We explore whether investors can benefit from applying the investment principles of endowment funds to their own portfolios. Providing valuable examples of a diversified portfolio of equities and property is in the eyes of the generational wealth experts. Endowment funds approach investing through the lens of the Modern Portfolio Theory. They have large exposure to alternative assets classes with varied correlations that achieve consistently attractive returns. By understanding their asset allocation, it provides individual investors a blueprint portfolio to obtain high levels of risk-adjusted returns if adopted.

Endowment Funds Explained

What is an endowment fund? They are investment portfolios with the initial capital originating from donations during the life of the entities. For example, Oxford College endowments still hold land received from benefactors such as the King of England when they were first founded century’s ago. Endowment funds fund charitable and non-profit institutions such as churches, charities, hospitals, and universities.

Investment policies for each endowment are different and governs how funds invest. The policies may cover asset allocation, risk level, targeted return, and so on. Endowment funds usually come with a lower risk threshold and strive for more liquidity than say a mutual fund or a hedge fund. This is because they need to have cash available to withdrawal when the organisation require.

Types Of Endowment Funds

There are 3 types of endowment fund structure:

Restricted Endowments: The donor restricts the use of the funds for a predetermined use. For example, a restricted university endowment fund may only pay for scholarships to students with certain abilities i.e. sport or maths.

Unrestricted Endowments: The donor of an unrestricted endowment fund has no limit to the purpose of the proceeds. The money can be for any purpose such as maintaining University buildings or staff wages.

Quasi-Endowment: This fund doesn’t need to exist permanently. The endowment can spend the principle completely, such as for a new library.

How Endowment Fund Principles Relate To Individuals.

I know it sounds far-fetched relating 600-hundred-year-old institutions to individuals but stay with me. There are similarities which make this asset allocation applicable for investing in 2023 as an individual or company. An endowment fund has money allocated for either certain activities a specific project or at the entity’s discretion. This is quite relevant to how individuals and companies navigate finances throughout life. Here are some examples of what I mean below:

Restricted fund: A budget that’s designed for a certain purpose, such as a kid’s education.

Unrestricted fund: This is to maintain our quality of life into the future and to be spent on anything you see fit to enrich your life.

Quasi fund: A fund that is spent completely. For example, a new car, home extension or a holiday.

There is a lot to learn about how endowments allocate their investment portfolio to sustain value for the future. Although at the same time having liquid funds to support day to day activities.

Further reasons why to study Endowment fund investing:

- Endowment funds constantly achieve superior investment returns.

- Rely less on market timing and more on strategic allocations that are consistent and stable to generate returns.

- The allocations are in a variety of alternative asset classes. Smaller investors can replicate this with relative ease and low trading costs.

The Endowment Funds Approach

There’s no one ideal investment or allocation, the following provides inspiration of how endowments allocate their assets. The key to success for these institutions is investing in a range of investments within various asset classes. Over long periods of time, a portfolio of diversified investments will typically out-earn an investment in any single asset type. It will also give you a smoother ride along the journey.

If you make a 50% loss, you need to make a 100% gain just to get back to where you started from. This shows the importance of asset allocation and trying to mitigate negative returns as much as possible. In Warren Buffets words “the first rule of investing is not to lose money; the second rule is not to forget the first rule”. The research to follow shows how the institutional stalwarts of investing allocate their assets within their portfolio. Furthermore, how the limit the downside and maximise the upside over for long periods of time.

