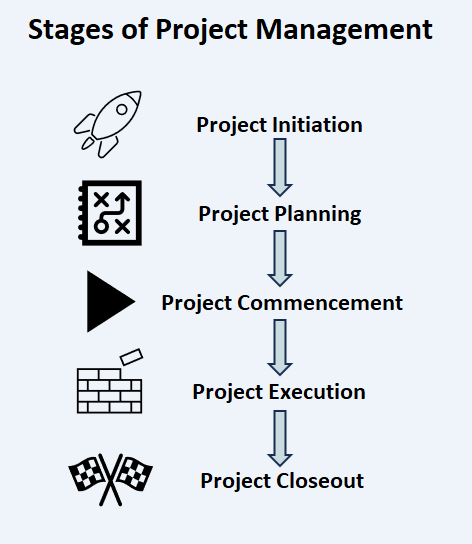

To build upon The 8 Proven Phases of Project Management for Real Estate, the following section covers the 5 stages of managing a real estate project and illustrates how each phase seamlessly integrates with each stage. Whether you’re starting from scratch or working on a redevelopment, these stages will guide you through the process.

Stages of a real estate project

Most projects encompass these stages and their respective phases to varying degrees. Furthermore, the depth required for each aspect depends on the scale and complexity of the project. The following provides a comprehensive understanding of the theory, rationale, and standard procedures behind each stage. Subsequently, you can adapt them to your specific project, ensuring a smooth project execution.

Stage 1: Project initiation

Typically, this stage commences with a launch meeting to establish the definition of a successful project. You identify the key goals, performance indicators, and project scope. The project scope serves as the foundation for evaluating the business case proposal.

It also involves identifying stakeholders suitable for the project, such as potential investors, lenders, contractors, or planners whose work aligns with the project’s scope. Moreover, it entails developing a procurement strategy that combines stakeholders’ interests with successful outcomes, including contract terms for investors, required contractor types, and timeframes.

This stage often involves inspecting the subject property to be purchased, leased, or already owned. It may be repeated several times until a project that aligns with the project scope is found. This stage is crucial for setting the foundation towards what a successful project.

Stage 2: Project planning

The planning stage involves a deep dive into all aspects that contribute to achieving the desired outcomes. It functions as a due diligence checklist to ensure that all elements of the real estate project align with the project’s objectives. Evaluating any aspects that do not meet the criteria is essential to determine their impact on the project’s feasibility.

The planning of deliverables ensures work quality, realistic timelines, and financial viability. It also involves identifying and managing risk events, as well as establishing effective communication channels.

By the end of stage 2, you should be able to answer the following questions:

- What do you aim to achieve? (Established in the project initiation stage)

- How does this project satisfy the project goals?

- How will you execute the project?

- Who will be involved in the execution?

- When will the project be carried out?

The subsequent planning phases help provide answers to these questions:

Stakeholders

Mapping, analysis, and initial discussions to assign key individuals responsible for overseeing the real estate project’s execution.

Scope management

Gathering requirements, defining the project’s specific scope, and creating a work breakdown structure. This phase also includes the design of floor plans, extensions, aesthetics, and other relevant considerations.

Time management

Establishing a schedule, defining activity requirements, sequencing activities, estimating resource requirements, and determining the overall duration.

Cost management

This includes determining budget estimates, contingencies, and overall project feasibility. These aspects should align with the KPIs established in the project initiation stage. Furthermore, feasibility metrics, such as return on investment, capital expenditure, or net present value, are commonly evaluated.

If you’re considering a refurbishment project for a property you currently own or plan to own for investment purposes, there are a few key elements to consider. First, you’ll need to estimate the construction and professional fees associated with the project. This will help determine the financial feasibility of the investment and provide guidelines for setting purchase prices and future values for refinancing or selling the property.

Now, let’s say you have a tenant who wants to fit out a space for their business operations rather than for investment purposes. In this case, the feasibility planning would focus on ensuring that the design aligns with the allocated capital expenditure budget. You’ll also need to assess whether the length of the proposed lease term justifies the capital expenditure required. To do this, you’ll gather estimates for construction and professional fees to ensure they fall within the budget and meet the tenant’s needs.

Communication management

Given the various parties involved, ensuring clarity and accuracy in communication is crucial for effective planning.

Risk management

Identifying risks, analyzing them, and planning responses to incorporate into the project scope. This includes developing alternative exit plans if the preferred option becomes unavailable.

Stage 3: Commencement of real estate project

After completing the planning and due diligence stages, the project moves into the commencement stage if it receives the green light from decision-makers.

This stage’s specific requirements depend on the type of real estate project being undertaken. It involves organizing and aligning all necessary elements before initiating work. For example, it includes finalizing the tender exercise, executing contracts with contractors or property purchases, confirming start dates, updating stakeholders, confirming risk analysis, and ordering resources and materials.

Stage 4: Execution

The execution phase involves actively carrying out the work. The following phases are essential for maintaining a smooth operation until project completion:

Time management and schedule maintenance

Managing the project schedule and analyzing critical paths. Any changes to the schedule may impact the critical path, resulting in modifications to activity sequences or logic.

Budget control

Monitoring and managing cost performance. If necessary, implementing financial improvement plans in response to changes in the budget or actual project costs.

Acquiring and managing the project team

Ensuring the right resources are available to achieve project goals and timelines. This includes coordinating contractors, equipment, and materials.

Communication

Regularly updating and instructing the different stakeholders involved in the project. Effective communication styles and content may vary depending on the personnel involved.

Risk management and analysis

Continuously reviewing risk plans to manage financial or operational consequences and adapt quality as needed. This phase involves monitoring and controlling risks, as well as implementing contingency plans when necessary.

Stage 5: Project closeout

The final stage of a real estate project involves wrapping up all activities and completing necessary documentation. Key aspects of this stage include:

Final inspections

Verifying that all work has been completed according to the project’s scope and quality standards.

Handover

Transferring the property or project deliverables to the intended beneficiaries or owners.

Post-project evaluation

Assessing the project’s overall success, identifying lessons learned, and documenting best practices and areas for improvement.

Financial closeout

Settling all financial obligations, including payments to contractors, lenders, and other parties involved in the project.

Archiving project records

Organizing and storing all project-related documentation and records for future reference or audits.

Real Estate project management summary

By following these stages and their corresponding phases, real estate project managers can effectively manage a project from initiation to closeout. Project management is not set in stone. It’s a dynamic process, and you may need to make adjustments along the way. The key is to stay adaptable and make informed decisions as you navigate the complexities of real estate project management.

For more information and courses, the Project Management Institute has specific real estate construction courses that delve deeper into the subject.