Financial freedom is when you’re in a position where your cash flow from investments covers your expenses. Therefore, it enables you to do what you want when you want and not be constrained by a paycheck. This can feel like a distant dream, with the constant day-to-day temptations affecting your ability to squirrel your money away.

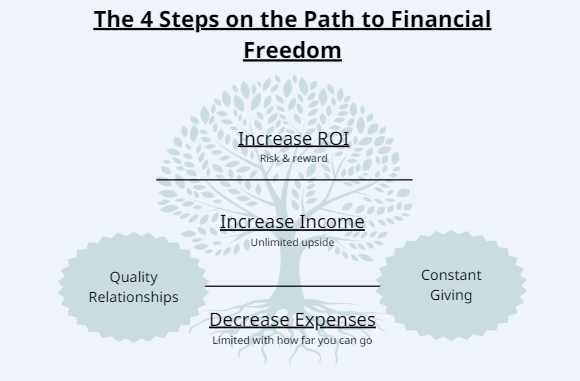

This 4-step guide will help you define financial freedom for yourself. Furthermore, learn how to set appropriate goals, maximise your monthly profit and loss statement, and finally invest. We also touch on the importance of quality relationships and constant giving. To start off, what does financial freedom mean? There’s a different definition for everyone. The following are a few examples of what achieving financial freedom generally means.

- Having control over your month-to-month finances.

- Having the ability to absorb any financial shock.

- The ability to meet your financial goals.

- Making the choices that enable you to best enjoy life

A STEP-BY-STEP GUIDE TO ACHIEVING FINANCIAL FREEDOM

During the journey, a good analogy is that investing is like planting a tree. A tree is small and unassuming at first, but it requires fertiliser and water to maintain its growth, such as through reinvestment. Furthermore, the tree needs protection from deer or economic uncertainty. After a while, the tree will grow to a level where the branches generate protection from bad weather and the constant re-generation of fruits to live off.

1) WHAT IS FINANCIAL FREEDOM

This is the start of your journey and involves your definition of financial freedom. There is no set amount of money that determines being financially free; it will vary depending on your lifestyle goals. It’s essentially defining your north star and what that looks like now. Your North Star will obviously change as you go through the journey, but establishing a goal now is key. The exercise defines how much cash flow you need to generate for that life and a timeline for achieving it.

To figure out how much money you need to afford your version of financial freedom, use the calculator below. It has been generated from the advice in Tony Robbins‘ book Money Master the Game. It establishes how much money you need in order to fund the five lifestyle stages on the road to financial freedom.

The 5 lifestyle stages to financial freedom

- Financial Security: being able to cover the necessities of your current lifestyle (food, housing, and utilities)

- Financial Vitality: be able to pay for half of your current lifestyle.

- Financial Independence: being able to pay for your current lifestyle

- Financial Freedom: Being able to pay for your current lifestyle plus 3 luxury items

- Completely Financially Free: Able to pay for your dream life

This is driven by your expected annual expenses. I think it will surprise you how attainable each level is when you list them down and attribute real numbers to them. Using this information, the forecast spreadsheet will tell you how long it will take to hit each marker. This depends on two things: your sustained commitment and the return on investment you achieve. If these timeline projections for hitting each stage don’t align with your goals. Then aspects of your lifestyle will need to be modified to succeed, which we address below. Clarity is power. These 5 stages serve as checkpoints up the financial freedom mountain to your desired lifestyle.

2) MAXIMISING YOUR PERSONAL PROFIT AND LOSS STATEMENT

I’m a big believer in running your personal finances like a business would run its finances. Hence the reference to a personal profit and loss statement. Businesses have fixed costs just like us; they also have ad hoc expenses such as client functions and Christmas parties. We also have fixed costs like housing and utility bills, as well as ad hoc expenses such as broken-down cars and first dates. The key difference is that a company requires a profit margin each month, quarter, and year. Whereas we don’t hold ourselves to the same standards and neglect the mandatory profit margin. The following will help get your business back on track and provide you with the habits to help you achieve your goals.

Track your spending!

In order to achieve your desired lifestyle quicker, tracking your spending is the first step. The old analogy of what you measure, you can manage rings true for personal finance. It provides clarity and understanding of where your money flows each month. Furthermore, it gives you a clear picture of the payments that add value to your life and which don’t. The aspects that don’t could be used to bulk out your freedom fund.

Do you know how much you spend each month? If not, now is the time to find out. You can either go into detail and pore through your last 12 months of bank statements or just your last couple of months to get a flavour of your spending habits. The small things really do add up. Understanding what they are is the key to planning a way forward and deciding where you can cut back. The link below provides a format for recording spending habits.

Create a budget!

Once you have taken a close look at your spending habits, you can create a budget that reflects how you want to spend your money. Below is a link to start with a budget worksheet, where you’ll be able to refer to your financial statements you gathered, accounting for each item, and adjust them to create your expenses budget going forward. Moreover, record your sources of income to complete your monthly profit and loss.

