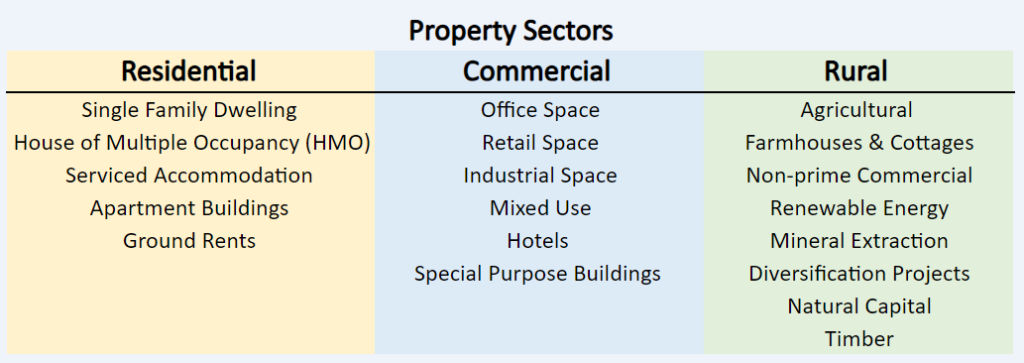

The main segments of the property investment can be split into the following categories, although there are many different property assets within these subsectors that make property so diverse and powerful.

Types of property Investments

Like equity, property assets are split into three main categories:

Investment property comes in different forms such as physical property, Real Estate Investment trusts (REITs), or debt. A combination of all three provides broad diversification within a property portfolio. Concentrating on physical property assets, highlighting the fundamental characteristics and the diversifying attributes that each subsection of property produces.

Different types of property and investment strategy can provide different rates of return and risk profiles. Moreover, a variety of real estate investments can provide significant diversification within a real estate portfolio. For example, some types of property act as a bond would, some more similar to equities, and others mirror venture capital or commodities. Many investors are chief exponents of this and have a very varied property portfolio with assets such as:

- A 99-year ground rent on a car park or block of flats with a rent review every 10 years provides very bond-like characteristics.

- Providing capital expenditure for their owned assets to provide the tenants with the ability to provide new income streams for land already occupied. The landlord takes a share of the profits from the venture and the original rent in a venture capital-type arrangement.

- And there are standard investments in property that gain capital appreciation in an equity-like fashion.

What are the benefits of property investment?

Real estate can enhance an investor’s portfolio by offering competitive risk-adjusted returns as well as diversification into uncorrelated assets. In the following in depth guides to the three-property investment sectors can be highly diversified hugely in their own right.

In general, the real estate market has low volatility, especially compared to equities and bonds. It provides monthly or quarterly cash flow that is inflation-protected. Furthermore, it provides scope to produce reliable income that can, in time, sustain you. It can generate flexibility to stop your day job or provide a reliable second income stream that gives you financial security and freedom.

The three property investment sectors

A deep dive into the three categories of property investment

Summary

The in-depth guides for commercial, rural, and residential real estate provide a complete guide to each property sector. They cover historic market performance, details on the subsectors within each property sector, an explanation of common practice, and project examples. This information is aimed at providing a deeper understanding of the sectors and what is possible within your portfolio. Each sector has differing qualities, so it is hard to judge what the best investment is for you as it is highly dependent on your goals and preferences. An evaluation of your long- and short-term goals would go a long way toward helping you understand what sectors would suit you.