The Average Endowment Funds Asset Allocation

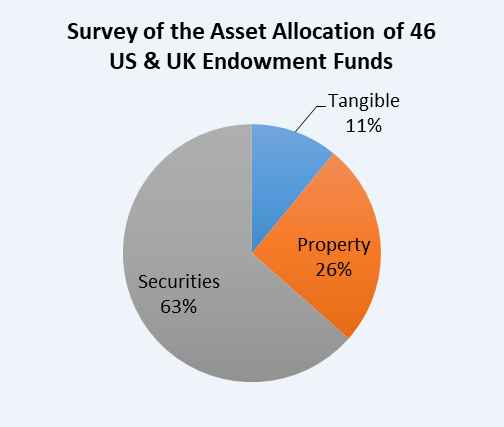

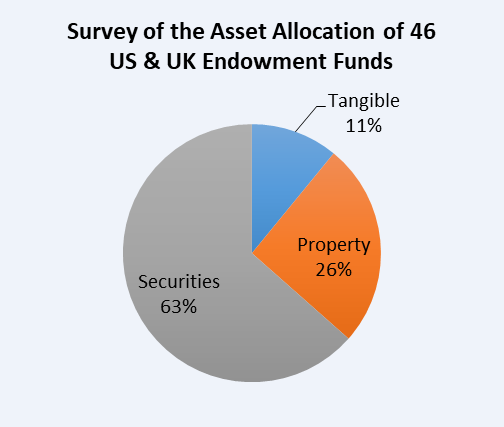

The following data is born from research of the 46 financial statements from the largest UK and US endowments funds. We show their distribution of investments held as property, securities, tangible assets and the various subsectors of these asset types.

Tangible assets in this survey consist of land and buildings owned by the institution. These buildings help provide their programs and activities in order to carry out the day-to-day functions of the entity.

Property includes investments in rural property, offices, retail, residential, industrial parks, student living and other diversification projects such as renewables and marine life.

Securities include public stocks, hedge funds, private equity, bonds, gold, commodities and fixed income/cash.

The following is how some of the largest 46 endowments funds invest their wealth.

Within the 46 Endowment funds analysed 13 of them were the largest Oxford College endowment funds. The Oxford Colleges broadly aligned with the average allocations of the endowment funds surveyed with slight increases in property and tangible assets.

The increased allocation to tangible assets for Oxford University is due to the requirement for the security of tenure of their educational buildings.

How Endowment Funds Perform

The following table shows a deep dive into the average net yield achieved from 20 of the 46 endowment funds surveyed. These figures are net of professional fees, maintenance costs and any loan repayments. We cover the specific property returns further in how much of my portfolio should be invested in real estate. The article investigates property portfolios, their returns and the pros/cons of the various property types.

Table 1. Average endowment fund net asset yields

| Asset Type | % |

| Tangible Assets | 0% |

| Property Rental Income | 5.56% |

| Security Dividend Income | 1.02% |

Within the survey there were 28 entities from the UK and 18 from the US. Furthermore, there are 33 universities and 13 charities/investment companies. The data shows clearly that there is a definite difference in attitude and styles of investing whether in the UK or US. Furthermore, if your benefactors are students or other causes. Articles that cover the difference between the UK and US institutional investment styles as well as securities investments are below.

Individual Endowment Fund Allocations And Historic Net Returns

The following selected entities included in the survey, provide a thorough breakdown of their portfolio and historic endowment performance over various timeframes.

