Our individual portfolio management could benefit from the data driven spending policies that institutions use. The balance between storing your money for the future and not neglecting the present is a tricky one to strike. The default recommendation is to save for your twilight years, and prepare for a comfortable retirement. This is a hard sell to 20- and 30-year-olds who won’t see the benefits for 30 to 40 years. The best of both worlds seems to be a great way forward to balance delayed and current gratification. The Yale matrix provides a blueprint spending policy that is adaptable to suit your personal requirements. We can continue to benefit from the portfolio without impeding its future buying power. We cover this blueprint in detail in the following article.

ENDOWMENT FUND PORTFOLIO MANAGEMENT

Portfolio management of endowment funds focuses on two aspects: generating market-beat returns and spending policy. Spending policies for endowments tread a fine line between neither overspending nor underspending. This is to ensure the current benefactors gain all reasonable benefits at the present time. Although these actions do not impede future portfolio purchasing power or financial support for future generations. This can relate to personal portfolio management by ensuring you’re balancing present and future enjoyment. Endowments are the difference between the survival and failure of entities. The spending policy is key to maintaining long-term wealth, considering inflationary effects and cash flow requirements from year to year.

THE YALE ENDOWMENT SPENDING POLICY

The master of the game over the past decades has been David Swensen at Yale University. He articulates his methods on investments and spending policy in his book, Pioneering Portfolio Management. The spending policy is designed “to stabilise annual spending levels and to achieve intergenerational neutrality by preserving the real value of the endowment portfolio over time”. Essentially, the endowment managers are stewards for all future generations of the university. This is done by ensuring that current students benefit equally from the support and opportunity as students in the future will. When factoring in the effect of inflation.

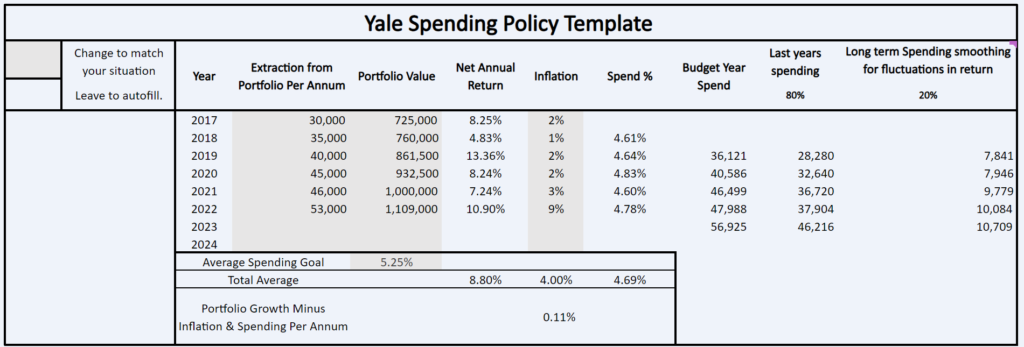

The spending policy for Yale aims to smooth year-to-year market swings and maintain buying power. The university’s desired extraction rate over the long-term is 5.25% of the total endowment value.

To calculate this, you use 80% of the previous year’s spending and 20% of the targeted long-term spending rate applied to the market value two years ago. The spending amount is adjusted for inflation and taxes. Furthermore, they moderate the spending rate to ensure it is at least 4.0% and no more than 6.5% of the endowment’s total market value.

THE SPENDING CALCULATION

80% of last year’s spending amount

+

20% of (5.25% x portfolio value 2 years ago)

=

This year’s spending amount (adjusted for inflation and taxes)

WHY SHOULD YOU SMOOTH THE SPENDING?

Portfolio returns are volatile with any asset allocation you select. Moreover, changing your personal household expenses is difficult, most are fixed at a certain price with a binding contract. This is similar for endowment returns and their expenses, which is why Yale carries out smoothing of spending year to year to maintain long-term buying power, although it provides necessary support for the present year.

IF THE ENDOWMENT’S ANNUAL RETURN IS ABOVE EXPECTATIONS

Yale spends more, although they adjust gradually to ensure they don’t underspend over time.

IF THE ENDOWMENT’S ANNUAL RETURN IS BELOW EXPECTATIONS

Yale spends less, adjusting gradually to ensure they don’t overspend over time.

YALE’S PORTFOLIO MANAGEMENT

Yale’s long-term plan assumes an endowment return of 8.25% per year, which is the standstill level for the portfolio when factoring in spending and inflation. For example, an 8.25% portfolio return in 2020 has no effect on spending in 2022. A 7.25% portfolio return in 2021 would change future spending in 2023, and this reduction is calculated as below:

FY 2022 = 53k (the spending rule is based on FY20 year-end market value).

Example Portfolio Market Value at the End of FY 2021 = 1 million

80% stays the same as the previous year’s spending plus inflation = 46k.

20% is reduced slightly to reflect the 2021 annual return.

1 million (mv) x -1% return x 5.25% spend rate x 20% smoothing = 11k

FY 2023 = 57k

Please note that these are example numbers and not exact portfolio figures from Yale University.

The full Excel is added to help you establish your portfolio spending moving forward and change it to reflect your desired spending level. The Excel also shows the impact on portfolio growth in the future, depending on the level of inflation and spending.

PORTFOLIO MANAGEMENT FACTORS TO WEIGH UP

The implication for Yale with the high extraction rate is that the portfolio needs to continually generate a high annual return to keep the spending policy sustainable over time. By sticking to Yale’s 5.25% spending goal plus approx. 3% for inflation (2022 would be an anomaly to this approximation) each year. The portfolio’s annual return needs to be 8.25% to just stand still.

PORTFOLIO MANAGEMENT: THE SPENDING POLICY FOR GROWTH

For your personal spending policy, it can differ from this rate to suit your personal circumstances. For instance, if you’re looking to grow your portfolio value and have income sources to maintain your current lifestyle. The expenditure rate can be reduced to give more surplus to reinvest profits back into the portfolio. Even in this example, some extraction is good to make sure you’re benefiting in some way from your portfolio as a reward.

PROPERTFOLIO MANAGEMENT: THE SPENDING POLICY FOR RETIREMENT

If you’re looking to use your portfolio to maintain your lifestyle, then the higher extraction rate, as used by Yale. It would suit your requirements now and maintain your ability to extract similar levels in perpetuity. Exceeding the spending rate of Yale would likely lead to a reduction in buying power unless you create incredible returns.

ADAPTING YOUR SPENDING TO YOUR PORTFOLIO’S EXPECTED RETURNS.

Another factor to consider is the expected return of your portfolio. For Yale, they have an aggressive portfolio with a long-term horizon for investments to flourish and achieve their expected high rate of return. Individuals may not have such a long-term horizon or have a less risky approach to their portfolio. Therefore, you need to understand the expected return of your portfolio to understand if your extraction rate is going to match that.

For example, if you have a portfolio of largely bonds that is likely to return 3.5% annually and a spending rate of 5.25% plus inflation, this is going to erode your portfolio hugely.

SUMMARY

Even with this significant level of spending, the Yale Endowment has more than maintained its value, allowing Yale to continue to grow support for financial aid, research, and education programmes. The key is to define the reason why your portfolio exists, and then you can define the spending policy and processes that your personal endowment requires. Once established, this model can be used as an aid to plan your portfolio spending and tweak it to suit your individual circumstances.