The comparable valuation method is the most common way to value real estate. It’s used in one form or another for other methods as well. Becoming knowledgeable is how to collect, assess, and adjust comparable properties to derive a value for your subject property is a good skill to have in your toolbox.

WHEN WOULD YOU USE THE COMPARABLE VALUATION METHOD?

This approach is particularly useful for residential properties and relies on the principle of supply and demand in the local market. You need to have an established transactional market to adjust comparable properties to the subject property. These types of properties are driven off the own occupier market.

You also use the comparison method when valuing through the investment method, the depreciated cost method, and the profits method. The comparison method helps adjust and establish the market yield for a particular asset. The yield you establish for the subject property can then be capitalized by the annual rent or profits to obtain the capital value.

THE 5 STEPS TO USING THE COMPARABLE VALUATION METHOD.

This valuation approach involves comparing a property of interest to recently sold properties that are similar in terms of location, size, condition, and other relevant factors. In this blog post, we will provide a step-by-step guide on how to establish real estate values using comparison. By understanding and applying these methods, buyers, sellers, and industry professionals can make informed decisions based on the market. The comparable method can be to establish both rental and sales values.

1. Identify Comparable Properties

Start by identifying recently sold properties that are comparable to the property you want to value. Look for properties in the same neighbourhood or area that have similar characteristics, such as size, type, age, amenities, sale date, and condition. Multiple comparable properties should be selected to ensure a reliable valuation.

2. Gather Sales Data

Obtain detailed sales data for the comparable properties, including the sale price, date of sale, property features, images, and any relevant market conditions at the time of sale. This information can be obtained from public records such as the land registry, real estate agents, or online databases such as Rightmove or Zoopla.

3. Adjust for Differences

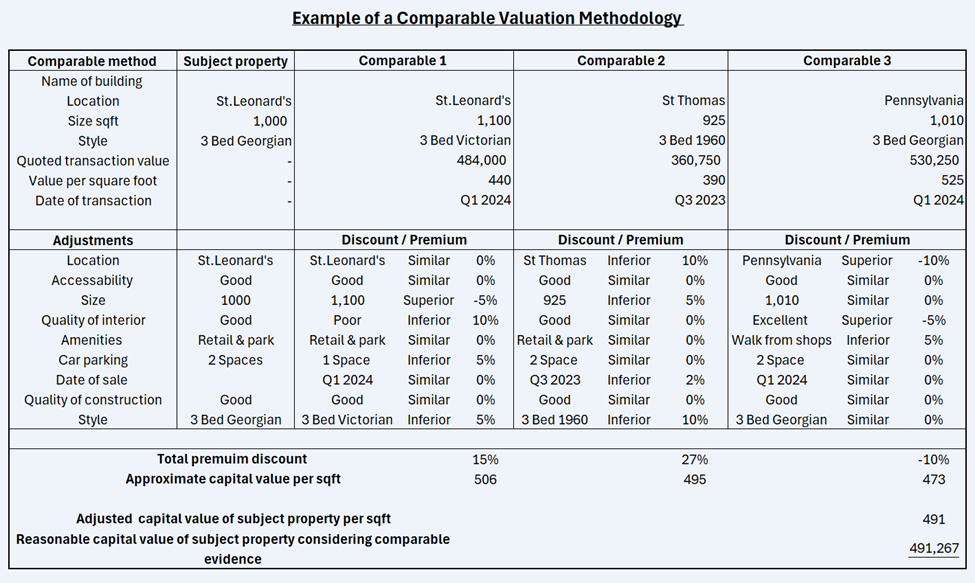

Every property has its differences. You need to compare the subject property to comparable properties and adjust for any differences. Adjustments are to account for these differences in order to make an apples-to-apples comparison. The example below shows how adjustments generate the valuation.

4. Analyze Market Trends

When assessing the value of a property through comparables, you need to be aware of the overall market trends and conditions of the market. Factors such as supply and demand, interest rates, economic conditions, and local market dynamics can affect property values. If one of your comparables sale dates is some time ago, you will need to adjust to reflect the growth or reduction in the market to have a fair representation of the comparable.

5. Determine the Value

Based on the analysis of the comparable properties and adjustments made, you need to establish the total percentage discount for each comparable. Thereafter, you can work out the approximate price per square foot for each comparable. Then, by averaging the adjusted per square foot sale prices of the comparable properties, you can establish the value of the subject property by multiplying this number by its size. The final value should reflect the property’s unique characteristics and the prevailing market conditions.

EXAMPLE OF A COMPARABLE VALUATION METHOD.

FAQS OF THE COMPARABLE VALUATION METHOD

Can I use advertised sale values as comparable evidence in a property valuation?

Not really, they hold very little weight in the overall decision because it’s not a complete market transaction. It’s just a value one side would like to achieve, it doesn’t necessarily mean they will. There is a hierarchy of evidence where the RICS has categorized comparables into three categories:

- Category A: direct transactional evidence. E.g., sold properties.

- Category B: general market data providing guidance rather than a direct indication of value, such as evidence from published sources, commercial databases, indices, historic evidence, and demand/supply data.

- Category C: other sources, such as transactional evidence from other property types and locations and other relevant background data.

What challenges do valuers face with the comparable method?

- Limited or infrequent transactions

- Lack of up-to-date evidence

- Evidence created by special purchasers, who may have paid more than the market because of an overriding motivation

- Lack of similar or identical evidence due to the complex nature of real estate

- Lack of market transparency

How do you value a property with the comparable method if you have a lack of evidence?

You should increase your search radius or look further back in time to find comparables. Then adjust according to the subject property. If there are still no comparables, then you will need to use another valuation method.

If property is sold to a family member or a neighbour, is that a good comparable to use?

No, it isn’t an arm’s-length market transaction. The price might be higher or lower than the market as a result. So it is not a fair reflection of what is achievable in the market.

COMPARABLE VALUATION METHOD SUMMARY

The comparable valuation method is a valuable tool for establishing real estate values based on recent sales data and market trends. By identifying comparable properties, gathering sales data, making appropriate adjustments, analysing market trends, and determining the value, stakeholders can make informed decisions regarding buying, selling, or investing in real estate.

However, it is important to note that a comparable valuation is not an exact science. Professional appraisal services may be necessary for complex or unique properties. By utilizing these methods, individuals can gain a better understanding of the market value of a property and make informed decisions in the real estate market.