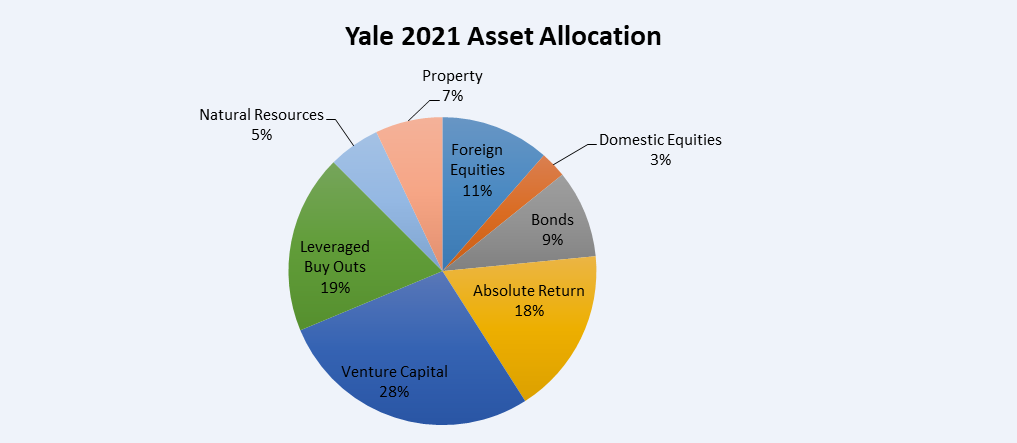

Portfolio of Yale university Endowment

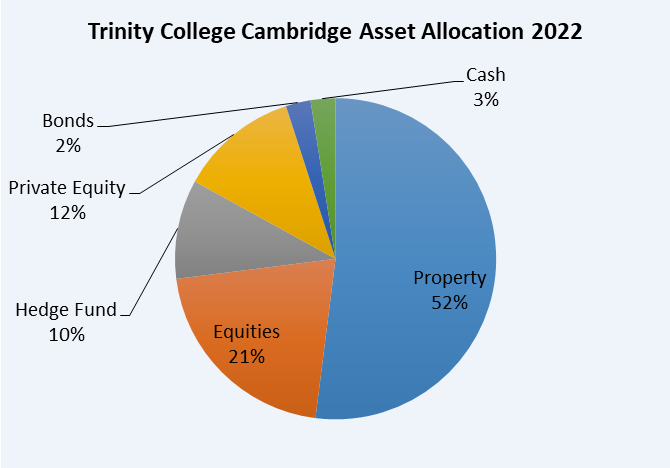

Asset Allocation of Trinity College Cambridge’s Endowment

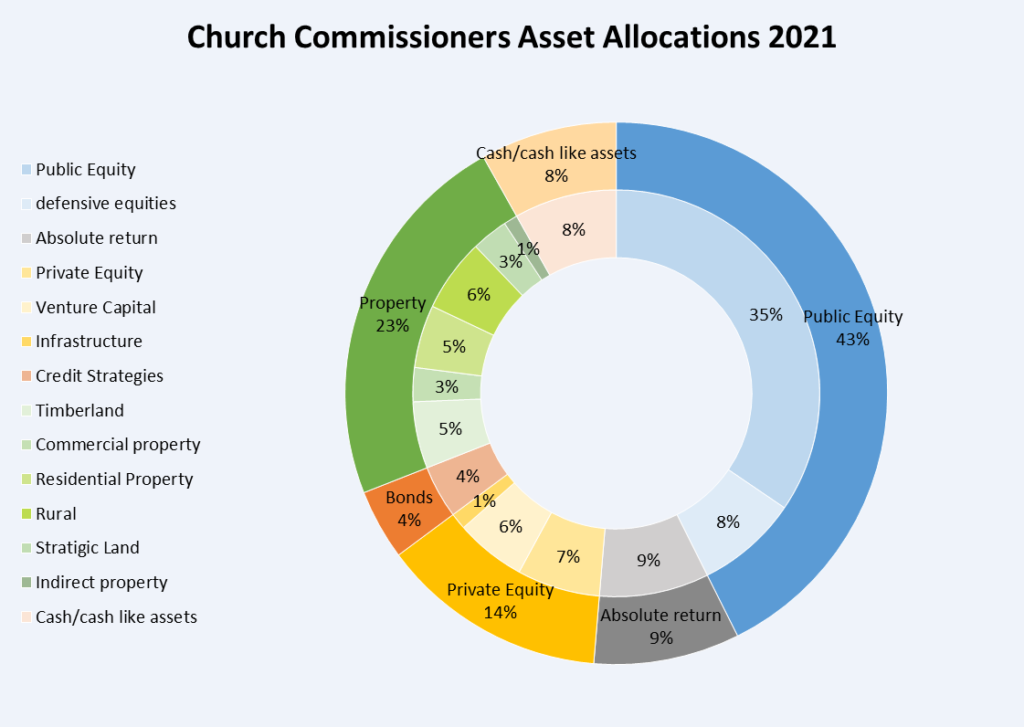

Portfolio of The Church Commissioner’s Endowment

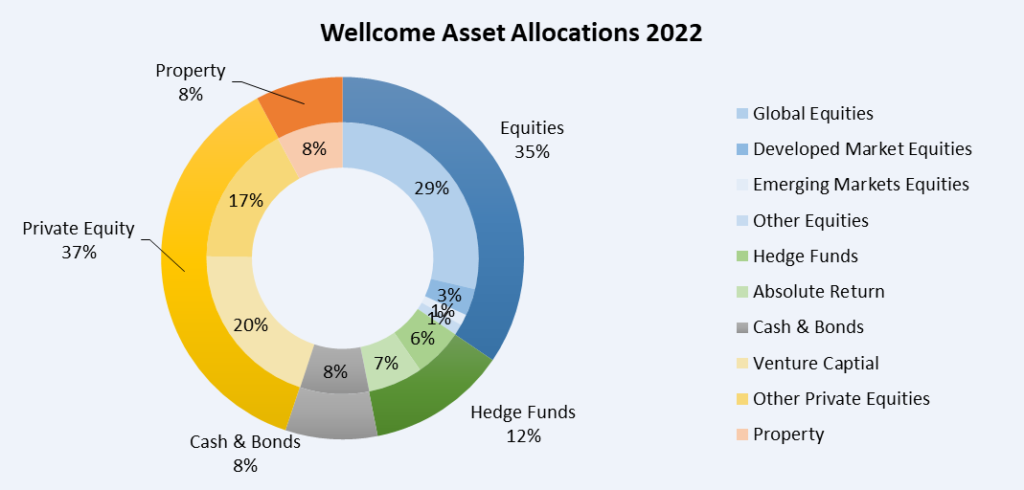

Asset Allocation of the Wellcome Trust Endowment

Table 2. Endowment funds net returns vs. standard benchmarks

| Entity Name | 30yr Return | 20yr Return | 10yr Return | 5yr Return | 3yr Returns | 1yr Return | Start Date |

|---|---|---|---|---|---|---|---|

| Yale University | 13.10% | 11.30% | 12.00% | 13.16% | 15.93% | 0.80% | Sep-22 |

| Church Commissioners | 10.0% | 8.90% | 10.20% | 8.40% | 11.20% | 5% | Dec-22 |

| Trinity College, Camb | – | – | 12.90% | 8.60% | 9.10% | 10.40% | Jun-22 |

| Wellcome Trust | 13.80% | 11.70% | 14.10% | 13.20% | 15.20% | 1.70% | Sep-22 |

| FTSE 100 | 4.64% | 2.73% | 3.20% | 3.30% | 3.10% | -2.04% | Sep-22 |

| Traditional 40/60 | 7.87% | 7.55% | 8.00% | 5.00% | 3.28% | -20.69% | Sep-22 |

| S&P 500 | 10.70% | 9.49% | 13.67% | 12.61% | 9.02% | -16.76% | Sep-22 |

For comparison purposes, table 2 shows that over 3, 5-, 10-, 20- and 30-years endowment funds have significantly outperformed the traditional 60/40 portfolio and the FTSE 100 index. The S&P 500’s performance has kept pace with the 4 selected endowment funds over these time frames. Although Yale University and the Wellcome Trust have outshone with increased returns in all but 1 of the timeframes in table 2.

