Valuing a property via the profit valuation method involves assessing its worth based on the business that operates within the property. Various factors come into play, such as financial performance, assets, market conditions, and industry trends. Depending on the nature of the business and the purpose of the valuation, there are other valuation methods that can aid the valuation. Here is a guide on how to value a business:

WHEN TO USE THE PROFIT VALUATION METHOD?

This type of property relies on the business operation and the specific use to generate its value. These are “special purpose property” or “owner-occupied property.” In other words, the underlying worth of the property goes beyond just its physical structure; it’s also the profitability of the business inside. Here are a few examples:

1. Restaurants and bars:

Properties with the design and equipment specifically for restaurant or bar operations. They often have layouts, fixtures, and amenities that are tailored to the needs of the business.

To value these types of properties, you can either capitalise the rent (if there is a rent) through the investment approach. Alternatively, you can use the profits valuation method by assessing the businesses’ ability to generate income from dining and entertainment activities.

2. Hotels and Resorts:

Properties that are purpose-built or extensively modified such as hotel or resort operations. The value of the property depends on their ability to generate revenue from room bookings and offer amenities and services that cater to travelers.

3. Fuel stations:

Properties housing fuel stations have purpose-built fuel pumps, convenience stores, and other necessary infrastructure. The value of these properties comes from their proximity to high-traffic areas, which dictates their profitability.

4. Healthcare Facilities:

Properties such as hospitals, medical clinics, and nurseries are buildings specific to their requirements. The value of these properties is dependent on their ability to attract patients and customers to their services.

5. Theatres and Entertainment Venues:

Properties that house theatres, cinemas, performance venues, or sports arenas have their value tied to their ability to attract audiences. These properties often have features like stages, seating arrangements, and designs to cater to specific entertainment purposes.

A Step-by-Step Process for Profit Valuation Method?

1. Gather financial information.

Collect financial information about the business. This includes financial statements, tax returns, and cash flow statements. This information will serve as the foundation for the valuation and establish the profit of the business. You’ll need to collect accounts dating back at least 3–4 years.

2. Analyse financial performance.

Once the financial information is gathered. We need to evaluate the business’s financial performance by examining key metrics such as revenue growth, profitability, cash flow, and return on investment. By assessing the stability and predictability of the business’s earnings, you can determine its long-term sustainability.

When assessing the performance of an entity, it’s important to split the different aspects into the following sections:

Gross revenue

The yearly revenue the business generates. It is simply the money that the business generates without taking anything else into account.

Variable costs

These include materials that aid the business to perform its day-to-day activities. A pub, for instance, would need to make food and drink purchases almost on a daily basis; without them, they would have nothing to sell.

Gross profit

Gross profit is the figure after taking away the variable costs from the gross revenue figure.

Fixed costs

They are the expenses that regularly occur and are due whether you have 10 or 110 customers. Fixed costs can include telephone, water, gas, electricity, and business rates, for instance.

Net profit

Calculated as gross profit – fixed costs. After all fixed and variable costs are deducted from the gross revenue, the net profit figure will importantly show you what is left. This reveals how profitable the business really is and the annual figure that we will use for the valuation.

3. Establish the capitalization rate for the profit valuation method.

Establishing the capitalization rate is the next step. This is largely done through comparable transactions within the industry. This is calculated by the marketed net profit of a comparable business (this always needs to be verified by your own due diligence) divided by the sold price.

This will give you the market capitalization rate for that industry. Websites such as Businesses for Sale show current special purposes businesses for sale. Although to get establish a true comparable, you will need to call up and ask for the sale prices to verify the price to net profit calculation. Other good sources are Rightmove and the Estate Gazette.

In addition, and to cross-reference, you should adjust for factors such as industry trends, market demand, competition, location, and growth potential to aid in the generation of a capitalization rate. Finding a few exact data sets as comparables is tricky, so assessing how the business compares to its competitors and its position within the market is helpful.

For example, a company with long-term contracted revenue and reoccurring revenue provides better cash flow qualities and less risk to an investor. Such as a nursery with most children on a monthly or quarterly payment plan to have their kids there each week. Alternatively, a business that is largely one-off sales provides a higher risk as revenue will be less stable for an investor. Such as a nursery booking for children on a day-by-day basis.

4. Establish the value

You can establish the value for rental and the capital value using the net profit of the business.

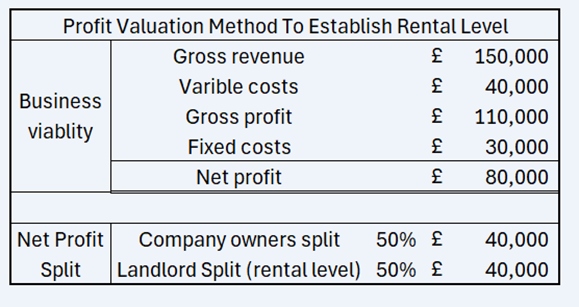

Profit method: rental valuation

First of all, establish the rental value for the business. As a very rough guide, you would normally divide the net profit in half to establish a fair rental value for the property. This would vary depending on the industry, but it’s a rough principle to guide you.

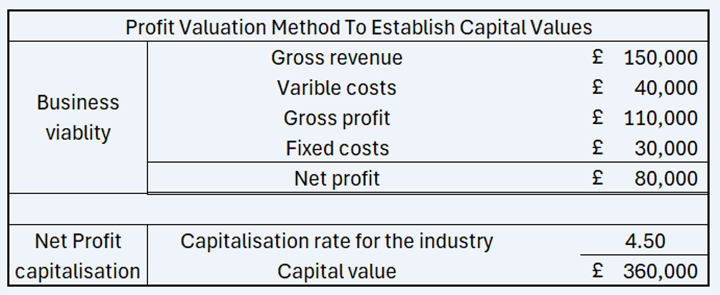

Profit method: capital valuation

To establish capital values through the profit method. As an example of how to calculate this method, the following valuation shows an exemplary profit and loss statement and the market capitalization rate example for an industry. Once the net profit and capitalization rate are set, you simply add them together to generate the capital value.

WHAT’S THE OPPORTUNITY FOR THE PROFIT VALUATION METHOD?

It’s important to note that special purpose properties can be challenging to value accurately due to their dependence on the success of the business operating within them. If you see a failing business that is in a quality building that is ripe for an alternative use. This is an opportunity to buy a property at a low price because it’s valued according to its current special-purpose use. If there is scope for redevelopment into another use class, such as residential, there could be significant value appreciation achieved by doing so.

PROFIT VALUATION METHOD SUMMARY

Valuing a business requires comprehensive analysis of its financial performance, industry conditions, market factors, and intangible assets. By gathering financial information, analysing the business’s performance, considering the cap rate for the industry, and adjusting that to the specific business in question, you are able to determine a fair and reasonable value for the business.

It’s important to note that the profits valuation method is relatively complex process. Moreover, for this reason, professional guidance should be considered to ensure accuracy and reliability with the red book.