between depreciated value and full replacement or reproduction value is the key determining factor for the evaluation.

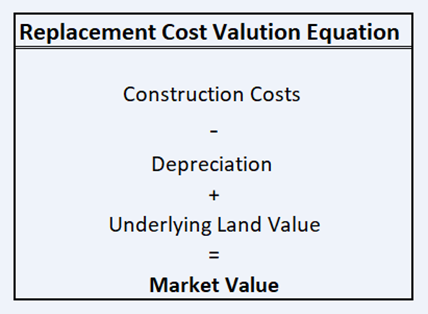

WHAT IS THE REPLACEMENT COSTS VALUATION FORMULA?

5 STEPS TO DO A REPLACEMENT COST VALUATION

1. Gather construction cost data.

Start by gathering construction cost data, including the cost of materials, labour, and associated expenses. A good resource for this is Arcadis; they provide updated construction cost data for global cities on a regular basis. In addition, ask construction professionals or other industry databases to obtain accurate and up-to-date cost information. You will need to adapt this data to consider the specific features of the subject property, such as its size and quality, when estimating construction costs.

2. Calculate the replacement cost valuation

Calculate the replacement cost by adding the estimated construction cost to the cost of land. The replacement cost represents the total amount required to recreate the property to its current layout and specifications.

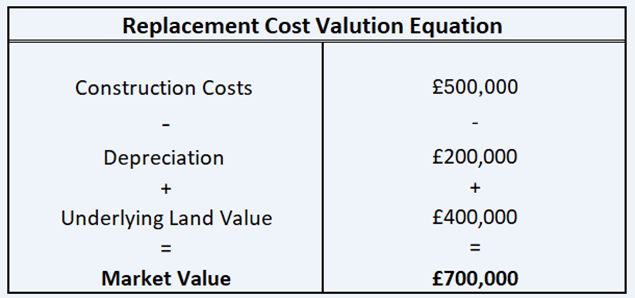

For example, from the data collected, the construction costs to replace the building would be £500,000.

3. Consider depreciation

Evaluate the property’s depreciation. For example, this considers factors such as physical wear and tear, functional obsolescence in some aspects, and external economic conditions. You will likely need to adapt to depreciation. Similarly, like a new car, the day after you take it out of the garage, it will start to depreciate. It’s the same for real estate construction, although not as drastic as car depreciation.

Therefore, apply appropriate depreciation factors to adjust the replacement cost and account for the property’s age and condition.

For example, let’s assume it’s an older property, and the accrued depreciation of the property is £200,000.

4. Determine the value of the underlying Land

To estimate the cost of the land under the church or school, for example, you will need to assess comparable land sales in the area. Therefore, this is based on the assumption that the construction of, say, the church or school is not on the land. By consulting with real estate professionals or databases, you will find historic transactions to compare the subject property against.

The variation of land costs depends significantly on the location, zoning, and accessibility. Additionally, assessing market conditions such as supply and demand dynamics, market trends, and other external factors can have an impact on the property’s value. Therefore, ensure the comparable evidence you compile is reflective of the property’s current market value.

For example, the adjusted comparable evidence suggests that the market is £100,000 per acre for the underlying land. The size of the subject property is 4 acres, meaning the land is worth £400,000.

5. Determine value with a replacement cost valuation method

Add the adjusted replacement cost and entrepreneurial profit to arrive at the property’s value. The formula is:

The result represents an estimate of the property’s value based on the replacement cost valuation method.

REPLACEMENT COST VALUATION LIMITATIONS

One significant limitation of this approach is its assumption that vacant land is readily available for constructing an identical property, which may not always be the case. Therefore, accounting for supply and demand dynamics in the adjustments for underlying land valuation can only partially address this issue. However, given the niche nature of these assets and the necessity of employing this method. There is an element of scarcity that proves challenging to fully capture in the valuation process.

Another weakness is that it’s difficult to estimate the depreciation of older properties. There are many factors to consider. For example, the reconstruction of some properties may be impractical because some materials are banned or not used anymore, like asbestos or reinforced autoclaved aerated concrete. Therefore, estimating the value of such a property is quite subjective.

SUMMARY OF REPLACEMENT COST VALUATIONS

The replacement cost valuation method provides a framework for estimating the value of real estate based on like-for-like replacement costs and underlying land value. By gathering construction cost data, determining the cost of land, calculating the replacement cost, and considering depreciation, you can value assets that can’t be valued through other, more conventional methods.