When analysing the 1-year returns, it’s clear to see that if you have a portfolio with 1 or 2 asset types in the portfolio then you are significantly susceptible to large drawdowns in times of economic stress. The traditional 40/60 portfolios of bonds & US stocks and the S&P 500 made up of US stocks reduced by over 15% for the year. On the other hand, the endowment funds varied somewhat but all posted a positive return. When focusing of Trinity College, they have achieved a 10.40% return, which is likely due to their allocation of 52% to property. Property is a good hedge against inflation due to the fact that both the rents and capital values are likely mirror or surpass the inflation rate. The Church Commissioners has 23% of property and is the other strong performer over 1 year considering the tough financial conditions.

Summary

These endowments funds have withstood the test of time. Moreover, have provided an abundance of opportunity for the proposed benefactors of the funds. The 46 endowments selected have a cumulative asset value of £543 billion and most establishments are older than 300 years old. To me, these figures and time periods speak for themselves that they have managed to thrive through rain or shine. They have grown through stable long-term investing whilst providing constant income for their benefactors along the way. This research demonstrates that the endowment funds consistently achieve attractive returns with moderate volatility. This is because of their multi assets approach, which gives exposure to uncorrelated asset classes. Whilst there are short-term elements that slightly impact the performance norms, the strategies prevail in the long term and give risk adjusted returns superior to the traditional portfolio benchmarks.