How to think about expenses

If you’re struggling to decide whether a certain item is worth it or not. The following is an alternative way of thinking about an expense and understanding the real cost of spending. 4% is known as the safe withdrawal rate for a standard portfolio of stocks and bonds, which returns 5%–7% a year. For example, if you were deciding between a £120-a-month car loan and a £300-a-month car loan, you would obviously be saving £180 a month. Although it means you need an extra £54,000 in savings to be able to be financially free and fund this car, This is worked out as:

Yearly cost: 180×12=2,160. Extra capital at 4% to service the increase in car loans: 2,160 x 25 (100%/4%) =£54,000

Is the car worth having to save an extra £54k and delay financial freedom for a few years?

Earn more money!

Reducing expenses is the root of the operation. Although you can only exhaust your expenses so much as you need to spend money to live, To take your monthly P&L to the next level, you need to earn more money. There is no limit to how much you can earn, and this is the easiest way to increase your savings rate. In the words of Robert Kiyosaki, “it’s not how much you make; it’s how much you keep”.

As long as you follow your expenses budget correctly, any increase in income will directly correlate to increased deposits into your Freedom Fund each month. For more ways to increase your savings rate, the following blog details this in full.

3) QUALITY RELATIONSHIP & CONSTANT GIVING

Quality relationships are the backbone of a successful and fruitful financial life. On average, your income and savings will be within the same 10%–15% of your closest 10 friends. So, choosing your friends is a key indicator of your financial wealth. Evil company corrupts good habits, as habits are a key driver of your financial situation. If you have friends, partners, or colleagues that lead you down bad paths, your freedom fund will pay the price.

Choosing the right partner

Choosing your partner is one of the main influences on your accumulation of wealth and whether you’re able to keep it. Money is the second most common reason why marriages fail. If they do fail, it’s a catastrophe for your freedom fund, as the lawyers tend to profit handsomely. Being open, honest, and having an agreed-upon financial plan with a partner is key to building the lifestyle you want. In The Millionaire Mind by T Harv Eker, he researched and showcased the 39 characteristics of people with 10 million dollars or more. Of the 39 characteristics, the top 5 all related to relationships, specifically the length, quality, and integrity of their marriage and wider friendship group.

Living in a state of constant giving to friends, family, and strangers, you become a generous person. With the reputation of someone who is trustworthy and reliable. Giving does not necessarily need to be financial; it can be time- or resource-related as well. When you become a generous person, you will always fall into quality relationships. Quality relationships tend to open the door to opportunities, which accelerate your journey to freedom.

4) SAVING & INVESTING

Now that we have the fundamentals organised, investing is really where the Freedom Fund grows. The growth is not linear; it is exponential due to the power of compounding.

Emergency Fund

First things first, having an emergency fund that is there for a rainy day is important. This is to ensure you don’t get forced to cash in on investments unnecessarily to pay for short-term cash flow issues. This is commonly between 2 and 5 months of expenses. It should be in an easy-access account that is accruing interest to make sure you’re not losing the value of the emergency fund.

Investing

Choosing long-term investments that align with your financial freedom blueprint is essential. There are plenty of investment styles, but yours needs to be aligned with your risk profile, sustainable, and something that you enjoy and understand. Having a long-term view is essential to achieving your financial freedom goals. There is no real excuse to retire broke. For example, if you invested £100 a month from 25 to 65 years old in the S&P 500 with an annual return of 12%, you would retire with a nest egg of £1.173 million heading into retirement.

Increasing your return on investment (ROI)

This is the way to accelerate your path to your dream lifestyle, although with an increased ROI comes increased risk. The following are types of investments and their average ROI as examples.

| Asset type | Average Total Return on Investment |

|---|---|

| Bonds | 2%–4% |

| Cash Property | 5%–8% |

| Stocks | 8%–12% |

| Leveraged Property | 12%–20% |

| Small Companies | 20% + |

The spreadsheet link directs you to the Financial Freedom Plan tab, which shows the difference that certain assets will have on obtaining your freedom in a specific timeframe. Please use this to understand the balance between your risk tolerance, time availability, and the speed at which you want to reach freedom when making your decision.

HOW MUCH MONEY DO I NEED TO REACH FINANCIAL-FREEDOM?

In summary, it depends first on your ability to earn money, what you are investing those subsequent savings in, and the ROI those investments are creating. Secondly, what are your expected annual expenses for your dream life? The higher they are, the longer it will take to achieve financial freedom. As a rough rule of thumb, a withdrawal rate of 4% has historically been the safest extraction rate. 4% is the balance between maintaining total value relative to inflation and providing consistent income to the benefactors. To work this out: Financial freedom = required annual income × 25 (100%÷4%). To achieve £50k a year for your desired lifestyle, you would need £1.25m (50,000×25).

Disclaimer: This post contains affiliate links. This means we may earn a commission if you choose to sign up or make a purchase of a product using the link. We independently evaluate all recommendations and love all the companies we promote to you.