The goal of diversification is to limit the risk involved without limiting the upside across a portfolio. The roller coaster ride that is the stock market can be a rocky road. Where the growth of your portfolio seems predictive and then suddenly becomes worth 20%–50% less overnight. Property investing tends to be more constant, any fluctuations in value slower and less significant compared to stocks. Due to property being a physical asset and the slower transaction times.

Despite the benefits and often lower risks, not all real estate investments are created equal. Property can play different roles and provide different levels of risk for your overall portfolio. To ensure consistent growth and balanced risk, you need to diversify your real estate portfolio. This can be done across a variety of different asset class, asset types, geographical markets, and more.

SHOULD YOU SEEK DIVERSIFICATION IN YOUR PROPERTY PORTFOLIO?

Through Fred Harrison’s research on the historical data. We know that corrections and recessions happen in cycles, and commonly one property cycle tends to last for 18 years. Thus, it’s important to hedge your bets and ensure sustained long-term growth is achieved throughout the 18-year window.

The most powerful strategies to protect against the downsides and not sacrifice optimal growth in your portfolio is diversification. You can diversify hugely within real estate itself, without jumping straight into stocks, bonds, etc. Real Estate has many different investment characteristics. When balanced, can lower your overall portfolio risk and increase your chances of higher long-term returns.

5 WAYS TO DIVERSIFY YOUR PROPERTY PORTFOLIO

1) Diversifying by Asset Type

Property investing is unique due to the variety of different asset types you can invest in. For example, you can invest in retail, industrial, office space, residential, rural land, and more. In just the residential subsector, you have the option of single-family houses and young professional apartment complexes. Furthermore, student housing, houses of multiple occupations (HMO), holiday lets, and serviced apartments. All of which provide different levels of risk and return.

Investing in a variety of real estate assets, you avoid the risk of over-concentration in one particular category. This provides protection against broader economic, and consumers shifts. For example, the growth of e-commerce has influenced an increased demand in the industrial sector and reduced demand in retail.

The following table indicates how the largest property portfolios in the UK allocate their investments and diversify their property holdings. On average, the main concentrations are in office and retail investments, followed by land and residential. The balance is made up of leisure, industrial, and diversification projects (mainly marine projects invested in by The Crown Estate).

| Name | Property Portfolio (m) | Agricultural/Strategic Land | Office | Retail | Industrial | Leisure | Residential | Other |

|---|---|---|---|---|---|---|---|---|

| Land Sec | £12,017 | 18% | 41% | 29% | 0% | 8% | 3% | 0% |

| British Land | £10,467 | 0% | 62% | 28% | 3% | 0% | 4% | 0% |

| Peel Group | £2,740 | 8% | 15% | 29% | 24% | 8% | 15% | 2% |

| The Grosvenor Estate | £9,290.8 | 4% | 32% | 26% | 7% | 4% | 27% | 0% |

| The Crown Estate | £14,825.1 | 8% | 26% | 16% | 0% | 6% | 6% | 35% |

| The Duchy of Cornwall | £1,015.011 | 46% | 20% | 7% | 7% | 0% | 21% | 0% |

| Combined Average | 14% | 33% | 22% | 7% | 4% | 13% | 6% |

2) Diversification By Geographical Location

Investors should diversify their portfolios across a variety of locations to avoid over-concentration in a particular local or regional market. Property investment is heavily influenced by the market in which the asset is located. By diversifying across a range of geographies, you can capitalise on the ups and downs of various markets. Furthermore, it mitigates against any major correction in a specific market.

When searching for locations to diversify into, the following are key indicators that strong growth potential in the coming years:

Markets with large multi-national companies

High average wages

Plans for infrastructure and regeneration projects

Population growth

Job diversity

When looking at The Crown Estate’s portfolio found on this link, the geographical diversification is substantial. They hold commercial property positions (dark green on the plan) in almost every major city in the UK. Rural land (light green) is also highly diversified by location. They have strategically located land holdings, on the outskirts of towns and cities throughout the country. The light blue/pink squares are areas of seabed that are offshore energy, marine aggregates, and pipelines. The central London estate (pink) in the heart of prime central London and accounts for approximately half the estate’s value.

The Grosvenor Estate has taken a different approach diversification and invests approximately 60% of its capital in UK property. The rest is split globally according to the table below.

| London | Regional Cities in the UK | Regional Land UK | North America | Asia Pacific | Europe | South America | |

|---|---|---|---|---|---|---|---|

| The Grosvenor Estate | 53.90% | 5.20% | 3.71% | 20.60% | 10.20% | 9.10% | 1% |

3) Diversification By Asset Class

Through understanding human trends, it shows the importance of diversifying across asset classes. Property is cyclical, and in times of growing confidence, there is what’s known as the ripple effect. Large demand comes first to the high-quality and nicer areas within a city. Slowly, as buyers are priced out of these areas, the second and third tier buildings/areas start to flourish towards the end of a cycle.

It’s similar when looking at the extremes in the market during boom-and-bust stages. In good times, people tend to strive for larger and more luxurious homes and office spaces in nicer areas. In tough times, they might need to downsize, find a more moderately priced space, or move across town.

As you can see, there are asset classes that suit different market conditions. Predicting when the next recession will hit is a hard game to play. Diversifying across asset classes is essential to ensure your portfolio is profitable and in demand at all stages of the cycle.

