Starting to invest in real estate is a big step, especially for an expat buying UK real estate from overseas. The stakes can feel higher as you likely don’t have feet on the ground to see the physical property you’re buying.

Dispite the doom and gloom, large volumes of expats buy UK real estate and do very well from it. Over the past decade, foreign investors have purchased approximately 250,000 UK properties.

For an expat, UK real estate can lead to substantial financial rewards, including a high return on investment (ROI). This blog explores the current market conditions, the unique benefits UK property provides expats, and a comparison between UK real estate and investment opportunities available to expats in other countries round the world.

UK real estate current market conditions

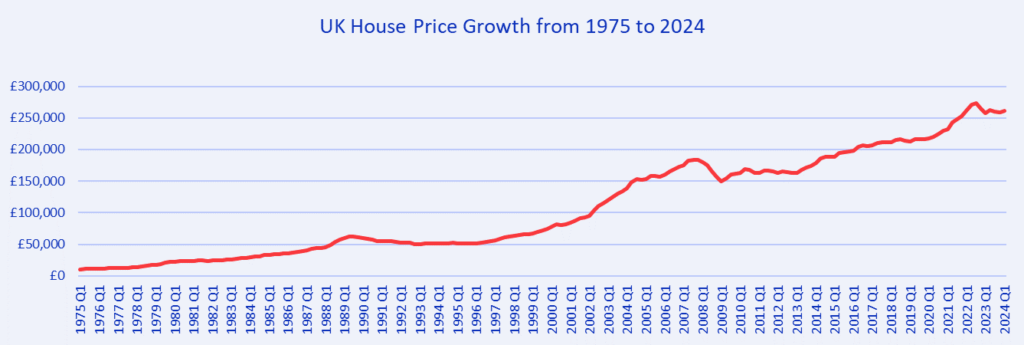

The UK real estate market has shown to be resilient through rain or shine. Particularly in the wake of global economic challenges. The following graph shows the consistency of the growth over time throughout the corrections in 1990, 2008, and 2023. Further detail on the ups and downs of the UK property market is covered in The 18-Year Property Cycle.

Property prices in the UK are stabilising after a period of volatility due to the rapid increase in interest rates. This period presents an opportune time for expats to consider their investment options and buy in while the market is in a stage of plateau.

Broad factors that drive the UK real estate market:

Economic Stability of UK Real Estate

The UK economy, while influenced by global events, remains one of the largest in Europe. Stability in the job market and a strong financial sector contribute to a more secure investment environment. For expats, investing in a stable market can mitigate risks associated with economic downturns or changing fashions.

Demand for Rental Properties

The demand for rental properties in the UK continues to rise. Partly due to the increasing gap between average wages and house prices increasing the proportion of people renting for longer.

Moreover, with a growing population and an influx of international students and professionals, combined with an undersupply of new-build homes every year, it generates significant opportunities in the rental market for expat investors. With high demand for rental property at already appealing yields, UK real estate is an attractive option for generating passive income whilst abroad.

Benefits for Expats Investing in UK Real Estate

Favourable Currency Exchange Rates

Currency rates often go up and down like a fiddler’s elbow, but if you time it right and the currency exchange rates work in their favour, you will have significantly more to invest with than you may have thought. If you are earning in a stronger currency, converting that into British pounds can lead to higher returns when it comes time to sell or rent the property.

Diversify Your Investment Portfolio with UK Real Estate

Expats often seek to diversify their investment portfolios to mitigate risks. UK real estate provides various opportunities to diversify an investment portfolio in terms of stability and uncorrelated returns. By investing in property, expats can balance their investments across different geographies, asset types, and deal structures to maximise diversification, which is especially important in a volatile global market.

Enhanced Security of Tenure

The UK has well-established laws protecting property rights, which isn’t the case in other countries. For example, in some Asian cities, property rights can be rather ambiguous, whereas UK laws ensure that property owners are protected against arbitrary eviction or confiscation. This point gives peace of mind, which is a crucial factor for expats considering long-term investments.

Passive Income Potential

Investing in rental properties should yield a steady stream of passive income. This is particularly appealing for expats who may want additional sources of income while living abroad. This can be done completely remotely through property management companies. Expats can enjoy the benefits of rental income without the day-to-day hassles of management.

Comparing UK real estate with other global cities

When being an expat, you naturally get exposed to lots of different investment opportunities in different countries and cities. This can be through having a more international friendship group or just having exposure to other markets than the UK. When considering expat investment options, it’s essential to compare the nature of UK real estate with investment opportunities in cities that’s close to you.

Yield Differences

In Asian cities, such as Hong Kong, Tokyo, and Singapore, property yields are very low because the asset values are so high. In contrast, in the UK, prices are lower and offer relatively higher yields in several regions. For example, cities like Manchester and Birmingham achieve average rental yields of 6-8%, significantly higher than many Asian counterparts.

Lending Conditions

The lending environment is where the UK outshines many foreign markets. In the UK, mortgage options have wide and competitive interest rates. Therefore, making finance is very accessible to expats.

Market Transparency and Regulation

UK real estate is very transparent and has a set regulatory framework, which provides a level of security that might be lacking in some other global markets. The UK’s property market has clear laws and guidelines, protecting the rights of both buyers and renters, which isn’t always the same globally.

Making the Decision to Invest

As an expat, investing in UK real estate can be a strategic move that offers numerous advantages. Here are some steps to consider:

Educate Yourself

Investing in real estate requires a solid understanding of markets, your investing goals, legal requirements, and tax aspects.

Partner with Local Experts

Having a joint venture partner or local expert can make a significant difference in your investment abilities. They can provide insights into market trends, help identify high-potential properties, and manage the ongoing investment.

Start Small

If you’re new to the UK property market, consider starting with a smaller investment. This approach allows you to gain experience and understand the nuances of property management without overwhelming financial risk. This can be done in a number of ways, either through direct property investment or through loaning money to other investors in the UK to dip your toes in before fully committing to owning a property.

Monitor Your Investment

Once you’ve made your investment, you’ll need to regularly review your investment performance and management to make sure it keeps aligning with your goals.

Conclusion

In summary, expat investment in UK real estate presents a compelling opportunity for expatriates looking to build wealth and secure financial stability. With favourable market conditions, high ROI potential, and a robust legal framework, investing in UK real estate can be a wise choice. By understanding the benefits and comparing them with investment options in other major cities, expats can make informed decisions that align with their financial goals.