Without knowing the locations and buildings in each portfolio, it’s hard to predict the different asset classes within these portfolios. The balance of London vs. regional investments below gives a fair representation of how the ripple effect works. London tends to move earlier in the cycle than regional cities. The following shows how these entities diversify to take advantage of this and the differential in yields achieved.

| Name | London | Yield | Regional Cities | Yield | Regional Land | Yield | Marine |

|---|---|---|---|---|---|---|---|

| The Crown Estate | 48.70% | 3.06% | 9.67% | 7.17% | 8.38% | 2.71% | 33.26% |

| Land Sec | 64.75% | 3.44% | 35.25% | 7.34% | |||

| British Land | 66.56% | 3.46% | 33.44% | 7.11% |

4) Diversifying By Strategy

Another option for diversification is to have a variety of investment strategies and hold times. While one rental property you pursue might be a buy-and-hold with a strong yield in a growth area. Whereas another could provide a strong value add through the BRRRR strategy (buy, rehab, rent, refinance, repeat). Other strategies include, a building could also have leases expiring or rent reviews due. If they had scope for a significant increase in rent achieved for the building, once executed, it would add significant value.

As for hold time, you could have shorter time horizons on certain properties due to specific market conditions or wanting to monetise the capital value added through refurbishment or lease restructuring. Alternatively, you can hold for long periods of time, taking the steady income and potentially passing it on to the next generation. Blending your strategy is good for diversification.

For example, Landsec is actively rebalancing their portfolio to focus on sectors with high growth potential. This will be achieved through a combination of disposing of older stock that has potential ESG issues or no further value creation in the near future and redeveloping owned stock that has potential value opportunities. The redevelopment opportunities total c.£3bn (18.27% of the portfolio value), and through direct investment or JVs, they strive to achieve this rebalancing over the next five years. The following shows the allocation of development compared to investment holds for The Grosvenor Estate, Land Sec, and British Land.

| Investment vs. Development Portfolio Allocation | Investment Hold | Development |

|---|---|---|

| The Grosvenor Estate | 90.14% | 9.86% |

| Land Sec | 81.73% | 18.27% |

| British Land | 89.07% | 10.93% |

| Combined Average | 86.98% | 13.02% |

5) Diversifying By Joint Venture Investing

Finally, introducing a mix of completely owned investment properties and joint venture properties in a syndicate style investment or a two-person arrangement can be a great way to gain exposure to properties previously not accessible in your portfolio.

By teaming up with other parties, you are able to gain access to larger and more premium commercial properties such as apartment buildings, office blocks, retail complexes, and industrial units. This arrangement opens the door for great diversification opportunities into other asset types for investors with less capital who would otherwise not be able to gain that broad exposure in the market. Furthermore, you leverage the experience and track record of others, which can sometimes introduce new strategies and new markets to your portfolio.

The majority of the entities included as examples in this blog have vast amounts of JV partners or syndicates, which shows it’s a well-trodden path for these organisations and that they believe it’s a positive strategy to aid their portfolio investments.

THE EFFECTS OF PORTFOLIO DIVERSIFICATION ON TOTAL RETURN

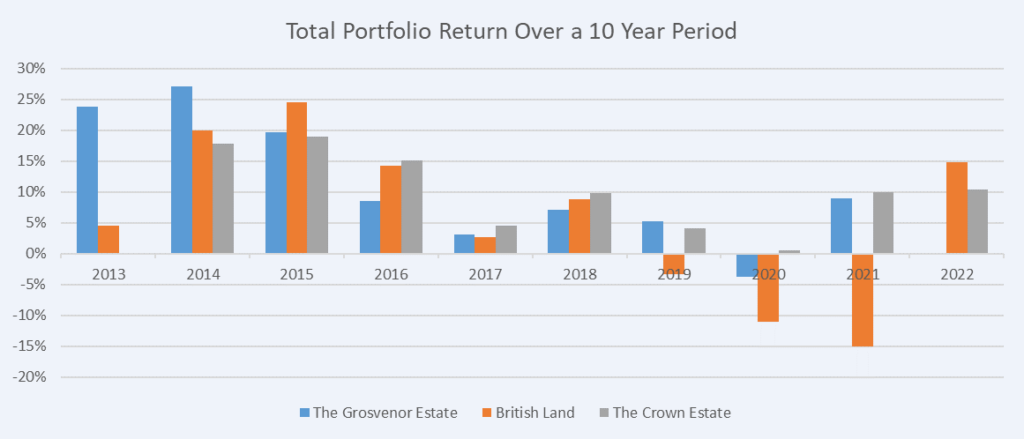

When reviewing the details above, The Grosvenor and Crown Estates are vastly superior in terms of asset type, geographical locations, and asset class diversification to British Land. The following shows the total return for The Grosvenor Estate, British Land, and The Crown Estate over a 10-year period. It shows the estates with more diversification in their portfolios reduce the chances for negative returns, British Land, with a less diversified portfolio, suffered three years of negative total returns from 2019–2021, whereas Grosvenor suffered one year, and The Crown Estate was positive for all 10 years. Also provided is the average 10-year total return, which shows that diversified portfolios provide vastly more favorable total returns over a 10-year period.

| Average 10-year Total Return 2013-2022 | Total Average Annual Return |

|---|---|

| The Grosvenor Estate | 11% |

| British Land | 6% |

| The Crown Estate | 10% |

NEXT STEPS FOR DIVERSIFYING YOUR PORTFOLIO

Diversification is one of the most important risk management tools in an investor’s toolbox. The key is to not time the market but to spread investments across asset types, geographical markets, asset classes, and investment strategies to minimize risk and maximize long-term steady growth.

Try to evaluate your existing individual investments and make notes on the risks and benefits of each, then evaluate your portfolio as a whole in a similar way. This will give you a clearer picture of your exposures and enable you to choose a strategy to start diversifying your portfolio. This could move you outside your comfort zone, but in the long-term, diversification will strengthen your overall growth.

Remember, diversification does not guarantee a profit or losses, it’s important to do your research and seek professional advice for your personal situation before making any investment decisions.